This was inspired from studying TKimble's weekly method and yezbick's hedging.

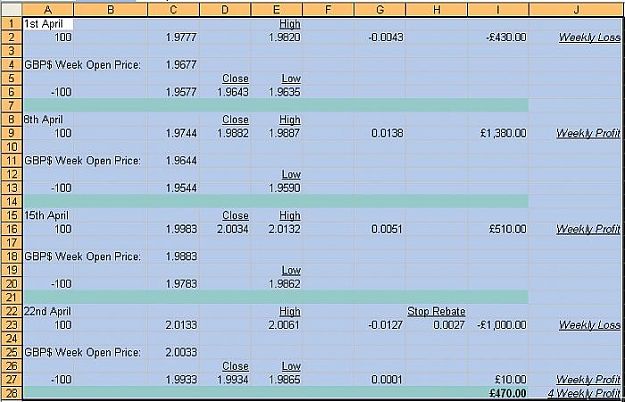

At the start of the week enter a buy stop 100 points up and a sell stop 100 points down. At the end of the week close either that is in profit for at least 100 points. If both are triggered, no worries, close the one in profit (if profit is at least 100 points, if not do nothing) and enter the next week with +1 lot of what you closed so if we closed a buy the next week we will have 2 lots buy stop 100 pips up and a 1 lot sell stop 100 pips down.

When we accumulate sells in an uptrend we are looking for a reversal after we closed all the buys, so for instance we have 5 sells active, next week we set a buy stop for 5 lots 100 pips up. If we are at the top of the trend the buys will not be activated so we have 5 sells working for us instead of just using a SL of 200.

The 200 points straddle and taking at least 100 pips profit works nice filtering ranging conditions and whipsaws so we won't accumulate too many buys and/or sells.

Close everything when in profit.

Any comments or improvements are welcomed.

At the start of the week enter a buy stop 100 points up and a sell stop 100 points down. At the end of the week close either that is in profit for at least 100 points. If both are triggered, no worries, close the one in profit (if profit is at least 100 points, if not do nothing) and enter the next week with +1 lot of what you closed so if we closed a buy the next week we will have 2 lots buy stop 100 pips up and a 1 lot sell stop 100 pips down.

When we accumulate sells in an uptrend we are looking for a reversal after we closed all the buys, so for instance we have 5 sells active, next week we set a buy stop for 5 lots 100 pips up. If we are at the top of the trend the buys will not be activated so we have 5 sells working for us instead of just using a SL of 200.

The 200 points straddle and taking at least 100 pips profit works nice filtering ranging conditions and whipsaws so we won't accumulate too many buys and/or sells.

Close everything when in profit.

Any comments or improvements are welcomed.