Hi everyone, I'm not sure where to begin but let me start by saying how I trade.

I trade price action. I have the stochastic, and a 20, 50, and 200 SMA on my charts. But the only time any of those indicators will affect a decision I make is if one of the MAs is acting as dynamic support/resistance. I trade any pair, but just currencies, not XAUUSD or anything else. I trade trend continuation, entering on pullbacks.

>I look first at the 1D chart. I plot out key levels of support and resistance. I draw the S/R areas as rectangles, not lines, because well, they are areas in most cases. Although I often use lines to mark out key psychological levels like round numbers and previous highs/lows. I don't use trend lines.

>Next I look at the 4H chart. I want to see a clear trend in one or the other direction. I make a note of clearly trending pairs. I see if what the 1D and 4H charts are telling me is in agreement. For example, I don't go against a higher time frame trend but say if the 4H candles have broken and retested a resistance zone on the 1D chart, I pay close attention.

>I wait for the London or New York session, which one depends on my work schedule. I also look at the 1H chart, and make sure all three time frames are in agreement. If price is in a clear trend on the 1H chart, and is at an area of value such as an S/R zone or dynamic S/R like an MA, I wait for my entry signal. That will be a doji or large wick, or an engulfing candle. And it will be the first FULL 1H candle printed on the NY or London session. But I sometimes trade the 2nd or 3 candle if for example like what often happens when the is some news a couple hours after open.

>Also, I don't trade a pair if there is major news coming within 24h of my entry. I keep track of the fundamentals of each currency and take those into account. I also keep track of COT data and use that as confluence. I risk 0.50% per trade and I only have one trade open for any given currency at any given time. I generally go for 2:1 RRR. But if the setup is solid, I accept as little as 1.6:1 if for example I think price will only go that far. I put my stop loss at the point where my trade thesis would be invalidated, plus a few more pips just in case there is stop hunting. In practice this usually means below the low/high of the previous pullback.

I started learning how to trade a year and a half ago. I've already passed two funding challenges. But the first account I lost due to max drawdown. It was death by a thousand cuts, and also at that time last year I was confused about how to be trading. My problem now is that my current funded account is in drawdown.

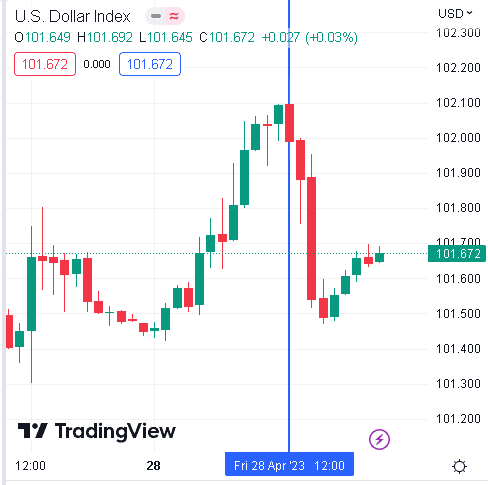

I was doing well until precisely April 14th when US retail sales came out. What I've noticed since then is that the DXY has been in a range. So I avoided the USD pairs and traded cross pairs. Both are profitable for me in my good months. Now, since April 14th, the same thing has happened again and again. I look at a cross pair, go through the whole process I outlined and enter a trade. And I'm getting stopped out again and again and again. And the trend always seems to reverse exactly when I enter the trade. It's like I'm cursed.

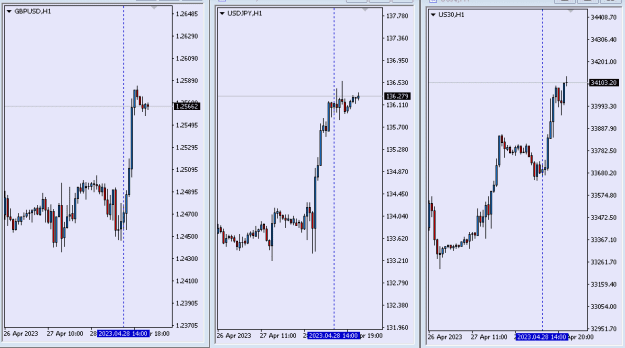

What I'm thinking I should do is wait until the DXY decisively breaks out of its range, I think that at the latest by the week after next, after FED, ECB and NFP this will be the case. What I'm noticing is that I can't even trust the movements on cross pairs when the USD is making choppy price action. I went over this on the charts today. For example, looking at CADCHF and USDCHF side to side. When I see some weird sudden choppy move that makes no sense on a cross pair, often when I go to the corresponding USD pairs for one of those two currencies, I see that same move.

So yeah basically I either have months where my win rate is 45%-55% with a 2:1 RRR (which I'm super happy about), or I have a horrible time when my win rate is literally like 25%. That's how I would lose my funded account.

So do more experienced traders agree with my thesis that I should only trade when DXY is clearly trending?

More long term, if I do this I will have sometimes long stretches where I don't trade. Regarding that I have two options:

1. Learn to trade mean reversion and switch to that strategy when the DXY is rangebound like it has been since April 14th.

2. Or I learn to trade other assets like USOIL or indices. I can trade those when they are trending. I'm leaning towards this solution now because I've started to trade USOIL and the S&P500 on a demo account. But I'm open minded.

I'd really hate to lose this funded account. Seeing how I have already passed two prop firm challenges and mostly profitable months on demo, I have a certain level of confidence. I think if I pass this hurdle the future looks bright. Any advice or thoughts from more experienced traders would be greatly appreciated. God bless you all.

Edit: The title should read "need advice from veterans". I'm a little tired today haha!

I trade price action. I have the stochastic, and a 20, 50, and 200 SMA on my charts. But the only time any of those indicators will affect a decision I make is if one of the MAs is acting as dynamic support/resistance. I trade any pair, but just currencies, not XAUUSD or anything else. I trade trend continuation, entering on pullbacks.

>I look first at the 1D chart. I plot out key levels of support and resistance. I draw the S/R areas as rectangles, not lines, because well, they are areas in most cases. Although I often use lines to mark out key psychological levels like round numbers and previous highs/lows. I don't use trend lines.

>Next I look at the 4H chart. I want to see a clear trend in one or the other direction. I make a note of clearly trending pairs. I see if what the 1D and 4H charts are telling me is in agreement. For example, I don't go against a higher time frame trend but say if the 4H candles have broken and retested a resistance zone on the 1D chart, I pay close attention.

>I wait for the London or New York session, which one depends on my work schedule. I also look at the 1H chart, and make sure all three time frames are in agreement. If price is in a clear trend on the 1H chart, and is at an area of value such as an S/R zone or dynamic S/R like an MA, I wait for my entry signal. That will be a doji or large wick, or an engulfing candle. And it will be the first FULL 1H candle printed on the NY or London session. But I sometimes trade the 2nd or 3 candle if for example like what often happens when the is some news a couple hours after open.

>Also, I don't trade a pair if there is major news coming within 24h of my entry. I keep track of the fundamentals of each currency and take those into account. I also keep track of COT data and use that as confluence. I risk 0.50% per trade and I only have one trade open for any given currency at any given time. I generally go for 2:1 RRR. But if the setup is solid, I accept as little as 1.6:1 if for example I think price will only go that far. I put my stop loss at the point where my trade thesis would be invalidated, plus a few more pips just in case there is stop hunting. In practice this usually means below the low/high of the previous pullback.

I started learning how to trade a year and a half ago. I've already passed two funding challenges. But the first account I lost due to max drawdown. It was death by a thousand cuts, and also at that time last year I was confused about how to be trading. My problem now is that my current funded account is in drawdown.

I was doing well until precisely April 14th when US retail sales came out. What I've noticed since then is that the DXY has been in a range. So I avoided the USD pairs and traded cross pairs. Both are profitable for me in my good months. Now, since April 14th, the same thing has happened again and again. I look at a cross pair, go through the whole process I outlined and enter a trade. And I'm getting stopped out again and again and again. And the trend always seems to reverse exactly when I enter the trade. It's like I'm cursed.

What I'm thinking I should do is wait until the DXY decisively breaks out of its range, I think that at the latest by the week after next, after FED, ECB and NFP this will be the case. What I'm noticing is that I can't even trust the movements on cross pairs when the USD is making choppy price action. I went over this on the charts today. For example, looking at CADCHF and USDCHF side to side. When I see some weird sudden choppy move that makes no sense on a cross pair, often when I go to the corresponding USD pairs for one of those two currencies, I see that same move.

So yeah basically I either have months where my win rate is 45%-55% with a 2:1 RRR (which I'm super happy about), or I have a horrible time when my win rate is literally like 25%. That's how I would lose my funded account.

So do more experienced traders agree with my thesis that I should only trade when DXY is clearly trending?

More long term, if I do this I will have sometimes long stretches where I don't trade. Regarding that I have two options:

1. Learn to trade mean reversion and switch to that strategy when the DXY is rangebound like it has been since April 14th.

2. Or I learn to trade other assets like USOIL or indices. I can trade those when they are trending. I'm leaning towards this solution now because I've started to trade USOIL and the S&P500 on a demo account. But I'm open minded.

I'd really hate to lose this funded account. Seeing how I have already passed two prop firm challenges and mostly profitable months on demo, I have a certain level of confidence. I think if I pass this hurdle the future looks bright. Any advice or thoughts from more experienced traders would be greatly appreciated. God bless you all.

Edit: The title should read "need advice from veterans". I'm a little tired today haha!