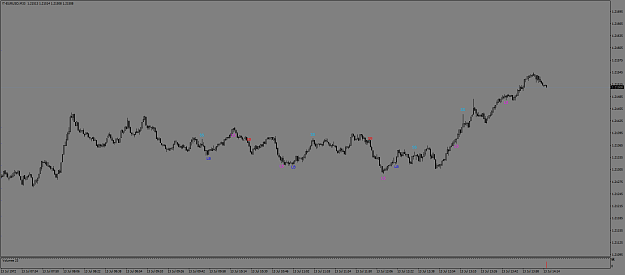

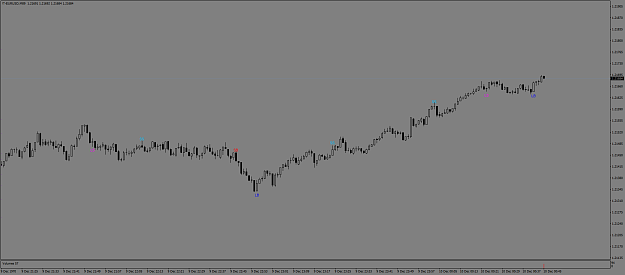

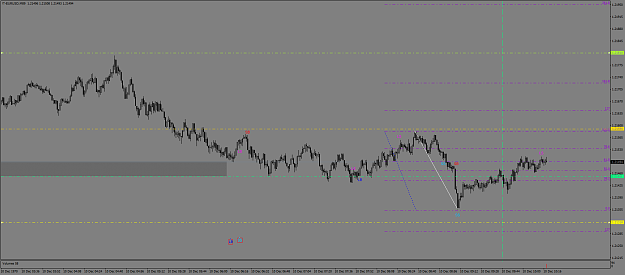

I intend to use this journal to build a new system I have named Conflict Candles.

It is basically PA reading but so far I have found incredible accuracy to read to the "right" side of the chart. I have just began, so there is much work to be done and there maybe ramblings of my thoughts as I try to figure out the finer points as I try to create the system.

First I need to clarify my terminologies: "Position" and "Action". In the market a "Long" is always a long and a "Short" is always a short. This is a "Position". However when you are "Buying" or "Selling" a trade, it is an "Action". What I mean is this: When you enter the market and "Buy" a "Long" you are buying that long from someone else. When you exit the trade you "Sell" that "Long" and someone else is buying that long from you. The same scenario exists for a "Short". So you enter the market and "Buy" a "Short" position from someone else and then when you exit the trade you "Sell" that "Short" to someone else. It is as you would imagine stocks, where the "Longs" are one stock and the "Sells" are another. They are two different entities, however they are in the same market and always are fighting for dominionship.

Conflict Candles

There are four types of Conflict Candles. By identifying the right candle in the right Scenario creates clarity of where the market is and what is going to happen next.

The Scenarios are:

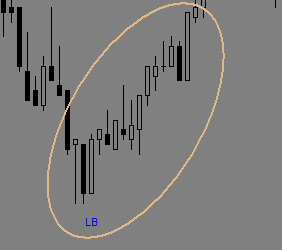

Long Buying (LB): This is a full throttle Candle move by the Bulls to move the market up. It is a positive move to the topside.

Long Selling (LS): This is a Candle of the Bulls exiting the market. It is considered a liquidation and potential for the bears to move in.

Short Buying (SB): This is a full throttle Candle move by the Bears to move the market down. It is a positive move to the downside.

Short Selling (SS): This is a Candle of the Bears exiting the market. It is considered a liquidation and potential for the Bulls to move in.

That's about it on the Introduction. This thread is going to be about how to read these candles and how to put the sequence of the conflict candles together. Not all candles are conflict candles but recognising these candles and how to put them together to understand the market is the purpose of this thread.

NB

A big thanks to Mr Pip. His thread and videos taught me about the market and charts. He taught me about Order Flow and the Harmonics of the market. His teachings are still my base reading of how the market flows and influenced many of my trade plans rules. If you want to start at the beginning and work through to becoming advanced, start here:

https://www.forexfactory.com/thread/...t-way-to-trade

He is in the commercial section of FF for reasons we can't fathom, I guarantee there is zero to sell on his thread or his You Tube channel.

Be sure to look him up on You Tube, his videos and live streams are educational and a great watch.

It is basically PA reading but so far I have found incredible accuracy to read to the "right" side of the chart. I have just began, so there is much work to be done and there maybe ramblings of my thoughts as I try to figure out the finer points as I try to create the system.

First I need to clarify my terminologies: "Position" and "Action". In the market a "Long" is always a long and a "Short" is always a short. This is a "Position". However when you are "Buying" or "Selling" a trade, it is an "Action". What I mean is this: When you enter the market and "Buy" a "Long" you are buying that long from someone else. When you exit the trade you "Sell" that "Long" and someone else is buying that long from you. The same scenario exists for a "Short". So you enter the market and "Buy" a "Short" position from someone else and then when you exit the trade you "Sell" that "Short" to someone else. It is as you would imagine stocks, where the "Longs" are one stock and the "Sells" are another. They are two different entities, however they are in the same market and always are fighting for dominionship.

Conflict Candles

There are four types of Conflict Candles. By identifying the right candle in the right Scenario creates clarity of where the market is and what is going to happen next.

The Scenarios are:

Long Buying (LB): This is a full throttle Candle move by the Bulls to move the market up. It is a positive move to the topside.

Long Selling (LS): This is a Candle of the Bulls exiting the market. It is considered a liquidation and potential for the bears to move in.

Short Buying (SB): This is a full throttle Candle move by the Bears to move the market down. It is a positive move to the downside.

Short Selling (SS): This is a Candle of the Bears exiting the market. It is considered a liquidation and potential for the Bulls to move in.

That's about it on the Introduction. This thread is going to be about how to read these candles and how to put the sequence of the conflict candles together. Not all candles are conflict candles but recognising these candles and how to put them together to understand the market is the purpose of this thread.

NB

A big thanks to Mr Pip. His thread and videos taught me about the market and charts. He taught me about Order Flow and the Harmonics of the market. His teachings are still my base reading of how the market flows and influenced many of my trade plans rules. If you want to start at the beginning and work through to becoming advanced, start here:

https://www.forexfactory.com/thread/...t-way-to-trade

He is in the commercial section of FF for reasons we can't fathom, I guarantee there is zero to sell on his thread or his You Tube channel.

Be sure to look him up on You Tube, his videos and live streams are educational and a great watch.

As the lights go by so too do the shadows move