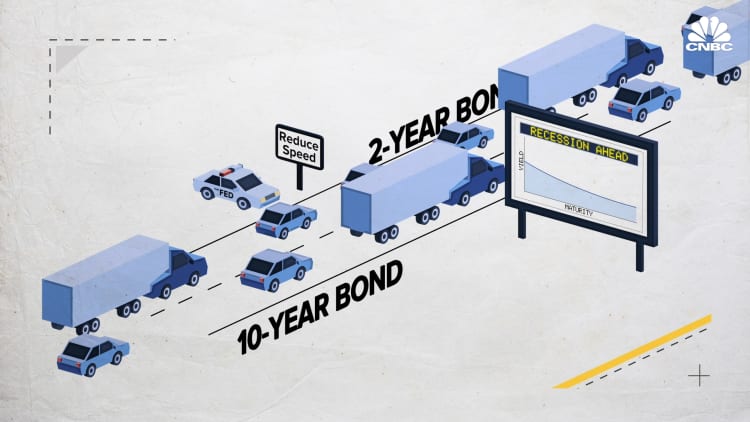

The yield curve was once just a wonky graph for academics and policymakers. But in recent years it has become a way to forecast looming recessions.

The curve has helped predict every recession over the past 50 years. That means the curve accurately predicted even largely unforeseen downturns like the dot-com bubble of 2001 and the Great Recession in 2007.

As a result, news of yield curve inversions can now send markets tumbling. Policymakers keep a close eye on even small changes in the curve's composition.

So how did this simple graph showing U.S. Treasury bond interest rates grow into one of the most reliable recession indicators we have? And what does a yield curve inversion really mean?

Watch the video above to learn more about how experts use the yield curve as a key recession indicator.