-

About Forex Factory / Blog / Page 5

New product: Brokers

May 7, 2012

We're pleased to announce the beta-release of Brokers, a highly advanced guide to regulated forex brokers. This new product is a breakthrough in the way traders research brokers, finally combining up-to-date information, extensive detail, real-time spreads, and a versatile interface that makes it easy to sort through it all!

While all information on the broker guide is kept fresh, the spreads are real-time! All spreads are pulled from each broker's standard live account (no demos) with mere millisecond of lag (click the icon to refresh). With the built-in sorting feature, you can even sort the brokers by the pair that you trade most!

icon to refresh). With the built-in sorting feature, you can even sort the brokers by the pair that you trade most!

You can learn more about the administration and design of Brokers in the 'About Brokers' box. We hope this new product helps you find the broker that best suits your trading!

While all information on the broker guide is kept fresh, the spreads are real-time! All spreads are pulled from each broker's standard live account (no demos) with mere millisecond of lag (click the

icon to refresh). With the built-in sorting feature, you can even sort the brokers by the pair that you trade most!

icon to refresh). With the built-in sorting feature, you can even sort the brokers by the pair that you trade most!

You can learn more about the administration and design of Brokers in the 'About Brokers' box. We hope this new product helps you find the broker that best suits your trading!

Get a fresh start with Trade Explorer

March 20, 2012

With the new 'Custom Start' feature, you can now specify a date that your Trade Explorer begins including brokerage account history. Strategies change, styles evolve, traders become smarter – all are good reasons you might want to exclude old performance from your metrics. While traders shouldn't forget lessons of the past, it's a lot easier to analyze performance when irrelevant trades are excluded.

To set up a custom start date, click 'Options' at the top-right of your Trade Explorer, and enter a date in the 'Custom Start' section, as shown below.

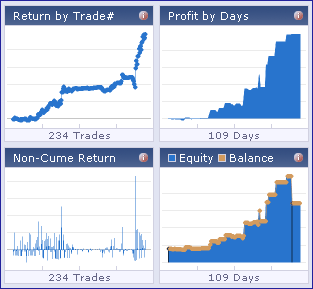

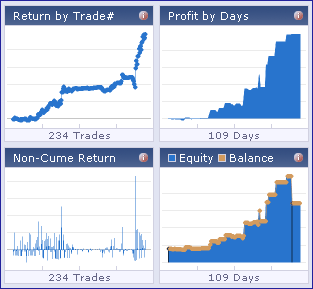

You may have also noticed that we recently changed the graph setup on the 'Overview' tab. Instead of one Flash-based graph, the Trade Explorer now has four image-based graphs on the main tab. This change gives you a thorough overview of the account with just a glance, plus it loads faster because it's no longer based on Flash technology (which was our initial motivation for changing).

The new graphs also interact with the 'Performance' table rows – click the small blue icon on each row to make the graphs represent only that particular period. This is a handy way to zoom in on performance for the year, month, week, or day.

Haven't tried the Trade Explorer yet? Get started here! Or if you have feedback or ideas for improvement, we're always glad to hear from you.

To set up a custom start date, click 'Options' at the top-right of your Trade Explorer, and enter a date in the 'Custom Start' section, as shown below.

You may have also noticed that we recently changed the graph setup on the 'Overview' tab. Instead of one Flash-based graph, the Trade Explorer now has four image-based graphs on the main tab. This change gives you a thorough overview of the account with just a glance, plus it loads faster because it's no longer based on Flash technology (which was our initial motivation for changing).

The new graphs also interact with the 'Performance' table rows – click the small blue icon on each row to make the graphs represent only that particular period. This is a handy way to zoom in on performance for the year, month, week, or day.

Haven't tried the Trade Explorer yet? Get started here! Or if you have feedback or ideas for improvement, we're always glad to hear from you.

Impact icons added to Market chart

January 24, 2012

Our newest feature interconnects three Forex Factory products – the Calendar, News, and Market – to bring you unprecedented insight into how fundamentals are affecting the market.

As shown above, news stories and calendar events are represented by the familiar factory-shaped impact icons at the bottom of the Market chart. Clicking the icons will bring you to the corresponding news story or calendar event for more detail. Impact icons can be turned on or off from the options below the chart, and only News impacts are turned on by default.

Give it a try and let us know what you think!

As shown above, news stories and calendar events are represented by the familiar factory-shaped impact icons at the bottom of the Market chart. Clicking the icons will bring you to the corresponding news story or calendar event for more detail. Impact icons can be turned on or off from the options below the chart, and only News impacts are turned on by default.

Give it a try and let us know what you think!

New product: Trades

December 12, 2011

We're pleased to announce the beta-release of Trades, a new product that tells you who's buying, who's selling, and who's winning!

The data for Trades is aggregated from members sharing their Trade Explorer information (i.e., permissions set to 'Public'), and the default settings only show activity from live brokerage accounts (i.e., no demos). Best of all, you can trust that the performance metrics are legitimate! The live/demo distinction cannot be faked on the Trade Explorer, and as we confirmed last month, all trade statistics are based on equity, so open positions are included in the metrics.

While the default settings only show live accounts, Trades is based on our Flexbox technology, so you can customize the content of the Trade Feed and Leaderboard applications.

There's also a very useful filter on the Trade Feed. You can adjust the setting to show only your buddies' trades, or only EUR/USD trades, for instance.

The default Leaderboard shows which traders are having the best month, and it can also be configured to display annual or weekly periods. To help keep the rankings pure, only Trade Explorers with equity greater than 100 currency units (dollars/euros/pounds/etc.) are included in the rankings, and commercial members are excluded.

So there you have it – a powerful new tool to assist you in your pursuit of profits!

PS, If you don't have a Trade Explorer yet, get one here!

The data for Trades is aggregated from members sharing their Trade Explorer information (i.e., permissions set to 'Public'), and the default settings only show activity from live brokerage accounts (i.e., no demos). Best of all, you can trust that the performance metrics are legitimate! The live/demo distinction cannot be faked on the Trade Explorer, and as we confirmed last month, all trade statistics are based on equity, so open positions are included in the metrics.

While the default settings only show live accounts, Trades is based on our Flexbox technology, so you can customize the content of the Trade Feed and Leaderboard applications.

There's also a very useful filter on the Trade Feed. You can adjust the setting to show only your buddies' trades, or only EUR/USD trades, for instance.

The default Leaderboard shows which traders are having the best month, and it can also be configured to display annual or weekly periods. To help keep the rankings pure, only Trade Explorers with equity greater than 100 currency units (dollars/euros/pounds/etc.) are included in the rankings, and commercial members are excluded.

So there you have it – a powerful new tool to assist you in your pursuit of profits!

PS, If you don't have a Trade Explorer yet, get one here!

Explore charted trades

November 29, 2011

You've probably seen this awesome feature on the more advanced trading platforms – and now the Trade Explorer has it too!

To open a charted trade, just click the chart icon ( ) for any trade on the Trade List tab. You can also option to show other trades on that instrument by checking 'Show Surrounding Trades.'

) for any trade on the Trade List tab. You can also option to show other trades on that instrument by checking 'Show Surrounding Trades.'

Haven't tried the Trade Explorer yet? Get started here! Or if you have feedback or ideas for improvement, we're always glad to hear from you.

To open a charted trade, just click the chart icon (

) for any trade on the Trade List tab. You can also option to show other trades on that instrument by checking 'Show Surrounding Trades.'

) for any trade on the Trade List tab. You can also option to show other trades on that instrument by checking 'Show Surrounding Trades.'

Haven't tried the Trade Explorer yet? Get started here! Or if you have feedback or ideas for improvement, we're always glad to hear from you.