Dear fellow traders, i have a question stuck long enough and still can't figure it out by myself, maybe i didn't learn enough about probability math.

This question is appointed for any quants, please help me with this

Here we go :

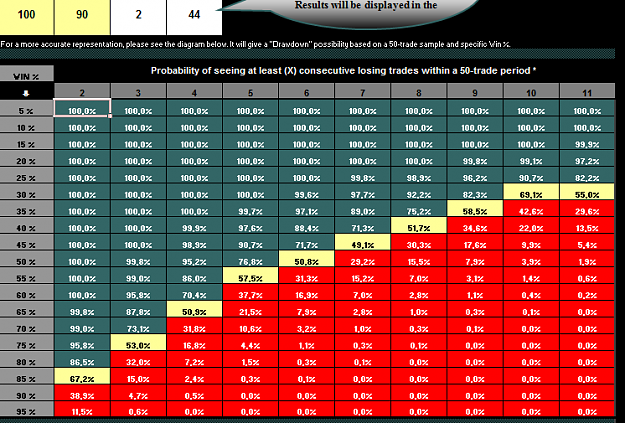

Let's say we have test our system for once, say it 100 trades, and we got 90 winning trades and 10 losing trades (so we have simply 90% winning and 10% losing in percentage terms)

Then, we run the system in the live account, and suddenly,we have like 30 consecutive losses. According to our system it was 10% of failures, so we should theoretically stick with our system and expecting that we will at least have other 270 winners (if we are planning to make a 300 trade in a year), am i right? please correct if anything wrong

Nah, the question is, how could we know the next trades will be 270 consecutive winning trades? it can also be 100 consecutive losing trades then 900 winning trades in a row, and it will still be a 90% winning and 10% losing.

If so, how could we simply apply what we have tested systems, even it is a 99% winning system, it also can be a 10 consecutive losing trades and 990 winning trades, how can we keep in faith with our system that generates large numbers of losing trades in a row while it was statistically a profitable systems?

Please help me with this problem

This question is appointed for any quants, please help me with this

Here we go :

Let's say we have test our system for once, say it 100 trades, and we got 90 winning trades and 10 losing trades (so we have simply 90% winning and 10% losing in percentage terms)

Then, we run the system in the live account, and suddenly,we have like 30 consecutive losses. According to our system it was 10% of failures, so we should theoretically stick with our system and expecting that we will at least have other 270 winners (if we are planning to make a 300 trade in a year), am i right? please correct if anything wrong

Nah, the question is, how could we know the next trades will be 270 consecutive winning trades? it can also be 100 consecutive losing trades then 900 winning trades in a row, and it will still be a 90% winning and 10% losing.

If so, how could we simply apply what we have tested systems, even it is a 99% winning system, it also can be a 10 consecutive losing trades and 990 winning trades, how can we keep in faith with our system that generates large numbers of losing trades in a row while it was statistically a profitable systems?

Please help me with this problem