-

Bitcoin jumps $400 in one day and soars to a new record high

Bitcoin skyrocketed past $7,400 on Friday, hitting yet another record high. The virtual currency had shot past the $7,000 mark for the first time Thursday and finished on $6,895.41 toward the end of the session. According to CoinDesk, the cryptocurrency reached a renewed all-time high of $7,454.04 at 6:40 a.m. ET Friday, after opening at $7,030. The jump in price saw bitcoin rise 6 percent. Analysts believe more institutional investors could warm to the digital token after derivatives operator CME Group announced it would introduce bitcoin futures contracts this year. "This is bitcoin crossing the divide from the ... (full story)

- Comments

- Comment

- Subscribe

- Comment #1

- Quote

- Nov 3, 2017 1:28pm Nov 3, 2017 1:28pm

-

raklian

raklian - Joined May 2017 | Status: Member | 721 Comments

- Comment #2

- Quote

- Nov 3, 2017 1:59pm Nov 3, 2017 1:59pm

-

Price

Price - | Joined Sep 2007 | Status: Member | 184 Comments

- Comment #3

- Quote

- Nov 3, 2017 2:13pm Nov 3, 2017 2:13pm

-

Nick.

Nick. - | Joined May 2013 | Status: Member | 898 Comments

- Comment #4

- Quote

- Nov 3, 2017 2:15pm Nov 3, 2017 2:15pm

-

raklian

raklian - Joined May 2017 | Status: Member | 721 Comments

- Comment #5

- Quote

- Nov 3, 2017 4:46pm Nov 3, 2017 4:46pm

-

Gaelounet

Gaelounet - | Joined Apr 2017 | Status: Member | 4 Comments

- Comment #6

- Quote

- Nov 3, 2017 5:33pm Nov 3, 2017 5:33pm

-

Nick.

Nick. - | Joined May 2013 | Status: Member | 898 Comments

- Comment #7

- Quote

- Nov 3, 2017 7:34pm Nov 3, 2017 7:34pm

-

Genimi

Genimi - | Joined Mar 2016 | Status: Member | 64 Comments

- Comment #8

- Quote

- Nov 3, 2017 8:08pm Nov 3, 2017 8:08pm

-

Nick.

Nick. - | Joined May 2013 | Status: Member | 898 Comments

- Comment #9

- Quote

- Nov 4, 2017 2:42am Nov 4, 2017 2:42am

-

Mingary

Mingary - Joined Mar 2011 | Status: I should be on your ignore list | 2344 Comments

- Comment #10

- Quote

- Nov 4, 2017 2:53am Nov 4, 2017 2:53am

- Guest

- | IP XXX.XXX.224.97

- Comment #11

- Quote

- Nov 4, 2017 5:12am Nov 4, 2017 5:12am

- digit1288

- | Joined Sep 2016 | Status: Member | 278 Comments

- Comment #12

- Quote

- Nov 4, 2017 5:26am Nov 4, 2017 5:26am

- digit1288

- | Joined Sep 2016 | Status: Member | 278 Comments

- Comment #13

- Quote

- Nov 4, 2017 7:01am Nov 4, 2017 7:01am

- Philforex

- | Joined Oct 2010 | Status: Member | 35 Comments

- Comment #14

- Quote

- Nov 4, 2017 8:54am Nov 4, 2017 8:54am

-

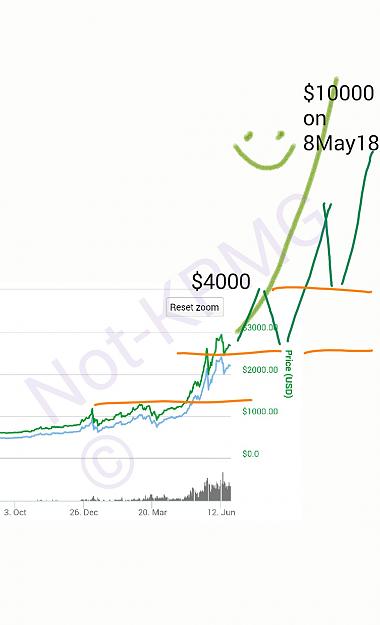

Not-KPMG

Not-KPMG - Joined Jun 2015 | Status: Member | 7592 Comments

Beware of robber banks (RB), bad advisors.

- Comment #15

- Quote

- Nov 4, 2017 8:56am Nov 4, 2017 8:56am

-

Not-KPMG

Not-KPMG - Joined Jun 2015 | Status: Member | 7592 Comments

Beware of robber banks (RB), bad advisors.

- Comment #16

- Quote

- Nov 4, 2017 3:57pm Nov 4, 2017 3:57pm

-

yolo

yolo - | Commercial Member | Joined Mar 2015 | 56 Comments

USA!

- Comment #17

- Quote

- Nov 4, 2017 4:18pm Nov 4, 2017 4:18pm

- Philforex

- | Joined Oct 2010 | Status: Member | 35 Comments

- Comment #18

- Quote

- Nov 5, 2017 6:40am Nov 5, 2017 6:40am

-

MustafaHaide

MustafaHaide - | Joined Mar 2016 | Status: Member | 21 Comments

- Comment #19

- Quote

- Nov 5, 2017 7:42am Nov 5, 2017 7:42am

-

cat

cat - Joined Oct 2010 | Status: Member | 445 Comments

- Comment #20

- Quote

- Nov 5, 2017 8:39am Nov 5, 2017 8:39am

-

johnston

johnston - | Joined May 2016 | Status: Member | 20 Comments

- Comment #21

- Quote

- Nov 5, 2017 8:42am Nov 5, 2017 8:42am

-

Wachturm

Wachturm - Joined Jun 2017 | Status: Member | 9 Comments

- Comment #22

- Quote

- Nov 5, 2017 9:04am Nov 5, 2017 9:04am

-

cat

cat - Joined Oct 2010 | Status: Member | 445 Comments

- Comment #23

- Quote

- Nov 5, 2017 10:01am Nov 5, 2017 10:01am

-

Wachturm

Wachturm - Joined Jun 2017 | Status: Member | 9 Comments

- Comment #24

- Quote

- Nov 5, 2017 10:55am Nov 5, 2017 10:55am

-

cat

cat - Joined Oct 2010 | Status: Member | 445 Comments

- Comment #25

- Quote

- Nov 5, 2017 11:15am Nov 5, 2017 11:15am

- rotherwell

- | Joined Jul 2007 | Status: Member | 104 Comments

scale in, scale out

- Comment #26

- Quote

- Nov 5, 2017 11:59am Nov 5, 2017 11:59am

-

MustafaHaide

MustafaHaide - | Joined Mar 2016 | Status: Member | 21 Comments

- Comment #27

- Quote

- Nov 5, 2017 12:24pm Nov 5, 2017 12:24pm

-

redpants

redpants - | Joined Jun 2014 | Status: Member | 7 Comments

- Comment #28

- Quote

- Nov 5, 2017 2:06pm Nov 5, 2017 2:06pm

-

Old_Dog

Old_Dog - Joined Sep 2010 | Status: Snake Oil sniffer dog | 3 Comments

- Comment #29

- Quote

- Nov 5, 2017 6:22pm Nov 5, 2017 6:22pm

-

Nick.

Nick. - | Joined May 2013 | Status: Member | 898 Comments

- Comment #30

- Quote

- Nov 5, 2017 6:27pm Nov 5, 2017 6:27pm

-

Nick.

Nick. - | Joined May 2013 | Status: Member | 898 Comments

- Comment #31

- Quote

- Nov 5, 2017 6:42pm Nov 5, 2017 6:42pm

-

Nick.

Nick. - | Joined May 2013 | Status: Member | 898 Comments

- Comment #32

- Quote

- Nov 5, 2017 7:36pm Nov 5, 2017 7:36pm

- Mwfinad1211

- | Joined Jun 2014 | Status: Member | 45 Comments

- Comment #33

- Quote

- Nov 5, 2017 7:56pm Nov 5, 2017 7:56pm

-

Nick.

Nick. - | Joined May 2013 | Status: Member | 898 Comments

- Comment #34

- Quote

- Nov 5, 2017 8:51pm Nov 5, 2017 8:51pm

-

MustafaHaide

MustafaHaide - | Joined Mar 2016 | Status: Member | 21 Comments

- Comment #35

- Quote

- Nov 5, 2017 9:08pm Nov 5, 2017 9:08pm

- sidhujag

- Joined Apr 2009 | Status: Non-Member | 930 Comments

- Comment #36

- Quote

- Nov 5, 2017 9:37pm Nov 5, 2017 9:37pm

- Sniper2000

- | Joined May 2012 | Status: Member | 777 Comments

- Comment #37

- Quote

- Nov 5, 2017 9:51pm Nov 5, 2017 9:51pm

- sidhujag

- Joined Apr 2009 | Status: Non-Member | 930 Comments

- Comment #38

- Quote

- Nov 5, 2017 9:54pm Nov 5, 2017 9:54pm

- Mwfinad1211

- | Joined Jun 2014 | Status: Member | 45 Comments

- Comment #39

- Quote

- Nov 5, 2017 10:31pm Nov 5, 2017 10:31pm

- Sniper2000

- | Joined May 2012 | Status: Member | 777 Comments

- Comment #40

- Quote

- Nov 5, 2017 11:44pm Nov 5, 2017 11:44pm

- sidhujag

- Joined Apr 2009 | Status: Non-Member | 930 Comments

- Comment #41

- Quote

- Nov 5, 2017 11:46pm Nov 5, 2017 11:46pm

- sidhujag

- Joined Apr 2009 | Status: Non-Member | 930 Comments

- Comment #42

- Quote

- Nov 6, 2017 12:12am Nov 6, 2017 12:12am

- Mwfinad1211

- | Joined Jun 2014 | Status: Member | 45 Comments

- Comment #43

- Quote

- Nov 6, 2017 12:41am Nov 6, 2017 12:41am

- sidhujag

- Joined Apr 2009 | Status: Non-Member | 930 Comments

- Comment #44

- Quote

- Nov 6, 2017 2:52am Nov 6, 2017 2:52am

-

Nick.

Nick. - | Joined May 2013 | Status: Member | 898 Comments

- Comment #45

- Quote

- Nov 6, 2017 8:44am Nov 6, 2017 8:44am

- gat

- | Joined Dec 2009 | Status: Member | 1040 Comments

- Comment #46

- Quote

- Nov 6, 2017 9:46am Nov 6, 2017 9:46am

-

Calculus

Calculus - Joined Apr 2011 | Status: Member | 200 Comments

Road To Wisdom? To err and err and err again, but less and less and less...

- Comment #47

- Quote

- Nov 6, 2017 11:13am Nov 6, 2017 11:13am

- sidhujag

- Joined Apr 2009 | Status: Non-Member | 930 Comments

- Comment #48

- Quote

- Nov 6, 2017 6:27pm Nov 6, 2017 6:27pm

- Jr123

- | Joined Jun 2017 | Status: Member | 389 Comments

- Comment #49

- Quote

- Nov 6, 2017 6:33pm Nov 6, 2017 6:33pm

- Jr123

- | Joined Jun 2017 | Status: Member | 389 Comments

- Comment #50

- Quote

- Nov 7, 2017 8:21am Nov 7, 2017 8:21am

- gat

- | Joined Dec 2009 | Status: Member | 1040 Comments

- Comment #51

- Quote

- Nov 7, 2017 12:30pm Nov 7, 2017 12:30pm

-

Not-KPMG

Not-KPMG - Joined Jun 2015 | Status: Member | 7592 Comments

Beware of robber banks (RB), bad advisors.

- Comment #52

- Quote

- Nov 7, 2017 1:59pm Nov 7, 2017 1:59pm

-

deltaone

deltaone - Joined Nov 2013 | Status: Made in Germany | 429 Comments

fortis fortuna adiuvat

- Comment #53

- Quote

- Nov 7, 2017 3:35pm Nov 7, 2017 3:35pm

-

Not-KPMG

Not-KPMG - Joined Jun 2015 | Status: Member | 7592 Comments

Beware of robber banks (RB), bad advisors.

- Comment #54

- Quote

- Nov 7, 2017 4:30pm Nov 7, 2017 4:30pm

-

deltaone

deltaone - Joined Nov 2013 | Status: Made in Germany | 429 Comments

fortis fortuna adiuvat

- Comment #55

- Quote

- Nov 7, 2017 10:58pm Nov 7, 2017 10:58pm

- sidhujag

- Joined Apr 2009 | Status: Non-Member | 930 Comments

- Comment #56

- Quote

- Nov 8, 2017 6:46am Nov 8, 2017 6:46am

-

clemmo17

clemmo17 - Joined Jul 2016 | Status: Member | 119 Comments

- Comment #57

- Quote

- Nov 8, 2017 8:42am Nov 8, 2017 8:42am

- gat

- | Joined Dec 2009 | Status: Member | 1040 Comments

- Comment #58

- Quote

- Nov 8, 2017 12:02pm Nov 8, 2017 12:02pm

-

MustafaHaide

MustafaHaide - | Joined Mar 2016 | Status: Member | 21 Comments

- Comment #59

- Quote

- Nov 8, 2017 6:37pm Nov 8, 2017 6:37pm

- sidhujag

- Joined Apr 2009 | Status: Non-Member | 930 Comments

- Comment #60

- Quote

- Nov 9, 2017 9:01am Nov 9, 2017 9:01am

- gat

- | Joined Dec 2009 | Status: Member | 1040 Comments

- Comment #61

- Quote

- Nov 9, 2017 10:41pm Nov 9, 2017 10:41pm

- sidhujag

- Joined Apr 2009 | Status: Non-Member | 930 Comments

- Comment #62

- Quote

- Nov 9, 2017 10:47pm Nov 9, 2017 10:47pm

-

Not-KPMG

Not-KPMG - Joined Jun 2015 | Status: Member | 7592 Comments

Beware of robber banks (RB), bad advisors.

- Comment #63

- Quote

- Nov 9, 2017 11:09pm Nov 9, 2017 11:09pm

- Sniper2000

- | Joined May 2012 | Status: Member | 777 Comments

- Comment #64

- Quote

- Nov 10, 2017 10:59pm Nov 10, 2017 10:59pm

- sidhujag

- Joined Apr 2009 | Status: Non-Member | 930 Comments

- Comment #65

- Quote

- Nov 10, 2017 11:15pm Nov 10, 2017 11:15pm

- Jr123

- | Joined Jun 2017 | Status: Member | 389 Comments

- Comment #66

- Quote

- Nov 12, 2017 1:30pm Nov 12, 2017 1:30pm

- Sniper2000

- | Joined May 2012 | Status: Member | 777 Comments

- Comment #67

- Quote

- Nov 14, 2017 12:40am Nov 14, 2017 12:40am

- sidhujag

- Joined Apr 2009 | Status: Non-Member | 930 Comments

- Comment #68

- Quote

- Nov 14, 2017 3:50am Nov 14, 2017 3:50am

- Jr123

- | Joined Jun 2017 | Status: Member | 389 Comments