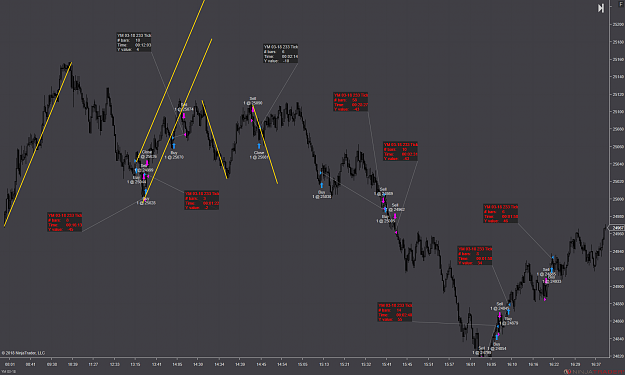

Disliked{quote} Trade 3 would have been too risky for me. I do not like to jump onto such a move and I did not expect that price will fall that much. However, you managed your trade nicely.Ignored

- Post #37,104

- Quote

- Feb 15, 2018 3:42pm Feb 15, 2018 3:42pm

- | Joined Oct 2016 | Status: Member | 390 Posts

- Post #37,105

- Quote

- Feb 15, 2018 3:42pm Feb 15, 2018 3:42pm

- Joined Dec 2017 | Status: Member | 1,054 Posts

- Post #37,106

- Quote

- Feb 15, 2018 3:43pm Feb 15, 2018 3:43pm

- | Joined Oct 2016 | Status: Member | 390 Posts

- Post #37,109

- Quote

- Feb 15, 2018 3:48pm Feb 15, 2018 3:48pm

- Joined Dec 2017 | Status: Member | 1,054 Posts

- Post #37,111

- Quote

- Feb 15, 2018 4:00pm Feb 15, 2018 4:00pm

- Joined Dec 2017 | Status: Member | 1,054 Posts

- Post #37,112

- Quote

- Feb 15, 2018 4:05pm Feb 15, 2018 4:05pm

- Joined Dec 2017 | Status: Member | 1,054 Posts

- Post #37,114

- Quote

- Edited 6:03pm Feb 15, 2018 5:21pm | Edited 6:03pm

- Joined Jan 2016 | Status: Member | 1,719 Posts

- Post #37,117

- Quote

- Feb 15, 2018 7:08pm Feb 15, 2018 7:08pm

- Joined Jan 2016 | Status: Member | 1,719 Posts

- Post #37,119

- Quote

- Feb 16, 2018 8:13am Feb 16, 2018 8:13am

Rise and rise again until lambs become lions

- Post #37,120

- Quote

- Feb 16, 2018 8:48am Feb 16, 2018 8:48am

- | Joined Oct 2016 | Status: Member | 390 Posts