This method is below in the first few posts, or in a nutshell at Post 185 on Page 10.

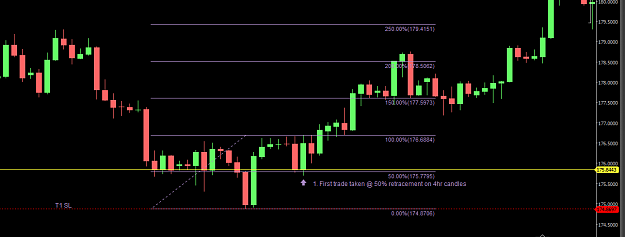

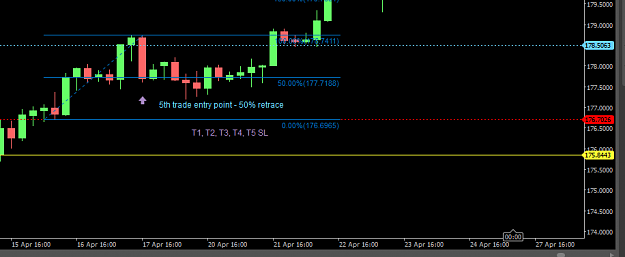

Live trades taken with result of +60% account growth in 1 trade run starts at Post number 176 on page 9.

1. Weekly candle chart - Draw in areas/lines of SR:

Live trades taken with result of +60% account growth in 1 trade run starts at Post number 176 on page 9.

1. Weekly candle chart - Draw in areas/lines of SR: