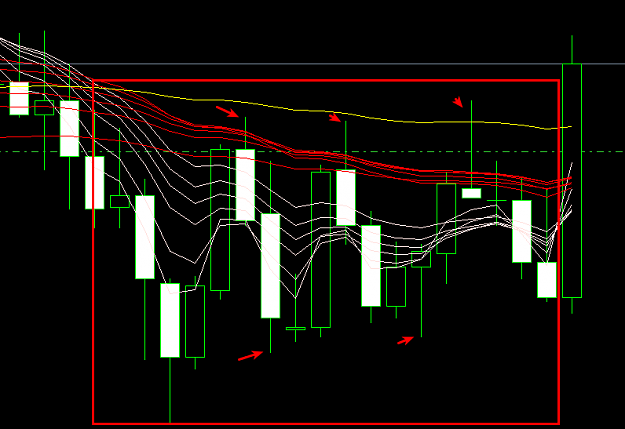

Folks, recently I have been trying to trade breakout method and it seems very effective, but one problem is that all major breakout comes from a ranging market, and during ranging market, it swing so much that my position would have been hitting cut loss point.

Now I am trying progressive approach, which means open a small position first, when breakout is confirm, open some more, so even it's bleeding due to market swing, loss would still be manageable.

What's your method then? want to improve my method a little bit, thanks.

Now I am trying progressive approach, which means open a small position first, when breakout is confirm, open some more, so even it's bleeding due to market swing, loss would still be manageable.

What's your method then? want to improve my method a little bit, thanks.