Hello traders. My name is Stefan. I am originally from Romania but I have been living in New Zealand for the last 14 years.

I have been trading the foreign exchange market for the last eleven years. Over the last two years my trading has been consistent and profitable using the same strategy over and over again. I have no secrets, I simply focus now on the factors that actually drives the market and have become fully proficient in them: price, supply/demand, resistance/support, and the trend my friend. I also prefer to use Heikin-Ashi instead of Japanese candles. They remove the noise from the charts and help to identify an establish trend. This is all you will need on your charts to join the profitability side alongside the required chart time to really master this approach. Before we continue, you must understand that trading is the hardest way to make easy money. And it will take you years to really master all the aspects of trading to make this easy money. If you are hoping for overnight success or think this is the Holy Grail to your trading inconsistency look elsewhere.

It is a proven statistic that 90-95% of traders will lose money in the markets and yet I only see winners on Instagram (social media.) Most, if not all of these so called Forex gurus make money selling a service than by actually trading. Trading is risky, teaching how to trade is risk-free which is the reason why so many gurus out there are ready to turn you into the next millionaire. They have realized it is more profitable to teach you and provide you a signal where your money is at risk, not theirs. They are marketers that capitalize on the fact that trading is an extremely challenging profession and a struggling trader is holding on dearly to the idea of overnight success. Everyone is teaching but no one is providing a monthly statement or all weekly trading setups taken with results. Instead, I see Demo accounts (heck sometimes photoshopped statements!) and luxury cars that fool the new trader into thinking consistency is easily attainable.

Most struggling traders have not even tested their strategy for positive expectancy. That simply means, examining a data of a large sample of trades that you have taken with your defined strategy for a conclusive result. All technical analysis books educate the reader in hindsight. Hindsight does not make you money. The proof is 95% of traders fail. Why? One reason is because they are being taught to place their entries in places where the smart money (banks and large institutions) are placing theirs orders that need to be filled. So it does not matter how much time you spend educating yourself and how many hours you put behind the charts because your brain has been wired to trade poorly. Do you trade falling wedges and indicators with consistency? Are you really making money month after month (which means your winnings months profit exceeds a losing month or two losses to cover a bad run?) I didnt think so. I certainly have had a few losing months over the last two years, but my winnings far exceed those losses.

Trading is about protecting your capital and adhering to a strict risk management plan and deploying your assets (money) when your edge is present at the current market conditions. Trading is not about flipping accounts. Lets be serious. The results that you see on Instagram, have you ever wondered how all 20-25 year olds there have $50,000, $100,000, $500,000 available to yield those types of returns if he was doing it in a safe and smart manner?

I don't have a crystal ball and I don't post only winning trades. This month actually has been in red for me so far. But this is the reality of trading and when you only see statements in green something is not right.

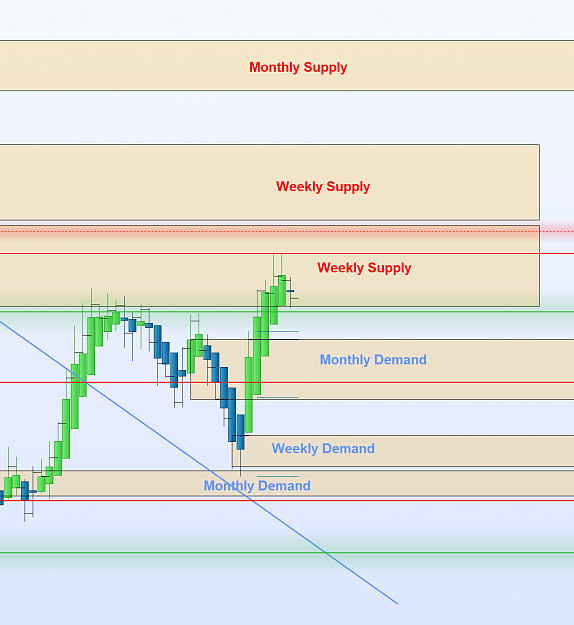

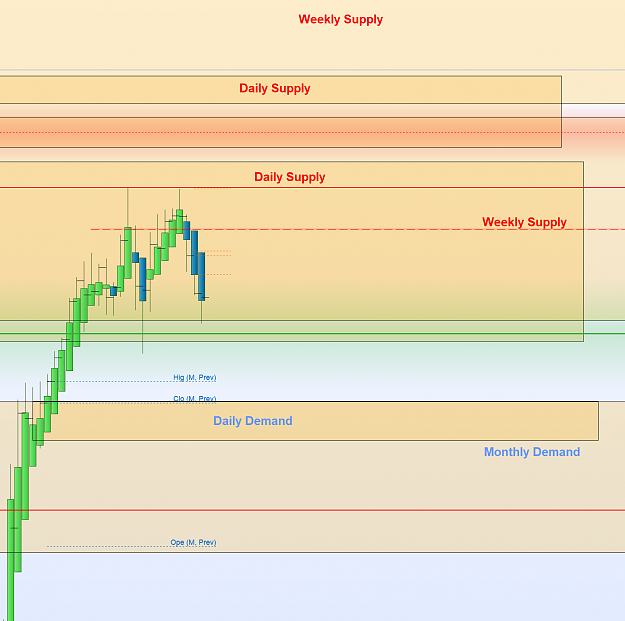

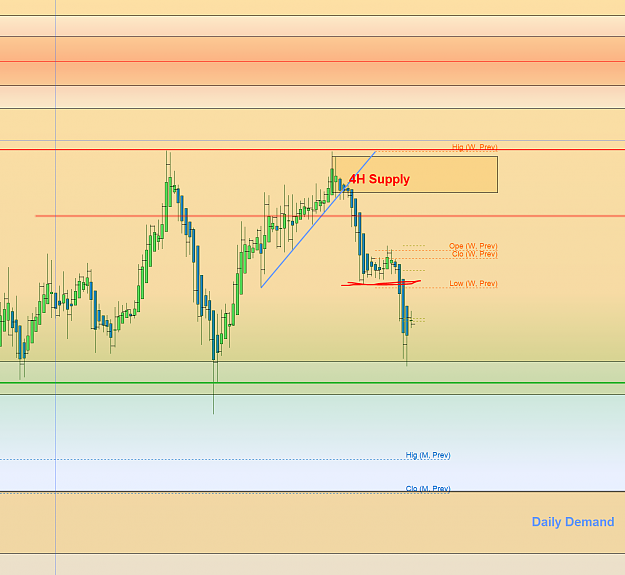

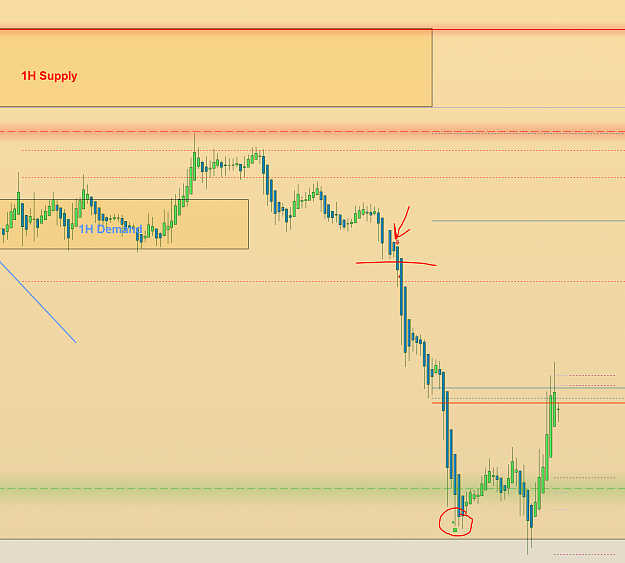

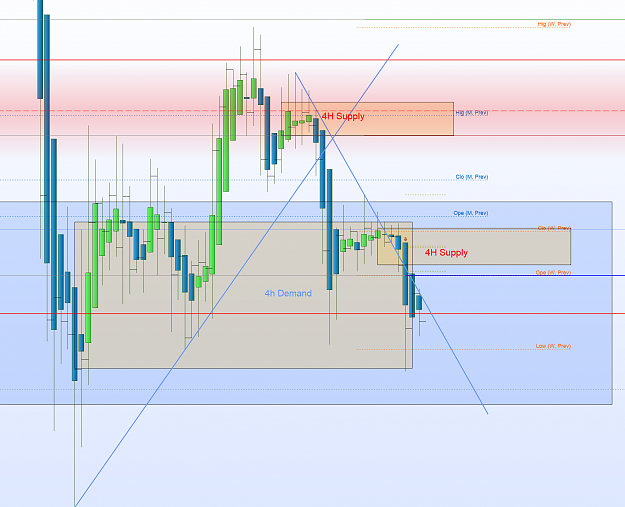

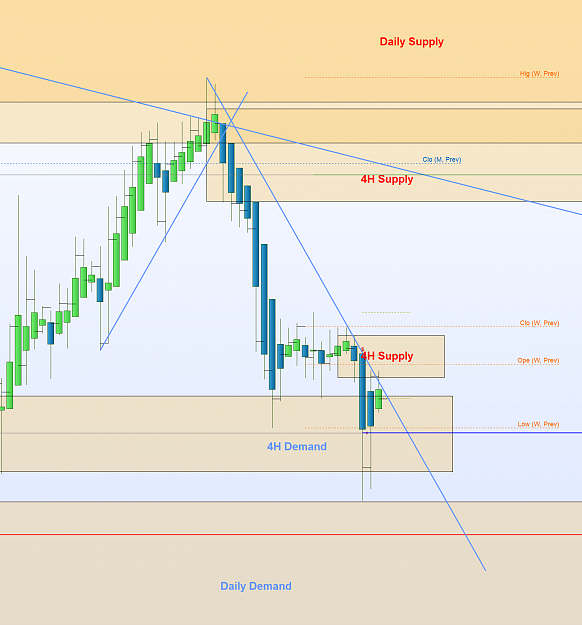

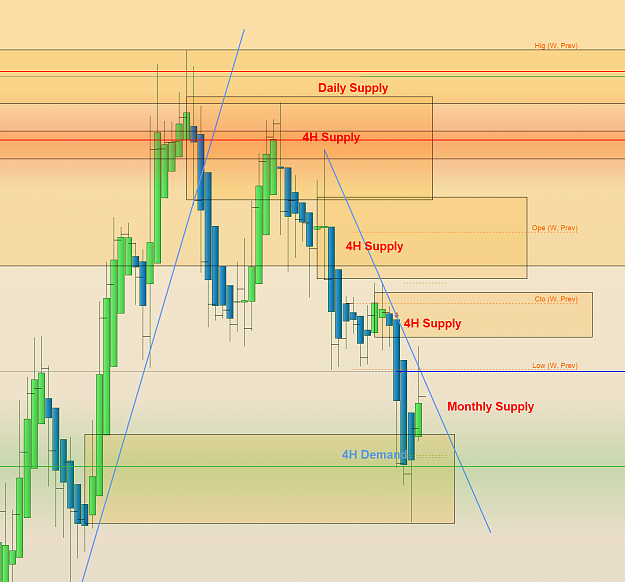

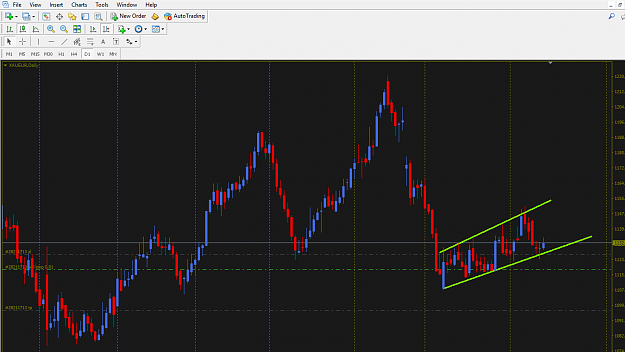

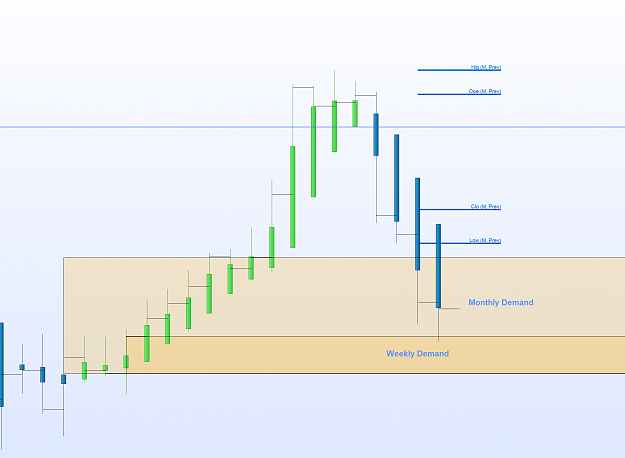

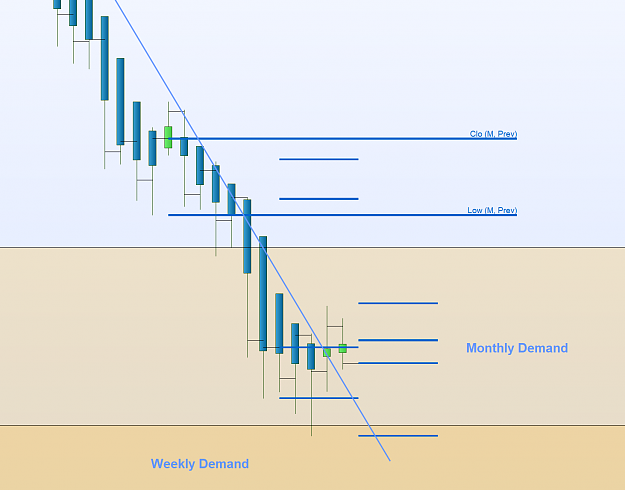

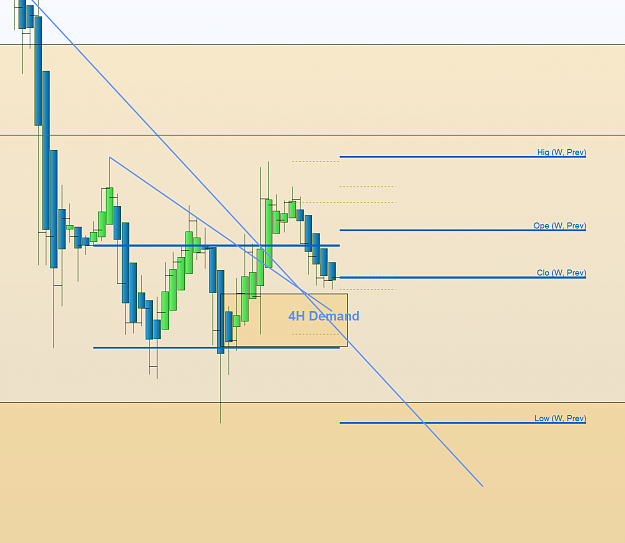

The blueprint of trading is price, supply and demand, support and resistance, and the trend and is all based on PRICE ACTION ONLY! This is all I need to make my trading decisions from a top-down approach. Now, I have molded my craft over the years in a way that works for me. Everyone has a different perspective and that is fine, you must mold a craft that works for you, but the blueprint is still the same.

This thread is not going to be repetitive on what you find in abundance in most TA books or have easily accessible on the Internet. This thread is based on my actual strategy that I have tested with positive expectancy for the last two years. I will go in depth on my interpretation of the charts and tell my story. I will explain how I built a case on every single trade I take by identifying the trend, where the current selling and buying is happening (demand and supply), and locating the resistance and support levels price has reacted to. Its that simple. If this is your first day in Forex, I insist you go through babypipss school to learn the dynamics of the market. You must also be able to differentiate that just because I am very successful with my approach does not mean you will have the same positive expectancy. Why is that? Simply because of perception like we talked earlier and more importantly behind my results are also 11 years of market exposure. Use the content found in this thread to enhance your interpretation of the charts and find out what works for you, this is paramount. It will require extreme efforts on your part. I want to show the world what real trading looks like. That means all my entries/exits (charts) for the week, statements at the end of the month. Stay tune, this will be a very active thread.

NOTE *this is NOT a signal service. You must learn to make your own trading decisions*

Thanks

Stefan

I have been trading the foreign exchange market for the last eleven years. Over the last two years my trading has been consistent and profitable using the same strategy over and over again. I have no secrets, I simply focus now on the factors that actually drives the market and have become fully proficient in them: price, supply/demand, resistance/support, and the trend my friend. I also prefer to use Heikin-Ashi instead of Japanese candles. They remove the noise from the charts and help to identify an establish trend. This is all you will need on your charts to join the profitability side alongside the required chart time to really master this approach. Before we continue, you must understand that trading is the hardest way to make easy money. And it will take you years to really master all the aspects of trading to make this easy money. If you are hoping for overnight success or think this is the Holy Grail to your trading inconsistency look elsewhere.

It is a proven statistic that 90-95% of traders will lose money in the markets and yet I only see winners on Instagram (social media.) Most, if not all of these so called Forex gurus make money selling a service than by actually trading. Trading is risky, teaching how to trade is risk-free which is the reason why so many gurus out there are ready to turn you into the next millionaire. They have realized it is more profitable to teach you and provide you a signal where your money is at risk, not theirs. They are marketers that capitalize on the fact that trading is an extremely challenging profession and a struggling trader is holding on dearly to the idea of overnight success. Everyone is teaching but no one is providing a monthly statement or all weekly trading setups taken with results. Instead, I see Demo accounts (heck sometimes photoshopped statements!) and luxury cars that fool the new trader into thinking consistency is easily attainable.

Most struggling traders have not even tested their strategy for positive expectancy. That simply means, examining a data of a large sample of trades that you have taken with your defined strategy for a conclusive result. All technical analysis books educate the reader in hindsight. Hindsight does not make you money. The proof is 95% of traders fail. Why? One reason is because they are being taught to place their entries in places where the smart money (banks and large institutions) are placing theirs orders that need to be filled. So it does not matter how much time you spend educating yourself and how many hours you put behind the charts because your brain has been wired to trade poorly. Do you trade falling wedges and indicators with consistency? Are you really making money month after month (which means your winnings months profit exceeds a losing month or two losses to cover a bad run?) I didnt think so. I certainly have had a few losing months over the last two years, but my winnings far exceed those losses.

Trading is about protecting your capital and adhering to a strict risk management plan and deploying your assets (money) when your edge is present at the current market conditions. Trading is not about flipping accounts. Lets be serious. The results that you see on Instagram, have you ever wondered how all 20-25 year olds there have $50,000, $100,000, $500,000 available to yield those types of returns if he was doing it in a safe and smart manner?

I don't have a crystal ball and I don't post only winning trades. This month actually has been in red for me so far. But this is the reality of trading and when you only see statements in green something is not right.

The blueprint of trading is price, supply and demand, support and resistance, and the trend and is all based on PRICE ACTION ONLY! This is all I need to make my trading decisions from a top-down approach. Now, I have molded my craft over the years in a way that works for me. Everyone has a different perspective and that is fine, you must mold a craft that works for you, but the blueprint is still the same.

This thread is not going to be repetitive on what you find in abundance in most TA books or have easily accessible on the Internet. This thread is based on my actual strategy that I have tested with positive expectancy for the last two years. I will go in depth on my interpretation of the charts and tell my story. I will explain how I built a case on every single trade I take by identifying the trend, where the current selling and buying is happening (demand and supply), and locating the resistance and support levels price has reacted to. Its that simple. If this is your first day in Forex, I insist you go through babypipss school to learn the dynamics of the market. You must also be able to differentiate that just because I am very successful with my approach does not mean you will have the same positive expectancy. Why is that? Simply because of perception like we talked earlier and more importantly behind my results are also 11 years of market exposure. Use the content found in this thread to enhance your interpretation of the charts and find out what works for you, this is paramount. It will require extreme efforts on your part. I want to show the world what real trading looks like. That means all my entries/exits (charts) for the week, statements at the end of the month. Stay tune, this will be a very active thread.

NOTE *this is NOT a signal service. You must learn to make your own trading decisions*

Thanks

Stefan