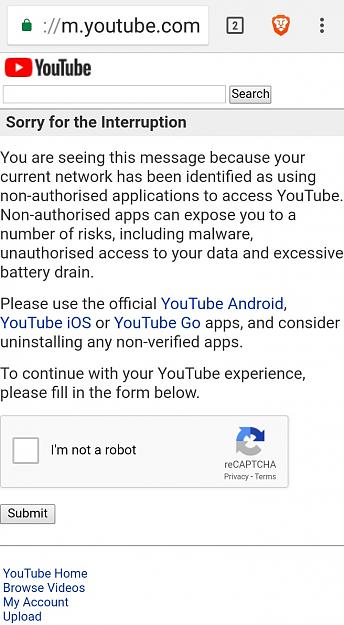

Dislikedhttps://youtu.be/oDvYLJBffNk Can't find peter paul mary jesus christ Kingston ssd instead. https://youtu.be/bI3QVsW30j0Ignored

- Post #60,281

- Quote

- Nov 9, 2019 11:12am Nov 9, 2019 11:12am

- | Joined Jan 2019 | Status: Member | 409 Posts

- Post #60,282

- Quote

- Nov 9, 2019 2:38pm Nov 9, 2019 2:38pm

- Joined Nov 2007 | Status: member | 19,782 Posts

- Post #60,283

- Quote

- Nov 9, 2019 2:46pm Nov 9, 2019 2:46pm

- Joined Nov 2007 | Status: member | 19,782 Posts

- Post #60,284

- Quote

- Nov 9, 2019 5:35pm Nov 9, 2019 5:35pm

- Joined Jul 2007 | Status: Member | 2,994 Posts

- Post #60,285

- Quote

- Nov 9, 2019 9:35pm Nov 9, 2019 9:35pm

- | Joined Dec 2013 | Status: Member | 1,062 Posts

THE ALL is MIND; The Universe is Mental

- Post #60,286

- Quote

- Edited 4:18am Nov 10, 2019 3:57am | Edited 4:18am

- Joined Jul 2011 | Status: an ant working the structure | 3,166 Posts

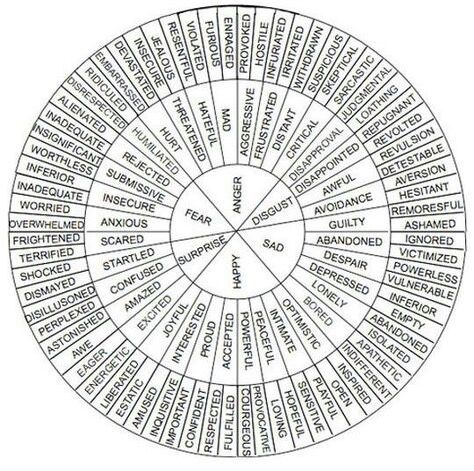

-be careful about what you allow to be put in your mind-

- Post #60,287

- Quote

- Nov 10, 2019 6:54am Nov 10, 2019 6:54am

- | Joined Dec 2013 | Status: Member | 1,062 Posts

THE ALL is MIND; The Universe is Mental

- Post #60,289

- Quote

- Nov 10, 2019 9:50am Nov 10, 2019 9:50am

- | Joined Jan 2019 | Status: Member | 409 Posts

- Post #60,291

- Quote

- Nov 10, 2019 11:50am Nov 10, 2019 11:50am

- | Joined Jan 2019 | Status: Member | 409 Posts

- Post #60,293

- Quote

- Nov 10, 2019 3:30pm Nov 10, 2019 3:30pm

- Joined May 2009 | Status: Member | 3,638 Posts

- Post #60,295

- Quote

- Edited 6:43pm Nov 10, 2019 6:31pm | Edited 6:43pm

- | Joined Dec 2013 | Status: Member | 1,062 Posts

THE ALL is MIND; The Universe is Mental

- Post #60,297

- Quote

- Nov 10, 2019 8:38pm Nov 10, 2019 8:38pm

- Joined Nov 2007 | Status: member | 19,782 Posts

- Post #60,298

- Quote

- Edited 9:04pm Nov 10, 2019 8:48pm | Edited 9:04pm

- Joined Nov 2007 | Status: member | 19,782 Posts

- Post #60,299

- Quote

- Nov 10, 2019 9:07pm Nov 10, 2019 9:07pm

- Joined Nov 2007 | Status: member | 19,782 Posts

- Post #60,300

- Quote

- Nov 10, 2019 9:40pm Nov 10, 2019 9:40pm

- Joined Nov 2007 | Status: member | 19,782 Posts