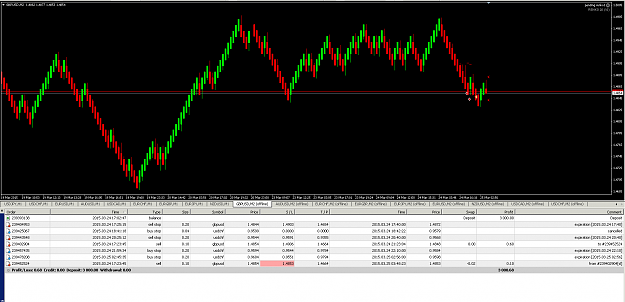

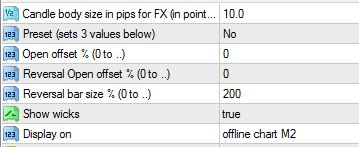

Entry for buy stop every green bar ( bar up ) distance to buy stop one bar gap + spread expiration time 15mts (delete order after 15m if not triggered).

Entry for sell stop every red bar ( bar down ) distance to sell stop one bar gap + spread expiration time 15mts (delete order after 15m if not triggered).

Exit negative trades two reverse bar and plus trades one reverse bar.

Stop loss three bar gap + spread .

Trailing stop two bar.

Can any one automate this strategy .Thanks in advance .

Entry for sell stop every red bar ( bar down ) distance to sell stop one bar gap + spread expiration time 15mts (delete order after 15m if not triggered).

Exit negative trades two reverse bar and plus trades one reverse bar.

Stop loss three bar gap + spread .

Trailing stop two bar.

Can any one automate this strategy .Thanks in advance .