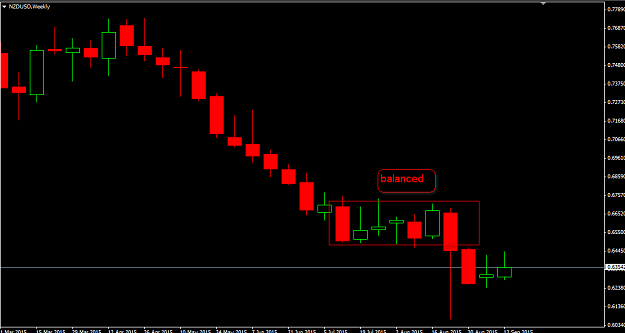

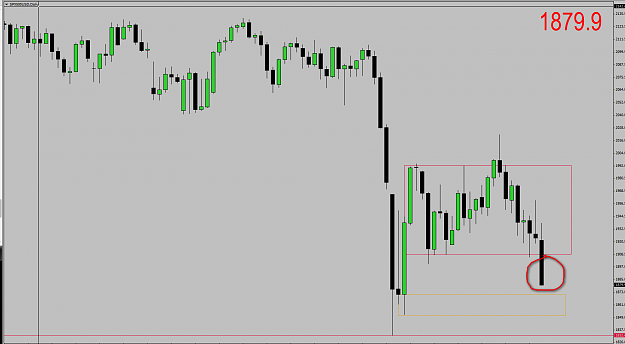

DislikedYet another Kiwi update!! This market is moving fast and the players are very active on both sides. We got the "whoosh" after the FED announcement, but it appears like profit takers are now active at the end of the day, pushing prices back into the balance zone...for any of you considering a long...this is what it looks like. My position was up as much as 120 pips but has now fallen back to 55. I have moved my stop to BE+10 pips. I did not anticipate the sellers to come in as quickly as they have. {image}Ignored

The week candle close under the balanced area.