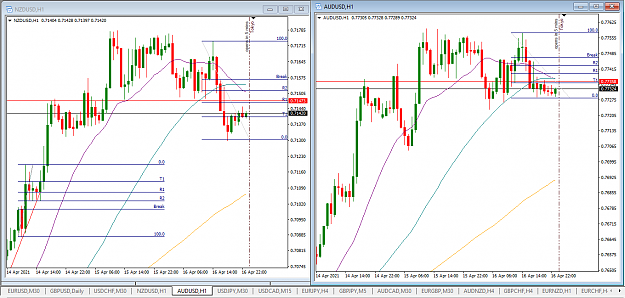

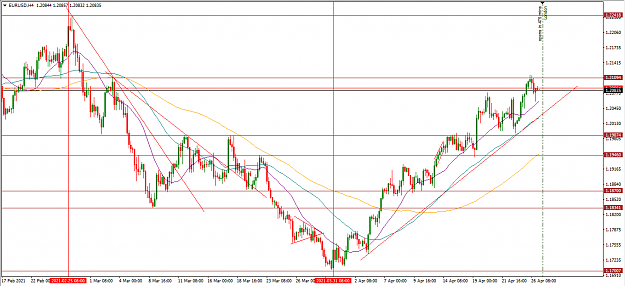

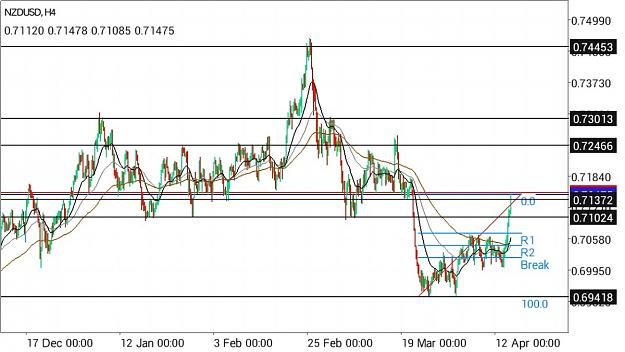

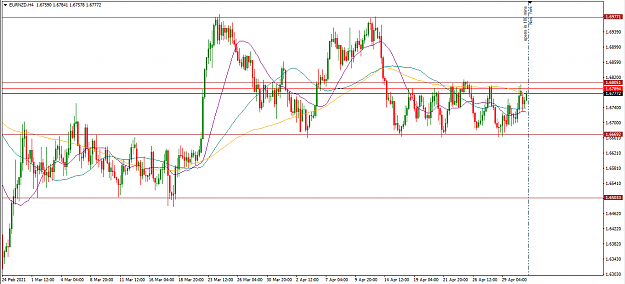

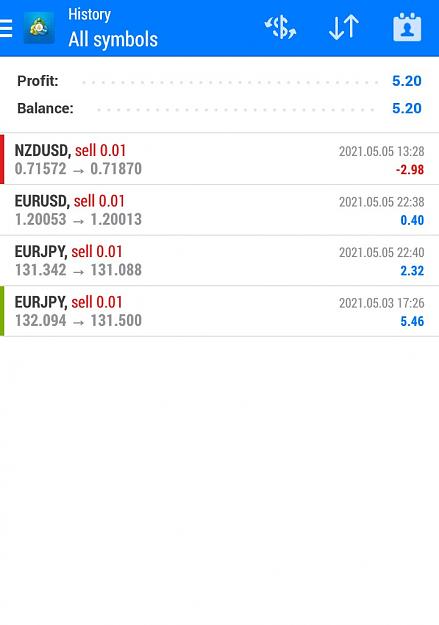

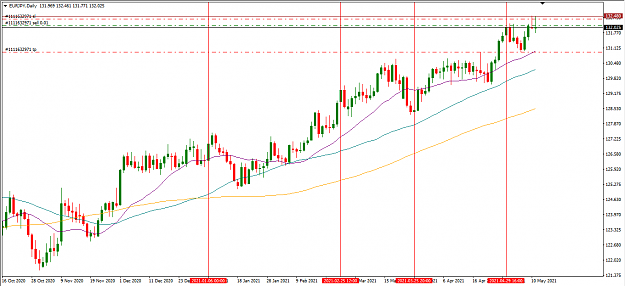

I just closed a 30pips long position on Kiwi, I tried to scalp what I believe to be the last upward momentum before the next corrective wave comes in the market.

The correction would start probably toward the opening of Tokyo session or early London session tomorrow.

After the correction wave, I'll be anticipating to buy the next impulsive wave, towards the next resistance zone.0.7245

The correction would start probably toward the opening of Tokyo session or early London session tomorrow.

After the correction wave, I'll be anticipating to buy the next impulsive wave, towards the next resistance zone.0.7245