Attached Image (click to enlarge)

| User | Time | Action Performed |

|---|---|---|

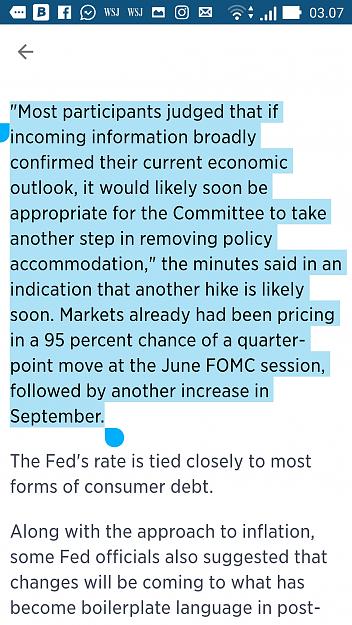

Federal Reserve officials would be content to let inflation briefly run above their 2 percent target as the economy continues to recover, according to minutes from the central bank's most recent meeting. Following the May 1-2 session, the policymaking Federal Open Market Committee said it wasn't raising rates yet but added the word "symmetric" to describe its inflation goal. Market participants since have puzzled over what the change in language might imply. The summary released Wednesday indicates a substantial level of debate over how the Fed should approach inflation. The minutes also pointed to an interest ... (full story)