Let's say, a pair is in 1000 pips range for years, even 2000 pips we can trade SYL method and increase our equity by;

As explained in the attached excel sheet,

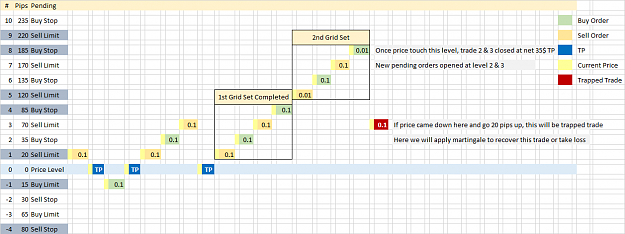

* if only one pending order hit (above or below) and price retrace then it will hit TP at next grid level.

* If price returns after hitting 3 pending orders then all 3 will hit TP at the original level.

* If only 2 pending orders triggered and price return then no order will close

* If 4 orders triggered, then it will be declared as a first complete set. Top and Bottom trades will be called fixed and middle two trades will be flexible.

When price will move 5 grid levels up from Buy trade or 5 grid down from sell trade, order 2 & 3 will close with net TP of 35 pips and will be refilled by pending orders again. We will get 35 net pips whenever price will pass through a complete set of 4 trades. (either range or trend)

Manually, this will need a lot of babysitting but the idea can be coded and by running this for months, we can reach our target equity (20%-30% or more).

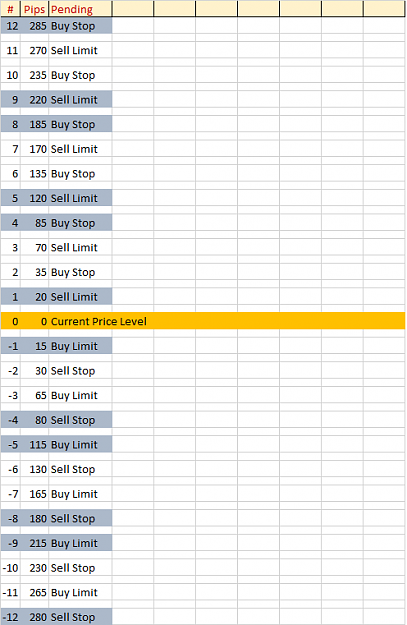

- Setting pending orders (all types) on above and below at fixed distance levels (grid-based)

- Keeping fixed trade open for eternity (using swap-free brokers)

- Declaring fixed and flexible trades.

- Closing flexible trades at TP levels and milking pips.

- Taking Stop Loss only for trapped trades (rare cases).

Don't expect huge profits but good regular profits can be made over the long run, so a lot of patience is required to win.

To understand the concept, please see the attached excel sheet; Thanks to Kingsley (Oyaks) for his idea.

SYL method starts with 12 pending orders above price and 12 below the current price as per set fixed distance in pips between each trade. The highlighted trades are fixed and cannot be closed until unless we reach our target equity.

As explained in the attached excel sheet,

* if only one pending order hit (above or below) and price retrace then it will hit TP at next grid level.

* If price returns after hitting 3 pending orders then all 3 will hit TP at the original level.

* If only 2 pending orders triggered and price return then no order will close

* If 4 orders triggered, then it will be declared as a first complete set. Top and Bottom trades will be called fixed and middle two trades will be flexible.

When price will move 5 grid levels up from Buy trade or 5 grid down from sell trade, order 2 & 3 will close with net TP of 35 pips and will be refilled by pending orders again. We will get 35 net pips whenever price will pass through a complete set of 4 trades. (either range or trend)

Manually, this will need a lot of babysitting but the idea can be coded and by running this for months, we can reach our target equity (20%-30% or more).

Attached File(s)

Grid / Martingale / Hedge Lover