PASR

I feel a bit lost on the PATH

Don't worry, you are doing good. It is normal to feel this way when the Worker on most pairs is stalling as it finds support/resistance for the next move.

Market Structure on that pair was H - L - LH - LL etc.

Disliked{quote} Thank you for your help I m not trading anything at the moment as I feel a bit lost on the PATH... This is why I m posting ideas (bad for the moment) to get back on track. As Market structure I think you are referring to a coil patternIgnored

Don't worry, you are doing good. It is normal to feel this way when the Worker on most pairs is stalling as it finds support/resistance for the next move.

Market Structure on that pair was H - L - LH - LL etc.

15 YEARS OF PASR ON FOREX FACTORY!

1

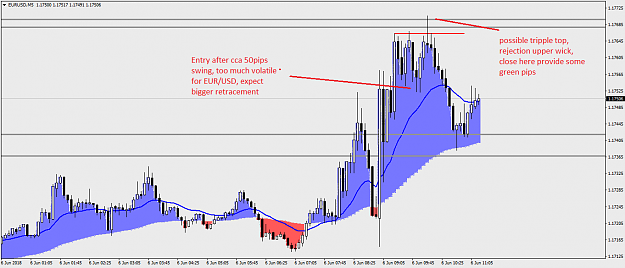

![Click to Enlarge

Name: [EURUSD,M5].jpg

Size: 88 KB](/attachment/image/2839353/thumbnail?d=1528274572)

![Click to Enlarge

Name: [EURUSD,M5] N2.jpg

Size: 95 KB](/attachment/image/2839420/thumbnail?d=1528277931)