DislikedOkay you are right, it was an unfair stereotype.

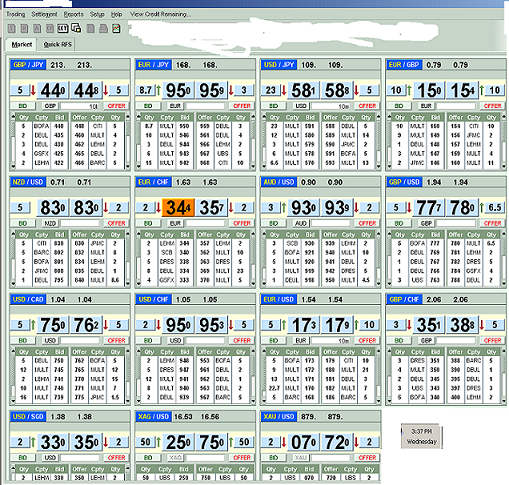

I am thinking of pairs such as GBP/JPY and GBP/CHF which I like to trade. They consistantly have a spread of 7-10 pips on either ECN or dealing desk. Useless for scalping. If there was to be mutiple ECN's adding to a larger liquidity pool im sure this spread would drop, and on other pairs as well.

When I log into my futures account I can see the e-mini S&P bid/ask barely 1-2 ticks apart. I can see trades of 400 contracts at a time and they get filled.

Yet FOREX, which supposedly has WAY more liquidity than futures, has wide ECN spreads on almost every pair except EUR/USD. Despite all the talk, this is a sure sign of either low liquidity or ECN spread manipulation (which supposedly does not happen).Ignored