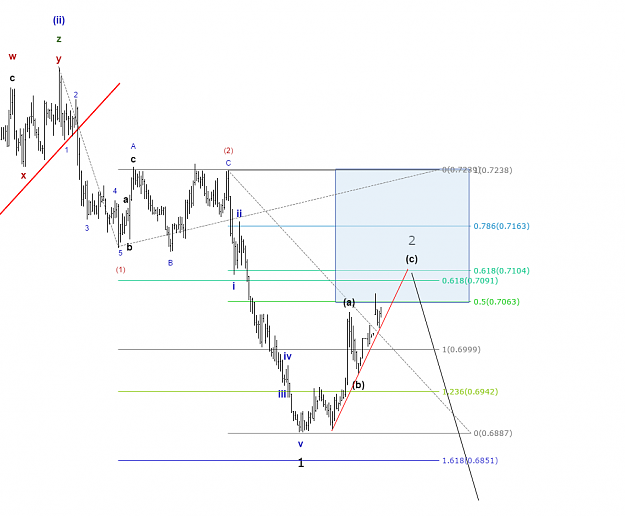

DislikedAlso nzd-usd has touched the swing high end zone. Nice too ! {image}Ignored

Good to short also.

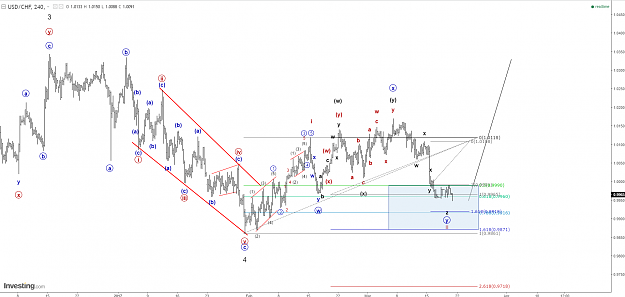

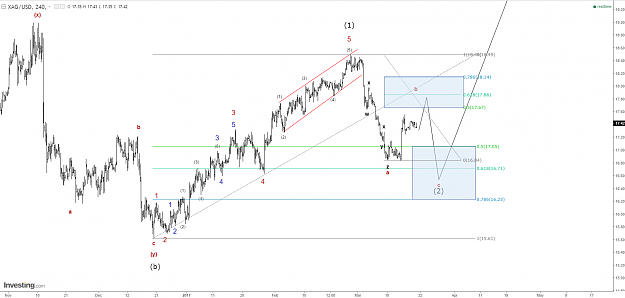

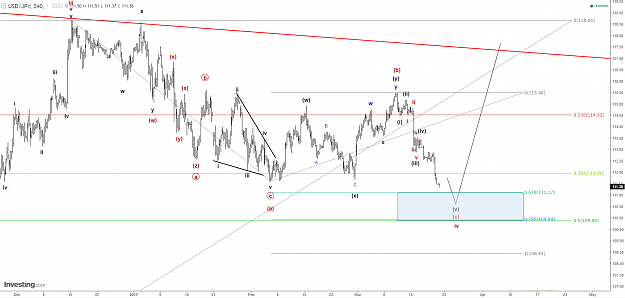

In NU H4 chart ,

Can you explain why after red wave (2) you've prefered to introduce black sub-waves 1 & 2

rather than to continue with same degree red waves (3) and (4) ?