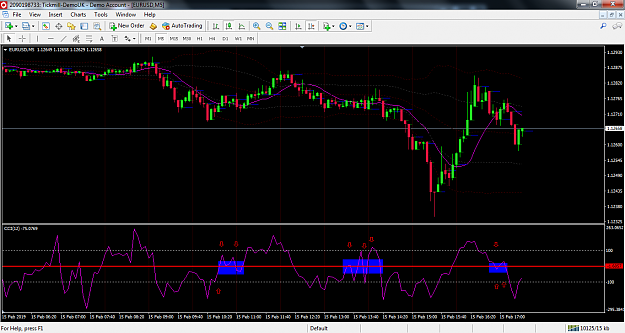

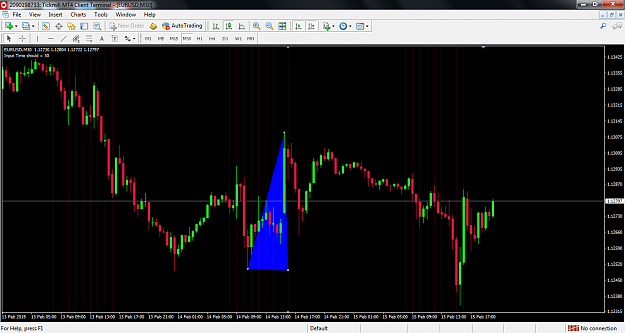

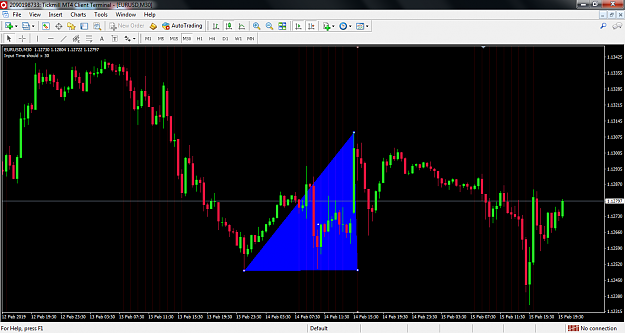

Disliked{quote} Thank you Dkrock for stepping in to reply. I will try different settings with the attached indicator as soon as I return from work by Gods grace. I'll let you know what I find out and where I find difficulties. I'll probably upload a chart if need be so you can understand me better. Thank you DKIgnored

You cannot be extraordinary by being normal

7