-

US Manufacturing PMI at 58.7%; December 2021 Manufacturing ISM Report On Business

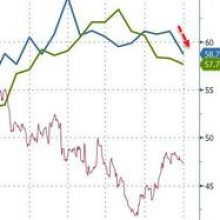

Economic activity in the manufacturing sector grew in December, with the overall economy achieving a 19th consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®. "The December Manufacturing PMI® registered 58.7 percent, a decrease of 2.4 percentage points from the November reading of 61.1 percent. This figure indicates expansion in the overall economy for the 19th month in a row after a contraction in April 2020. The New Orders Index registered 60.4 percent, down 1.1 percentage points compared to the November reading of 61.5 percent. The Production Index ... (full story)

-

*U.S. ISM MANUFACTURING INDEX LOWEST SINCE JANUARY 2021

— *Walter Bloomberg (@DeItaone) January 4, 2022

-

US ISM Manufacturing Dec: 58.7 (est 60.0; prev 61.1)

— LiveSquawk (@LiveSquawk) January 4, 2022

- Prices Paid: 68.2 (est 79.3; prev 82.4)

- New Orders: 60.4 (est 60.4; prev 61.5)

- Employment: 54.2 (est 53.6; prev 53.3)

-

US Manufacturing Unexpectedly Tumbles To 12-Month Low As Prices-Paid Slump

After yesterday's disappointing Markit survey of US Manufacturing, analysts expected ISM Manufacturing to print lower and its did significantly. December ISM Manufacturing printed 58.7, well below the 60.0 expected and the 61.1 prior as it caught down to the 12-month lows of Markit's measure... chart Moist notably, Prices Paid tumbled in December to its lowest since Nov 2020... chart Orders dropped modestly also. The ISM’s factory production measure slipped to 59.2, the lowest since July but robust by historical standards. The pullback may reflect disruptions due to the omicron variant. Improved delivery times ... (full story)