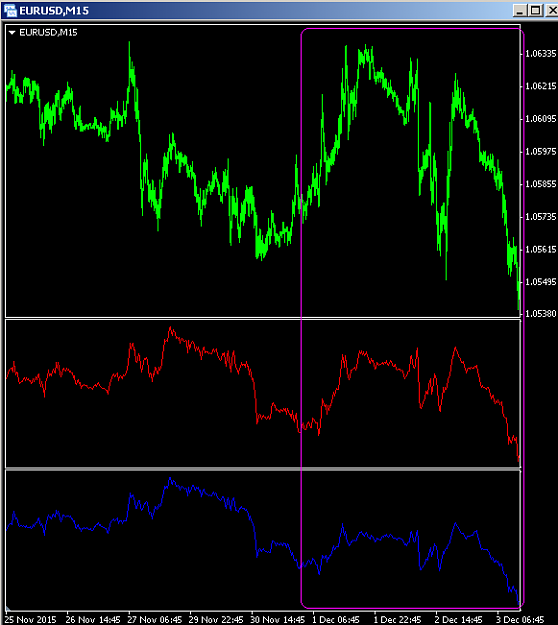

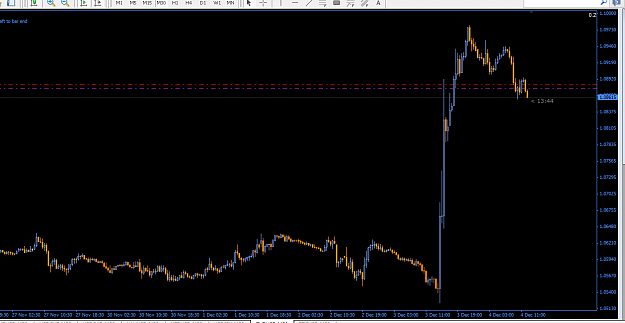

DislikedWell, GS got it half right --- EU certainly moved 3 big figures on the day!{quote} Like you, SK, I'm glad I stayed out of EUR. I guessed that EU was oversold, and that anything less than a very dovish outcome was already priced in, but I certainly didn't anticipate that result.

Ignored

Oct ECB meeting -

'Given EUR/$ is above 1.13 in the top half of the recent range, with short positioning in EUR continuing to decline, and because the ECB is unlikely to want to encourage a stronger EUR from here, we continue to favour EUR/$ lower.

Should we get a surprise easing announcement, we would expect the EUR to trade lower, particularly in the scenarios of either an increase in the run-rate of QE or a cut to the deposit rate by our estimates, a cut in the deposit rate of 10bp would be worth around 2 big figures in EUR/$," GS projects. '

"The single most important task for President Draghi and the Governing Council is to clarify their message at coming ECB meetings. Even if there is no near term QE augmentation or deposit cut, a lot can be achieved simply by stabilizing bund yields at a reasonable level (again, what matters is stability foremost), much as the Fed or BoJ did from the start of their QE programs

Were there any other foreseeable agenda on the horizon that ECB will or will not deliberate on that will aid EUR/$ go higher from here ? None.

They didn't get it right. Rather, they didn't get it wrong, Eurozone economies needed monetary boost which is why this QE is on the table in the 1st place. It's a case of yes or nothing more, which would you choose at that time if given the A-B choice to pick with the given state of the economies in the region ?

Dec ECB meeting -

"This weeks ECB meeting is therefore more than just the usual policy decision. It is about fixing some of the damage from the summer and doing it like you mean it. We think that dimension is underappreciated and means that, together with the low risk appetite typical for this time of year, the hurdle is low for a dovish surprise on December 3," GS adds.

"We continue to expect EUR/$ to head into the ECB at 1.05, drop 2-3 big figures on the day, and then fall to parity by end-December, aided by a Fed lift-off.

As risk-taking resumes in January, the divergence trade should pick up steam, with a possibility that our 12-month forecast of 0.95 for EUR/$ could be reached by end-Q1," GS projects.

This analysis can only be termed as a complete disaster, plain rubbish no ? It's a 3% gain not only on a single day but all done in a few hours. Bla, bla, bla.....they will do this and that and this and that will happen.....I particularly like this reference to divergence of monetary policy stuff which supposedly will give easy correct directional predictions of EUR/$. Remember this day - 3% in a few hours. And that Oct analysis came from the best economist money can buy. What more with the pretenders that peddle their ware which some of us seek as guidance ?

Best takeaway from this is......CB basic responsibility is to manage the monetary policy for the economy, not some foreign exchange rate which is an integral part of the whole fiscal mechanism. GS and the rest of the gang sell fictions to whales who generate business that justify their trillion dollar existence.

Well, now we have the NFP and Yellen's turn. Any more interesting fictions to read in between trading ?