Forum Purpose:

Purpose of this forum is to create a community of "dissenters" that can respectfully discuss differences of opinion on pure Price Action Trade Developments based on Bob Volman's Trading Strategies (references listed below).

Anyone who studies trading long enough will soon come to terms with the fact that the Outcomes are Independent from Decisions.

I won't give a long discussion on the two modes of thinking but its important to understand that we have a Deliberate and a Reflexive thought process that we use to make Decisions Under Uncertainty. This makes us exceptionally skilled at creating "out of the air" biasedness. The question then arises, "How do we reduce these cognitive risks that bleed into our decision making process? "

"Fielding Outcomes" is a critical skill that directly contributes to your skill level as you learn to delineate skill and luck; giving light to the understanding that the probability distribution is not binary but instead a wide spectrum ranging from 0-100%

Consider this forum as a center of Accountability, where the intent is to shed light into your decision making process, reduce biasedness, and "encourage" Truth-seeking by way of discussion.

I am not here to argue statistics as these distribution (& strategy) themselves are subjective but similar to a poker player the intent must be made to give an accurate approximation of the probability with the limited information you have at hand.

By discussing these probabilities the brain will become accustomed to seeking out the truth behind the facts instead of succumbing to weaknesses such as confirmation bias and motivated reasoning. This is part of the process of becoming a "mechanical trader"

Forum Rules:

-Respect first and foremost - this channel is built on a feedback loop thus you should be able to give and take criticism

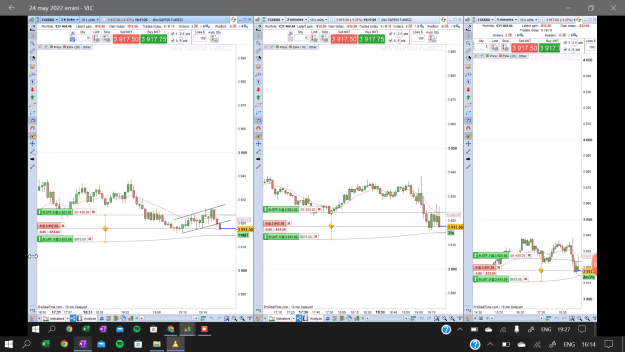

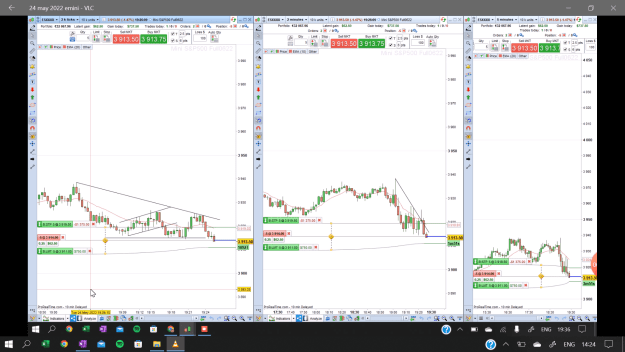

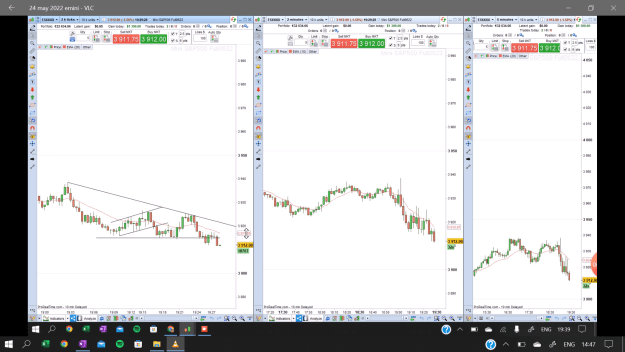

-Aim to accompany each post with screenshot (win or loss), BOTH opposing and supporting views, and what you feel is an accurate probability.

-Lets keep it a pure Bob Volman Price Action Discussion

Thank you in advance for participating.

References

Technical:

Purpose of this forum is to create a community of "dissenters" that can respectfully discuss differences of opinion on pure Price Action Trade Developments based on Bob Volman's Trading Strategies (references listed below).

Anyone who studies trading long enough will soon come to terms with the fact that the Outcomes are Independent from Decisions.

I won't give a long discussion on the two modes of thinking but its important to understand that we have a Deliberate and a Reflexive thought process that we use to make Decisions Under Uncertainty. This makes us exceptionally skilled at creating "out of the air" biasedness. The question then arises, "How do we reduce these cognitive risks that bleed into our decision making process? "

"Fielding Outcomes" is a critical skill that directly contributes to your skill level as you learn to delineate skill and luck; giving light to the understanding that the probability distribution is not binary but instead a wide spectrum ranging from 0-100%

Consider this forum as a center of Accountability, where the intent is to shed light into your decision making process, reduce biasedness, and "encourage" Truth-seeking by way of discussion.

I am not here to argue statistics as these distribution (& strategy) themselves are subjective but similar to a poker player the intent must be made to give an accurate approximation of the probability with the limited information you have at hand.

By discussing these probabilities the brain will become accustomed to seeking out the truth behind the facts instead of succumbing to weaknesses such as confirmation bias and motivated reasoning. This is part of the process of becoming a "mechanical trader"

Forum Rules:

-Respect first and foremost - this channel is built on a feedback loop thus you should be able to give and take criticism

-Aim to accompany each post with screenshot (win or loss), BOTH opposing and supporting views, and what you feel is an accurate probability.

-Lets keep it a pure Bob Volman Price Action Discussion

Thank you in advance for participating.

References

Technical:

- Understanding Price Action

- Price Action Scalping

Psychology

- Thinking Fast & Slow

- Thinking in Bets

- Trading in the Zone

****The Documents are outdated and will be updated accordingly - 05/25/22

Attached File(s)