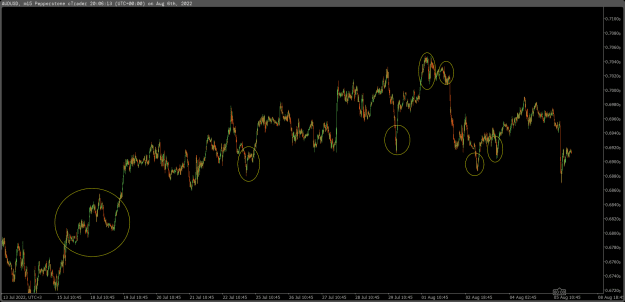

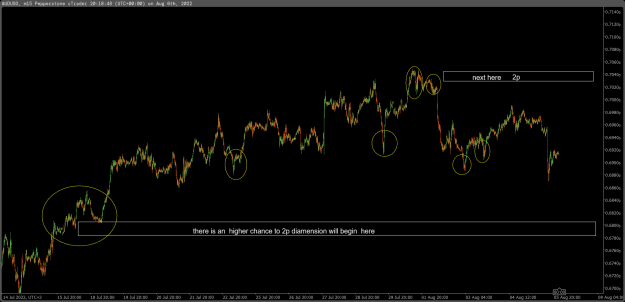

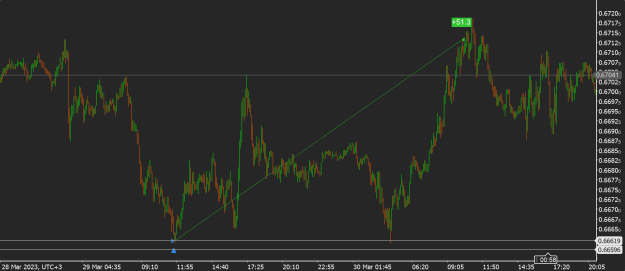

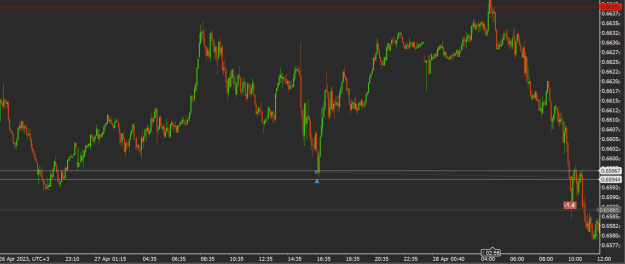

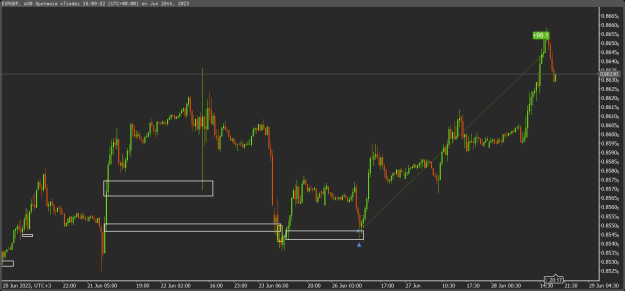

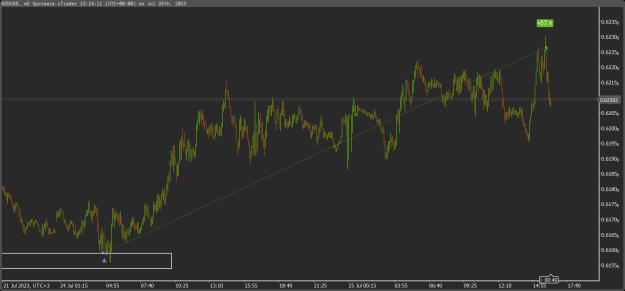

eventually, I grasped some concepts, and now I know where to look for 2P dimension. entering this area makes good profits with low risk, check lower timeframe another breakout entries they will consume eventualy. these marked areas are already expected areas before that move happens. because there are clean orders present we can call it orderflow

1