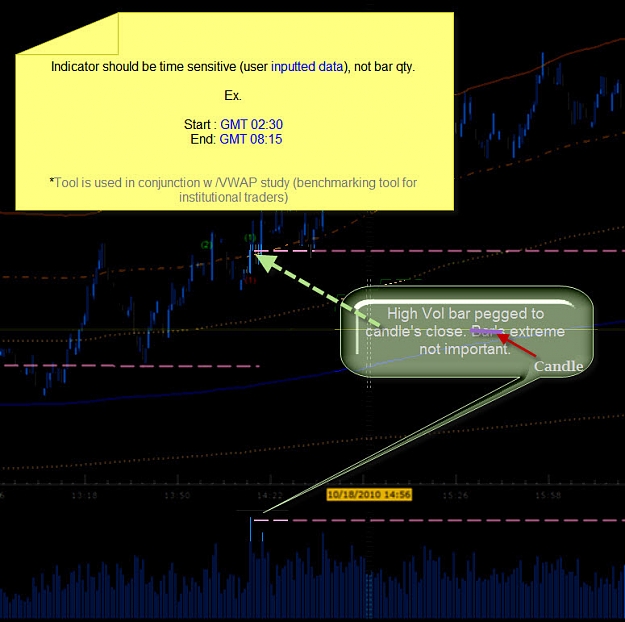

I've been searching, but no luck. Does anyone have a PVP (Peak Volume Price) indicator that draws a line at the close of a high volume bar for a specified time period?

Much appreciated if have and can share... thanks.

Much appreciated if have and can share... thanks.