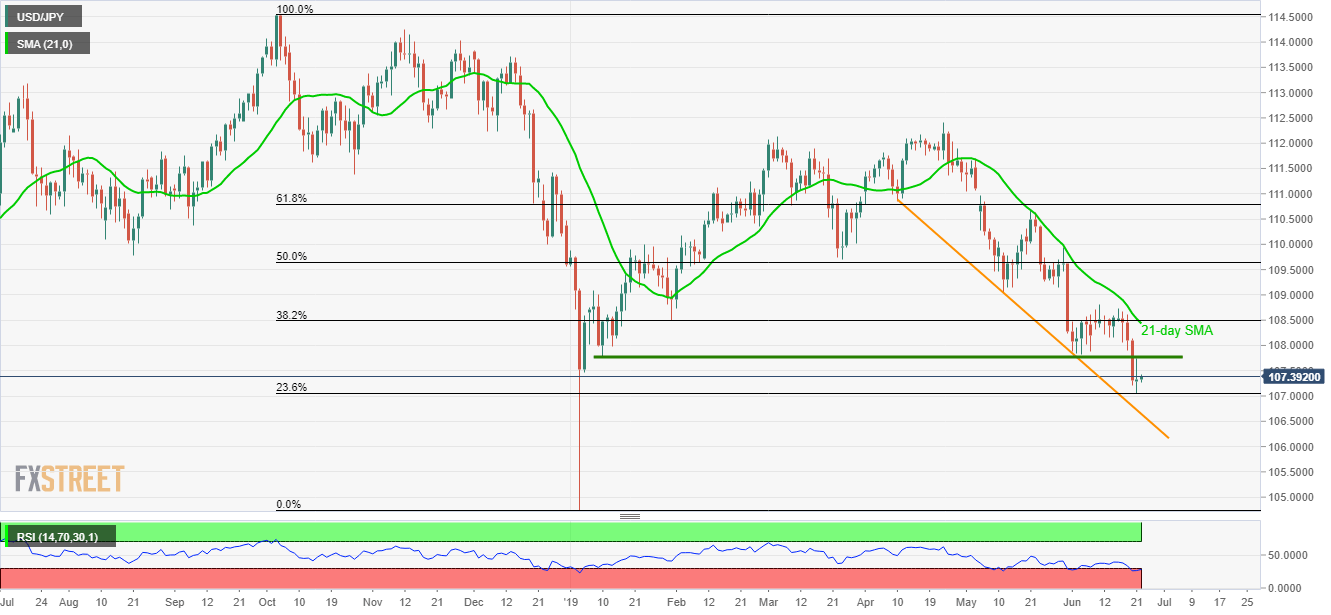

- USD/JPY’s pullback from 23.6% Fibonacci retracement needs to clear 107.77/81 horizontal-resistance.

- Oversold RSI favors the pair’s rise to 21-DMA if it manages to clear immediate upside barrier.

While oversold levels of 14-day relative strength index (RSI) might have played its role in fetching the USD/JPY pair upwards, the quote still needs to clear nearby horizontal-resistance in order to justify its strength as it takes the rounds to 107.37 during early Monday.

An area comprising lows of January 10 and June 05 questions the pair’s latest uptick targeting 21-day simple moving average (SMA) level of 108.44.

Should oversold RSI manages to propel prices beyond 108.44, current month top surrounding 108.80 and May month low near 109.01 can entertain buyers.

Meanwhile, pair’s decline below 107.06 comprising 23.6% Fibonacci retracement of October 2018 to January 2019 decline can drag it to a descending trend-line stretched since early April, at 106.64.

It should also be noted that pair’s extended south-run past-106.64 may avail 106.00 and 105.00 round-figures as intermediate halts before revisiting the yearly low near 104.75.

USD/JPY daily chart

Trend: Pullback expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Live: BoE kept rates unchanged at 5.25%, GBP/USD extends slump

The Bank of England left rates steady at 5.25%, as expected. The British Pound fell with the news, as two of the MPC voting members opted for a rate cut. Fears of recession diminish as BOE upwardly reviewed growth forecast. Less loosening at sight.

EUR/USD extends weekly decline, approaches 1.0700

EUR/USD grinds lower and nears 1.0700 in European trading hours. The US Dollar takes modest advantage of a mixed sentiment and the absence of relevant macroeconomic news. An uptick in government bond yields provides additional support to the Greenback.

Gold stable just above $2,300 ahead of a fresh catalyst

Gold price remains little changed for a fourth consecutive day on Thursday, trading just above the $2,300 mark. The soft performance of global equities keeps the bright metal afloat as investors hope for directional clues.

Solana meme coins TREMP, BODEN rise after Donald Trump’s pro-crypto stance

Solana-based meme coins TREMP and BODEN post nearly 125% and 7% gains on Thursday. Former US President Donald Trump says his campaign will likely accept crypto donations.

Forex fundamentals unpacked: Decoding the drivers of major currency movements

This report looks at the recent performance and future outlook for the major currencies, including the US Dollar, Euro, British Pound, Japanese Yen, Swiss Franc, and Canadian Dollar.