Hi,

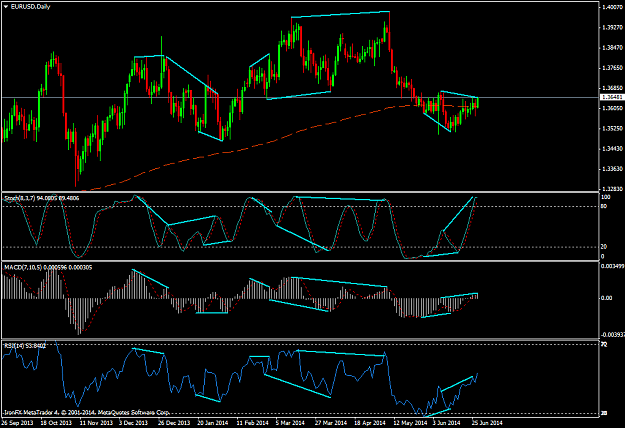

I would like to hear peoples opinions on the best indicator for divergence on the daily charts. I have been looking into the use of Money Flow Index for this, aswell as for overbought/sold levels. Any input would be appreciated!

I would like to hear peoples opinions on the best indicator for divergence on the daily charts. I have been looking into the use of Money Flow Index for this, aswell as for overbought/sold levels. Any input would be appreciated!