GBP/USD Current price: 1.3266

- UK data disappointed big, adding to concerns of the local economy.

- UK politicians' resignations continue in protest against PM May´s softer Brexit strategy.

The GBP/USD pair extended its relief rally at the beginning of the day but was unable to hold on to gains, as UK data disappointed, while more politicians resigned in protest at PM May's softer-Brexit plan. UK Industrial Production fell 0.4% in May, against an expected 0.5%, while Manufacturing Production rose by just 0.4% vs. the 0.9% forecasted. The annual figures posted modest advances that fell short from market's expectations. The Goods Trade Balance posted a wider-than-expected deficit of £12.36B in the same month, while the GBP growth estimate, a new figure that will be released monthly basis from now on, showed that the economy grew by 0.3% in the three-month to May. During the US session, two vice chairs of the Conservative Party, Maria Caulfield, and Ben Bradley, quitted, in protest to PM May's plan.

On Wednesday, the kingdom will release the NIESR GDP estimate for the three months to Jun, while BOE's Governor Carney is scheduled to speak about the global financial crisis at the National Bureau of Economic Research conference, in Boston.

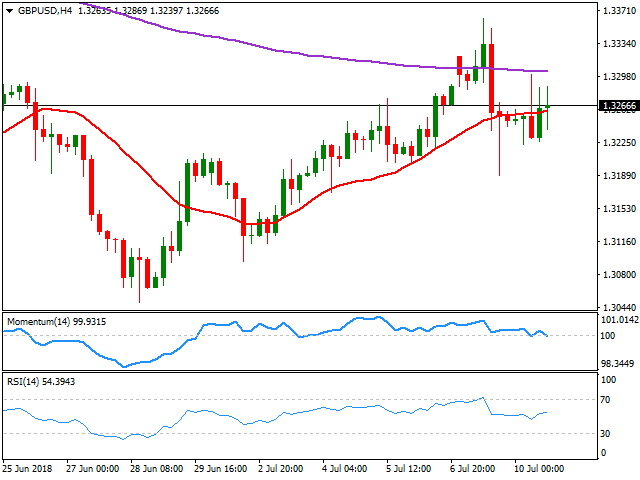

The 4 hours chart for the pair presents a neutral to negative stance, as it met selling interest at around 1.3300, where the pair also has the 200 EMA, and now trades around a flat 20 SMA. In the same chart, technical indicators turned lower, but now lacking directional strength and within neutral levels. The pair has an immediate support around 1.3220, where it bottomed several times during the last few hours, with a break below it, increasing chances for a bearish extension this Wednesday.

Support levels: 1.3220 1.3190 1.3155

Resistance levels: 1.3285 1.3320 1.3365

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0750 with a negative sentiment amid hawkish Fed

EUR/USD could extend its losses for the third successive session, trading around 1.0750 during the Asian session on Thursday. The US Dollar appreciates amid expectations of the Federal Reserve’s maintaining higher interest rates.

GBP/USD holds below 1.2500 ahead of BoE rate decision

GBP/USD extends its losing streak for the third successive session, trading around 1.2490 during the Asian session on Thursday. Thursday brings the Bank of England interest rate decision, with expectations of maintaining interest rate at 5.25%.

Gold price gains momentum, investors await US data, Fedspeak for fresh catalyst

Gold price holds positive ground in Thursday’s Asian session. The rise in global gold demand, persistent central bank purchasing, and safe-haven flows might continue to boost the precious metal.

President Biden threatens crypto with possible veto of Bitcoin custody among trusted custodians

Joe Biden could veto legislation that would allow regulated financial institutions to custody Bitcoin and crypto. Biden administration’s stance would disrupt US SEC’s work to protect crypto market investors and efforts to safeguard broader financial system.

BoE set to leave interest rates unchanged amid increasing expectations of cuts

It's anticipated that the BoE will maintain the benchmark interest rate at 5.25% after its policy meeting today at 11:00 GMT. Alongside the policy rate announcement, the bank will release the Monetary Policy Minutes and the Monetary Policy Report.