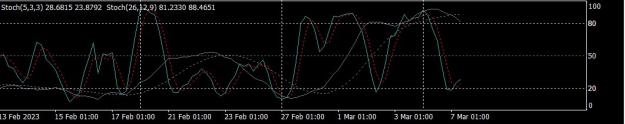

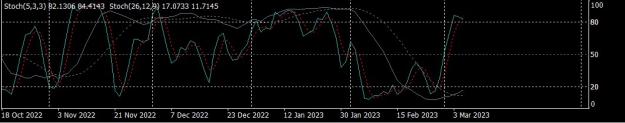

Price action lies at the very heart of market analysis, a powerful tool honed by traders for over a century.

From the timeless principles of Dow Theory and Wyckoff analysis and Elliot Wave to the modern advancements of Smart Money Concepts (SMC) and ICT, the core remains constant: reading the market's story through its raw price movements.

Join us on this exciting journey into Price Action Trading (PAT). Here, we delve deep into the pure analysis of price action, stripping away distractions and focusing on the market's fundamental language.

Rule:

Where the only rule that matters is fresh breath!

We believe that good dental hygiene and good intentions go hand in hand, so before you post, make sure to brush your teeth (and your brain!) and leave your troll impulses at the door.

As for the rest of the rules, we'll make them up as we go along, because where's the fun in following a boring rule book?

So come join the fun and let's see where our collaborative and well-intentioned discussions take us!

Pat Chiko

From the timeless principles of Dow Theory and Wyckoff analysis and Elliot Wave to the modern advancements of Smart Money Concepts (SMC) and ICT, the core remains constant: reading the market's story through its raw price movements.

Join us on this exciting journey into Price Action Trading (PAT). Here, we delve deep into the pure analysis of price action, stripping away distractions and focusing on the market's fundamental language.

Rule:

Where the only rule that matters is fresh breath!

We believe that good dental hygiene and good intentions go hand in hand, so before you post, make sure to brush your teeth (and your brain!) and leave your troll impulses at the door.

As for the rest of the rules, we'll make them up as we go along, because where's the fun in following a boring rule book?

So come join the fun and let's see where our collaborative and well-intentioned discussions take us!

Pat Chiko

I come from the future.