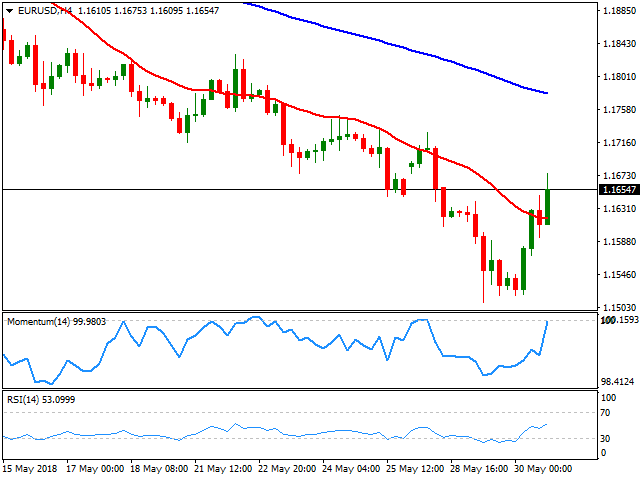

EUR/USD Current price: 1.1654

- News that the Italian 5 Start Movement and the League will try to form a government brought relief to financial assets.

- EU preliminary May inflation and US PCE price index to be out this Thursday.

Easing risk aversion helped major pairs correct this Wednesday, with the dollar easing against its high yielding rivals and recovering against those considered safe-havens. Headlines indicating that the two major Italian parties are willing to form a coalition and that they withdraw Savona candidacy as economy minister spooked fears. Backing the common currency were German data, which showed that despite the economic growth in the Union has decelerated, it remains far from being at risk. Retail Sales in the country were up 2.3% in April, beating market's expectations of 0.7%, although the yearly reading was softer than the previous and expected 1.3%, resulting at 1.2%. The unemployment rate in the country fell to a record low of 5.2% in May. The most positive figure, however, was May preliminary CPI estimate, up 2.2% YoY, a nice recovery from April's figures and a positive hint on upcoming EU May inflation, to be out this Thursday. US figures, on the contrary, were disappointing, as the ADP survey showed the private sector added 178,000 new jobs in May, while April's figure was downwardly revised to 163K from the previous estimate of 204K. Also, the Q1 GDP second estimate resulted at 2.2%, slightly below the previous 2.3%.

Inflation is the key this Thursday, as not only the EU will release its preliminary May estimates, with annual CPI seen up to 1.0% from the previous 0.7%, but the US will also release the PCE price index, Fed's favorite inflation measure for April. The core monthly reading is seen at 0.1% while the yearly one is expected to come at 1.8%, both below March final readings.

The EUR/USD pair recovered up to 1.1675, settling in the US afternoon some 20 pips below the level, but considering the pair lost roughly 1000 pips since mid-April, a 10% advance the movement seems just a correction within the dominant bearish trend. Whether this correction could continue or not, will depend on the mentioned inflation releases and political developments in Europe. Technically, and according to the 4 hours chart, the ongoing advance could continue, as technical indicators head sharply higher aiming to cross above their midlines, while the price is advancing above its 20 SMA. There's a long way ahead to the 100 SMA, currently at 1.1780, with gains beyond this last required to consider a more solid recovery ahead.

Support levels: 1.1625 1.1590 1.1550

Resistance levels: 1.1700 1.1735 1.1780

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD holds ground after Chinese import data shows rise in April

The AUD/USD continues its losing streak, trading around 0.6580 on Thursday following the Reserve Bank of Australia's less hawkish stance, especially after last week's inflation data exceeded predictions. Nevertheless, the RBA acknowledged that recent progress in controlling inflation has stalled, maintaining its stance of keeping options open.

USD/JPY holds positive ground above 155.50 following the BoJ Summary of Opinions

The USD/JPY pair trades in positive territory for the fourth consecutive day around 155.60 during the Asian trading hours on Thursday. However, the fear of further intervention from the Bank of Japan is likely to cap the downside of the Japanese Yen for the time being.

Gold price gains ground, investors await US data, Fedspeak for fresh catalyst

Gold price trades with a positive bias on Thursday amid the absence of top-tier economic data releases at mid-week. However, multiple headwinds, such as the firmer US Dollar and the hawkish comments from the US Federal Reserve are likely to cap the upside of the precious metal in the near term.

President Biden threatens crypto with possible veto of Bitcoin custody among trusted custodians

Joe Biden could veto legislation that would allow regulated financial institutions to custody Bitcoin and crypto. Biden administration’s stance would disrupt US SEC’s work to protect crypto market investors and efforts to safeguard broader financial system.

US inflation data in the market purview

With next week's pivotal US inflation data looming, we're witnessing a stall in stock market momentum and an uptick in US Treasury yields. This shift comes amid murmurs of hawkish sentiment from Fed speak.