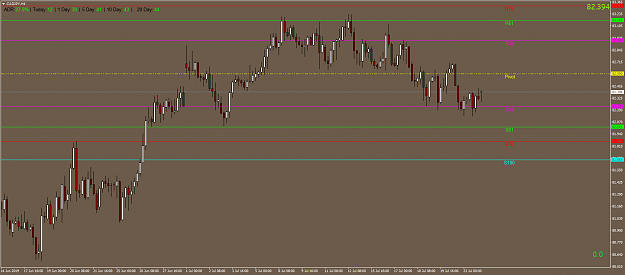

Trade#35. Got in short on EG again during morning US session for 26 pips, $650, 2.8% on the account. Pretty smooth trade, only 10 pips of drawdown. Between the two trades I got almost all of the 80 pip move. Looking to continue selling this pair next week.

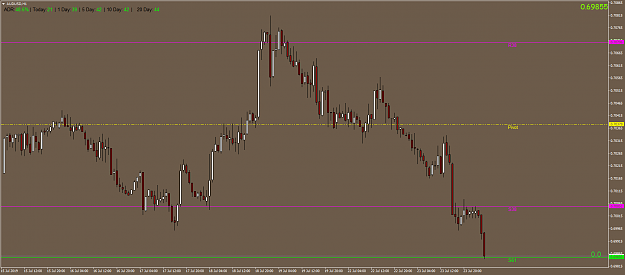

Letting the AU trade run for the weekend, close to BE on it. Looking for a gap and go situation on Sunday which may fuel a drop by trapping people long. Smelling some risk off coming in the week ahead with the uncertainty surrounding the Fed cut and ECB policy, Brexit, and the Iranian conflict.

Letting the AU trade run for the weekend, close to BE on it. Looking for a gap and go situation on Sunday which may fuel a drop by trapping people long. Smelling some risk off coming in the week ahead with the uncertainty surrounding the Fed cut and ECB policy, Brexit, and the Iranian conflict.