-

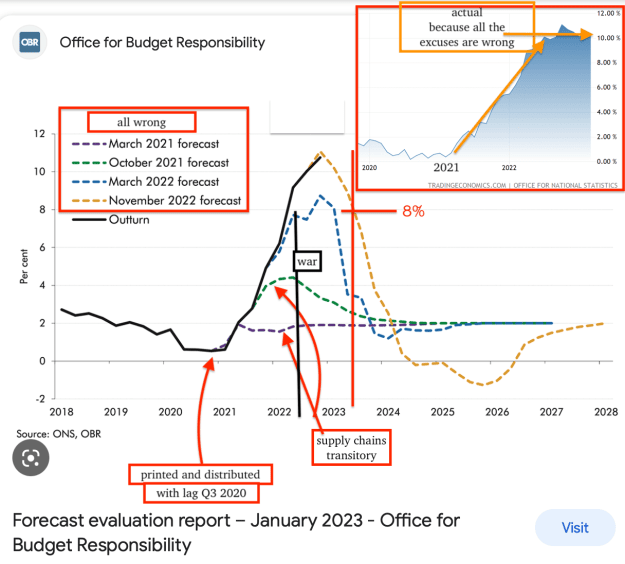

Consumer price inflation, UK: March 2023

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 8.9% in the 12 months to March 2023, down from 9.2% in February. The largest upward contributions to the annual CPIH inflation rate in March 2023 came from housing and household services (principally from electricity, gas and other fuels), and food and non-alcoholic beverages. On a monthly basis, CPIH rose by 0.7% in March 2023, compared with a rise of 0.9% in March 2022. The Consumer Prices Index (CPI) rose by 10.1% in the 12 months to March 2023, down from 10.4% in February. On a monthly basis, CPI rose by 0.8% in March 2023, ... (full story)

- Comments

- Comment

- Subscribe

- Comment #1

- Quote

- Apr 19, 2023 2:02am Apr 19, 2023 2:02am

- jordanvic

- | Joined Jul 2020 | Status: Bro | 920 Comments

- Comment #2

- Quote

- Apr 19, 2023 2:03am Apr 19, 2023 2:03am

- Guest

- | IP XX.XX.42.48

- Comment #3

- Quote

- Apr 19, 2023 2:08am Apr 19, 2023 2:08am

- swagtrading

- Joined May 2019 | Status: Member | 169 Comments

- Comment #4

- Quote

- Apr 19, 2023 2:14am Apr 19, 2023 2:14am

- Guest

- | IP XXX.XXX.27.228

- Comment #5

- Quote

- Apr 19, 2023 2:16am Apr 19, 2023 2:16am

-

hesron

hesron - Joined Dec 2012 | Status: Member | 1917 Comments

Follow price direction

- Comment #6

- Quote

- Apr 19, 2023 2:21am Apr 19, 2023 2:21am

- swagtrading

- Joined May 2019 | Status: Member | 169 Comments

- Comment #7

- Quote

- Apr 19, 2023 2:21am Apr 19, 2023 2:21am

- DaJoWaBa

- Joined Sep 2018 | Status: Member | 730 Comments

- Comment #8

- Quote

- Apr 19, 2023 2:22am Apr 19, 2023 2:22am

- aelvis

- | Joined Apr 2023 | Status: Junior Member | 1 Comment

- Comment #9

- Quote

- Apr 19, 2023 2:35am Apr 19, 2023 2:35am

-

unemployed

unemployed - | Joined Jan 2021 | Status: Member | 26 Comments

- Comment #10

- Quote

- Apr 19, 2023 2:40am Apr 19, 2023 2:40am

-

Rich.C

Rich.C - Joined Nov 2022 | Status: Nothing beats cake | 76 Comments

Break the cake

- Comment #11

- Quote

- Apr 19, 2023 2:47am Apr 19, 2023 2:47am

- Wingcommandr

- | Joined Jun 2022 | Status: Member | 53 Comments

- Comment #12

- Quote

- Apr 19, 2023 2:51am Apr 19, 2023 2:51am

-

hesron

hesron - Joined Dec 2012 | Status: Member | 1917 Comments

Follow price direction

- Comment #13

- Quote

- Apr 19, 2023 2:52am Apr 19, 2023 2:52am

-

Jolita

Jolita - Joined Jan 2012 | Status: Trade Follower | 259 Comments

- Comment #14

- Quote

- Apr 19, 2023 2:52am Apr 19, 2023 2:52am

- DaJoWaBa

- Joined Sep 2018 | Status: Member | 730 Comments

- Comment #15

- Quote

- Apr 19, 2023 2:59am Apr 19, 2023 2:59am

-

NewtonsCash

NewtonsCash - Joined Mar 2014 | Status: Member | 2586 Comments

- Comment #16

- Quote

- Edited 4:07am Apr 19, 2023 3:04am | Edited 4:07am

- DaJoWaBa

- Joined Sep 2018 | Status: Member | 730 Comments

- Comment #17

- Quote

- Apr 19, 2023 3:06am Apr 19, 2023 3:06am

-

hesron

hesron - Joined Dec 2012 | Status: Member | 1917 Comments

Follow price direction

- Comment #18

- Quote

- Apr 19, 2023 3:11am Apr 19, 2023 3:11am

- Guest

- | IP XXX.XX.232.30

- Comment #19

- Quote

- Apr 19, 2023 3:14am Apr 19, 2023 3:14am

- DaJoWaBa

- Joined Sep 2018 | Status: Member | 730 Comments

- Comment #20

- Quote

- Apr 19, 2023 3:14am Apr 19, 2023 3:14am

-

haamzoo

haamzoo - | Joined May 2022 | Status: Member | 2 Comments

- Comment #21

- Quote

- Apr 19, 2023 3:19am Apr 19, 2023 3:19am

-

hesron

hesron - Joined Dec 2012 | Status: Member | 1917 Comments

Follow price direction

- Comment #22

- Quote

- Apr 19, 2023 3:30am Apr 19, 2023 3:30am

- DaJoWaBa

- Joined Sep 2018 | Status: Member | 730 Comments

- Comment #23

- Quote

- Apr 19, 2023 3:43am Apr 19, 2023 3:43am

- Guest

- | IP XXX.XXX.82.144

- Comment #24

- Quote

- Apr 19, 2023 3:50am Apr 19, 2023 3:50am

- jordanvic

- | Joined Jul 2020 | Status: Bro | 920 Comments

- Comment #25

- Quote

- Apr 19, 2023 5:05am Apr 19, 2023 5:05am

- Guest

- | IP XX.XXX.65.13

- Comment #26

- Quote

- Apr 19, 2023 5:23am Apr 19, 2023 5:23am

- readme

- | Joined Mar 2023 | Status: Member | 32 Comments

- Comment #27

- Quote

- Apr 19, 2023 6:15am Apr 19, 2023 6:15am

-

Bones

Bones - Joined Nov 2007 | Status: left CanaryWharf desk-tea break | 2814 Comments | Online Now

#doyourownanalysisordietryin

- Comment #28

- Quote

- Apr 19, 2023 6:26am Apr 19, 2023 6:26am

- jordanvic

- | Joined Jul 2020 | Status: Bro | 920 Comments

- Comment #29

- Quote

- Apr 19, 2023 6:33am Apr 19, 2023 6:33am

-

Bones

Bones - Joined Nov 2007 | Status: left CanaryWharf desk-tea break | 2814 Comments | Online Now

#doyourownanalysisordietryin

- Comment #30

- Quote

- Apr 19, 2023 6:40am Apr 19, 2023 6:40am

- Blessed-man

- | Joined Apr 2016 | Status: Member | 444 Comments

- Comment #31

- Quote

- Apr 19, 2023 6:43am Apr 19, 2023 6:43am

-

Bones

Bones - Joined Nov 2007 | Status: left CanaryWharf desk-tea break | 2814 Comments | Online Now

#doyourownanalysisordietryin

- Comment #32

- Quote

- Edited 8:29am Apr 19, 2023 7:18am | Edited 8:29am

-

Bones

Bones - Joined Nov 2007 | Status: left CanaryWharf desk-tea break | 2814 Comments | Online Now

#doyourownanalysisordietryin

- Comment #33

- Quote

- Apr 19, 2023 7:25am Apr 19, 2023 7:25am

- X0speculator

- | Joined Apr 2023 | Status: Junior Member | 1 Comment

- Comment #34

- Quote

- Apr 19, 2023 8:53am Apr 19, 2023 8:53am

-

turnip15

turnip15 - Joined Sep 2006 | Status: Member | 576 Comments

every Saint has a past. Every Sinner has a Future

- Comment #35

- Quote

- Apr 19, 2023 9:25am Apr 19, 2023 9:25am

- DaJoWaBa

- Joined Sep 2018 | Status: Member | 730 Comments

- Comment #36

- Quote

- Edited 3:52pm Apr 19, 2023 10:02am | Edited 3:52pm

-

Bones

Bones - Joined Nov 2007 | Status: left CanaryWharf desk-tea break | 2814 Comments | Online Now

#doyourownanalysisordietryin

- Comment #37

- Quote

- Apr 19, 2023 10:55am Apr 19, 2023 10:55am

- DaJoWaBa

- Joined Sep 2018 | Status: Member | 730 Comments

- Comment #38

- Quote

- Apr 19, 2023 12:12pm Apr 19, 2023 12:12pm

-

Bones

Bones - Joined Nov 2007 | Status: left CanaryWharf desk-tea break | 2814 Comments | Online Now

#doyourownanalysisordietryin

- Comment #39

- Quote

- Apr 20, 2023 4:02am Apr 20, 2023 4:02am

-

RossEdwards

RossEdwards - Joined Jun 2019 | Status: Member | 3299 Comments

Warning: A Dangerous Subversive: 1% of comments CoCed

- Comment #40

- Quote

- Apr 20, 2023 4:36am Apr 20, 2023 4:36am

- DaJoWaBa

- Joined Sep 2018 | Status: Member | 730 Comments

- Comment #41

- Quote

- Apr 20, 2023 9:04am Apr 20, 2023 9:04am

-

Bones

Bones - Joined Nov 2007 | Status: left CanaryWharf desk-tea break | 2814 Comments | Online Now

#doyourownanalysisordietryin

- Comment #42

- Quote

- Edited 10:57am Apr 20, 2023 10:28am | Edited 10:57am

-

Bones

Bones - Joined Nov 2007 | Status: left CanaryWharf desk-tea break | 2814 Comments | Online Now

#doyourownanalysisordietryin

- Comment #43

- Quote

- Apr 20, 2023 4:55pm Apr 20, 2023 4:55pm

-

RossEdwards

RossEdwards - Joined Jun 2019 | Status: Member | 3299 Comments

Warning: A Dangerous Subversive: 1% of comments CoCed

- Comment #44

- Quote

- Apr 21, 2023 8:02am Apr 21, 2023 8:02am

-

Bones

Bones - Joined Nov 2007 | Status: left CanaryWharf desk-tea break | 2814 Comments | Online Now

#doyourownanalysisordietryin