EUR/USD Current price: 1.1673

- Trump announced steel and aluminum tariffs on the EU, Canada, and Mexico.

- Italian 5 Star Movement and the League complete agreement on a coalition government.

So much for easing geopolitical tensions. The good mood was wiped out by headlines coming from the US, as the Commerce Secretary Ross announced that EU, Canada, and Mexico will start paying tariffs on steel and aluminum starting June 1st. Mexico and Europe didn't take long to respond, with the EU announcing duties “on a number of imports from the United States,” while Mexico announced taxes on US exports of different farm products. Safe-haven assets, which were under pressure, got a boost with the headline, although news that the Italian 5 Star Movement and the League parties have reached a new agreement on a possible coalition government, putting Paolo Savona at European affairs and making of Giovanni Tria the new Economy Minister. Risk was put back in pause, while volatility shrinks as speculative interest turns cautious ahead of Friday's US Nonfarm Payroll release.

Such headlines overshadowed macroeconomic data, although worth mention that European inflation picked up in May, reaching 1.9% YoY, while in the US, core PCE inflation came as expected at 1.8%. Friday will bring the final EU Markit Manufacturing PMI, alongside with the mentioned US NFP report. The US economy is expected to have added 188K new jobs in the month, while the unemployment rate is seen steady at 3.9%. Wages are expected to post modest upticks, seen up 0.2% monthly basis, from 0.1% previously, while the year-on-year number is forecasted at 2.7% from 2.6% in April.

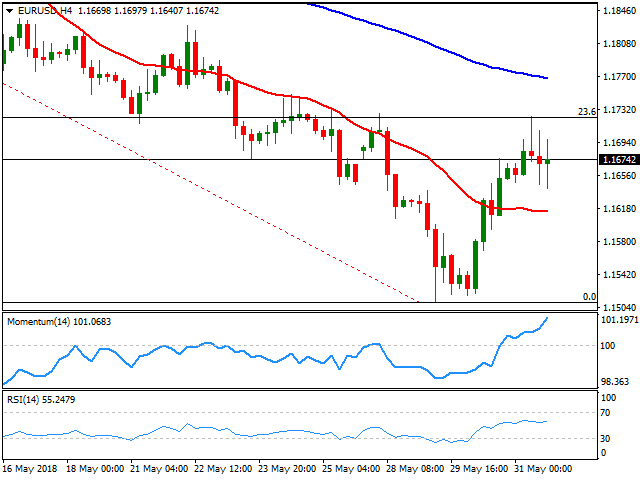

The EUR/USD pair reached a daily high of 1.1723, before retreating to the 1.1660 region, spending most of the US session hovering around this last. The pair topped at the 23.6% retracement of its latest slump and 5 pips below its weekly high, making of the 1.1730 price zone a major resistance for this last day of the week. Ahead of the Asian opening, the pair presents a short-term positive stance as in the 4 hours chart, it holds above a flat 20 SMA, while the Momentum indicator continues heading north near overbought reading, while the RSI lost upward strength, but holds around 53. The NFP report will for sure bring some action, particularly if the figures come in line with the dominant dollar's strength.

Support levels: 1.1625 1.1590 1.1550

Resistance levels: 1.1700 1.1730 1.1770

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD continues to lose ground amid firmer US Dollar

The AUD/USD continues its losing streak, trading around 0.6580 on Thursday following the Reserve Bank of Australia's less hawkish stance, especially after last week's inflation data exceeded predictions. Nevertheless, the RBA acknowledged that recent progress in controlling inflation has stalled, maintaining its stance of keeping options open.

USD/JPY holds positive ground above 155.50 following the BoJ Summary of Opinions

The USD/JPY pair trades in positive territory for the fourth consecutive day around 155.60 during the Asian trading hours on Thursday. However, the fear of further intervention from the Bank of Japan is likely to cap the downside of the Japanese Yen for the time being.

Gold price gains ground, investors await US data, Fedspeak for fresh catalyst

Gold price trades with a positive bias on Thursday amid the absence of top-tier economic data releases at mid-week. However, multiple headwinds, such as the firmer US Dollar and the hawkish comments from the US Federal Reserve are likely to cap the upside of the precious metal in the near term.

President Biden threatens crypto with possible veto of Bitcoin custody among trusted custodians

Joe Biden could veto legislation that would allow regulated financial institutions to custody Bitcoin and crypto. Biden administration’s stance would disrupt US SEC’s work to protect crypto market investors and efforts to safeguard broader financial system.

US inflation data in the market purview

With next week's pivotal US inflation data looming, we're witnessing a stall in stock market momentum and an uptick in US Treasury yields. This shift comes amid murmurs of hawkish sentiment from Fed speak. Indeed the mind games intensify even further as investors cling to their rate cut hopes.