Hitting the brakes:

How the energy transition could decelerate in the US

May 2024

Authors

Generous investment incentives have catapulted the US to global leadership in decarbonisation. Thanks to the support for low-carbon energy in the Infrastructure Investment and Jobs Act (IIJA) of 2021 and the Inflation Reduction Act (IRA) of 2022, our base case forecast for the US projects that by 2050 wind and solar power capacity will expand six-fold and low-carbon hydrogen will account for 5% of the energy mix. It also shows that fossil fuel demand will peak by 2030.

But it might not work out that way. A victory for former President Donald Trump in the election in November would mean new policy priorities and an immediate deceleration in support for decarbonisation. Incentives for electric vehicle (EV) sales would likely be cut, while the growth of green hydrogen and carbon capture, utilisation and storage (CCUS) could falter. At the same time, unabated fossil generation would expand. The economic nationalism that has defined both Trump and Biden administrations would continue. Companies could be less likely to invest in emerging technologies. These steps would push the US even further away from a net zero emissions pathway.

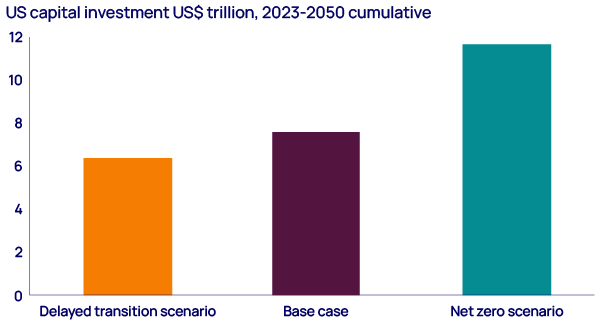

In this month’s Horizons we explore the impact of government policy, consumer choices and the competitiveness of emerging technologies on the future of US energy investment. In our delayed transition scenario, Wood Mackenzie projects about US$6.5 trillion in investment for the US energy sector over 2023-50, about 55% lower than in our net zero scenario.

Figure 1. US$11.8 trillion dollars in capital investment in US energy is required on a cumulative basis from 2023-2050 to reach our net zero scenario. Investment is 55% lower in our delayed transition scenario

Our delayed transition scenario: a different course for US energy is possible after the election

The results of the November 2024 election, US tensions with China and US rising budget deficits could significantly alter the path of US energy policy.

- A second Trump White House is likely to issue executive orders that would roll back support for low-carbon energy, while the permitting of LNG projects would likely be expedited.

- The Environmental Protection Agency (EPA), Department of Energy (DOE) and Treasury Department would promulgate new regulations that would favour fossil fuels. For example, the 45V production tax credit could favour blue hydrogen over green hydrogen.

- The EPA would be likely to roll back methane regulations, new power plant emissions standards and lower emissions targets in the transport sector.

- A full repeal of the IRA is unlikely. However, new legislation and trade policy targeting China’s dominance of low-carbon supply chain is likely to emerge.

- Broad-based corporate tax cuts could reduce the tax capacity available to help renewable and new energy investors monetise the credits provided by the IRA.

- US government spending could also be limited to address the country’s debt burden. The US Congressional Budget Office expects the debt-to-GDP ratio to reach 109% by 2030 and hit 155% by 2050.

Emissions: net zero is out of reach

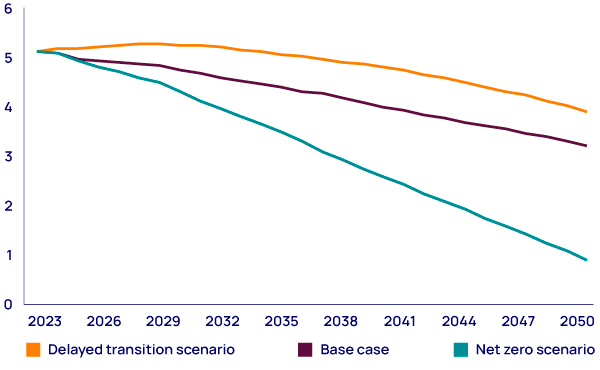

The US is the second-largest greenhouse gas emitter globally behind China. Investment in low-carbon supply in the US is key to lowering global emissions in our base case outlook. In this forecast, we project that by 2030 the US will reach peak fossil fuel demand and have about 30% of global CCUS capacity, and electricity demand will double by 2050.

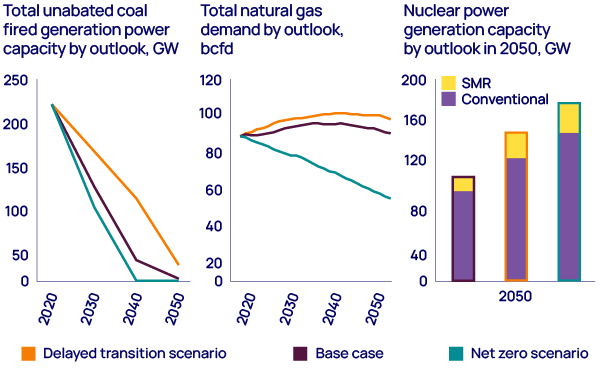

In a delayed transition scenario where policy support for low-carbon energy is cut back, fossil fuel demand would peak at least 10 years later than our base case. Total gas demand would rise to be 6 billion cubic feet per day (bcfd) higher by 2030 than in our base case, a jump of 6%. CCUS and low-carbon hydrogen would face a slower investment pathway, constrained by policy and cost uncertainty.

Under these circumstances, net zero quickly becomes out of reach, and a new slower pathway emerges for the energy transition (see Figure 2). Each sector, from transport to power and emerging technologies, will be affected by a complex set of drivers. We break these down below.

Figure 2. In 2050, net US energy-related CO2 emissions are 1 billion tonnes higher in our delayed transition scenario compared to our base case

Transport: hybrids kick into high gear

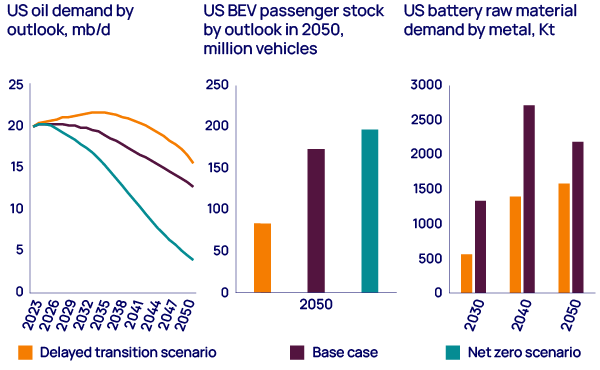

A look at new car sales in the US so far in 2024 offers clear indications that a slower energy transition is plausible. Consumers are increasingly embracing hybrids as a lower-carbon alternative to conventional gasoline and diesel, and one which also removes the range anxiety of a fully electric vehicle. While sales of hybrids have leapt 57%, EV sales have undershot expectations, growing by only 19%.

We expect a second Trump administration would amplify this trend by weakening federal greenhouse gas (GHG) emissions and fuel economy standards for the 2027-32 timeframe. This would likely lead to automakers increasing investment in hybrids to meet consumer demand while complying with federal emissions targets. As a result, the total stock of EVs by 2050 would be 50% lower than in our base case.

Automakers would increasingly shift EV batteries from high-cost metals such as cobalt to lower-cost iron-based chemistries. US battery raw material demand would be about 27% lower than in our base case, easing supply chain stress and US reliance on China. (US battery raw material demand includes lithium, graphite, nickel, manganese and cobalt.)

With hybrids, not EVs, in the driving seat of transport decarbonisation, US oil demand could be 15 million barrels per day by 2050, down only 24% from 2024 levels.

Power markets: policy headwinds slow investment

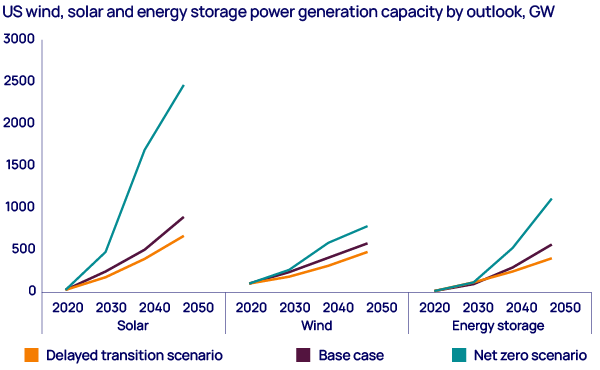

Across all outlooks, we expect strong growth in zero-carbon power generation in the coming decades. However, the pace of that growth will depend on the policy environment. In our delayed transition scenario, we project that total US wind, solar and energy storage capacity would be about 500 gigawatts (GW), or 25% lower in 2050 compared to our base case.

In this scenario, we do not assume legislative changes to the production and investment tax credits in the IRA. While Republicans have voted to end these provisions, the benefits of investment supported by these tax credits are widely spread across the US, underpinning bipartisan support. A vote to end the PTC and ITC, while not impossible, is unlikely.

Instead, our delayed transition scenario models other factors that constrain investment in low-carbon energy, including:

- Reforms to generator interconnection queues fail to clear current backlogs and interconnection delays impede the growth of new renewable generation.

- Infrastructure permitting reform remains limited. Harmonising local, state and federal permitting proves to be an insurmountable challenge.

- Trade policy continues to restrict imports, with Section 201 and 232 tariffs, intended to protect domestic industries from imported supply, remaining in effect.

- Cuts in financial support from the DOE’s Loan Program Office, the EPA’s US$27 billion Greenhouse Gas Reduction Fund and the DOE’s Grid Resilience and Innovation Program.

Even in our base case, development of low-carbon generation wasn't yet at the pace required to reach net zero by 2050. The impact of the changes in our delayed transition scenario means reaching net zero in the power sector is out of reach.

As an example of the potential consequences, we have applied the national trends in our delayed transition scenario to ERCOT, Texas’ power market. With fewer renewables on the grid and continued load growth, coal shutdowns are delayed, and gas-fired power generation ramps up. New nuclear plants could be needed, adding 4 GW of capacity after 2040. Gas and coal prices would rise as higher-cost fossil fuel supply is brought online. Comparing our 2023 long-term outlook for ERCOT to our delayed energy transition scenario, average energy prices across ERCOT are 8% higher in 2030 and 25% higher in 2040.

A greater role for gas and nuclear

In our delayed energy transition scenario, the pace of electrification would ease in the near term. A second Trump administration would likely slow down funding for a trio of initiatives: the National Electric Vehicle Infrastructure Program, Home Energy Rebate Programs and the Clean School Bus Program. However, electrification is a structural trend; industrial, residential, electrolytic hydrogen and EV usage would still combine to increase power demand by about 2 petawatt-hours (PWh), or 45%, over the period from 2030 to 2050.

Industrial load growth, driven by data centres and manufacturing reshoring, is one of the most urgent issues facing the US energy market today. It will take time for new data centres to find appropriate sites, connect to the grid and secure reliable power supply. Once major roadblocks are addressed, demand growth through the late 2020s and 2030s is likely to outpace recent historical averages. Eventually, however, efficiency gains should reduce load growth in the long term.

Amid continued load growth, less policy support for renewables and mounting confusion over emerging technologies, the biggest states for coal-fired power generation – including Indiana, Michigan, Texas and Tennessee – would slow down coal retirements significantly. Companies would take time to decide how to decarbonise their power plant fleet and keep the lights on. As a result, by 2040, coal generation capacity in our delayed transition scenario would be four times higher than our base case, with 104 GW on the system. This is down from 2024 levels of about 180 GW.

To replace coal plants that are shutting down, natural gas is required to meet power demand. With slower growth in renewable generation, natural gas capacity in 2040 is 30 GW higher in our delayed transition scenario than in our base case. The growth of gas could be supported by additional policy measures. Texas has already legislated for US$5 billion in loans to support new gas-fired power plants, and similar measures could be brought in more widely.

New nuclear capacity will be needed to meet power demand post-2040. In our delayed transition scenario, we would expect advanced nuclear power generation capacity driven by both large scale and small modular reactors (SMRs) to expand by about 40 GW. SMRs would target data centre off-takers that are less price-sensitive than utility markets. Large-scale nuclear would also expand among utilities that can absorb the capital costs. To deliver nuclear capacity by 2040, market and policy improvements would be needed by 2030. These include faster licensing from the US Nuclear Regulatory Commission, buying consortia for nuclear power and more domestic uranium supply.

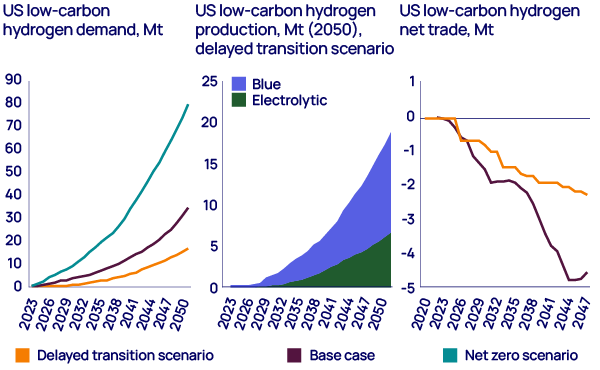

Low-carbon hydrogen: blue leads green

In our base case, only 5% of the low-carbon hydrogen projects likely to take a final investment decision (FID) in the next two years will be for green (electrolytic) production. Blue hydrogen, made from natural gas with carbon capture, has also faced challenges. Both Woodside’s H2OK facility and Nutrein’s US$2 billion Geismar blue ammonia plant have delayed FIDs, citing reasons including the need for clarification of government tax incentives and uncertain demand. These trends suggest that low-carbon hydrogen momentum could slow even with the IIJA and IRA.

With the market challenges facing electrolytic hydrogen and the changes to the national policy environment, we assume the rules for eligibility for tax credits under the IRA would be adjusted to tilt incentives towards blue hydrogen.

Two of the most impactful policy changes available are:

- allowing individual blue hydrogen projects to use reported carbon intensities of gas feedstock rather than national average intensities

- allowing the use of renewable natural gas as a feedstock with source-specific carbon intensities.

Outside of the US, demand for low-carbon hydrogen and ammonia is expanding, driven by Europe, Japan and South Korea. We would expect lower exports under our delayed transition scenario compared to our base case. However, we would still foresee a two million tonne export market emerging by 2050.

Low-carbon leadership shifts to states

Since 2020, California’s utility-scale battery capacity has expanded eight-fold to 8.4 GW. By the end of the year, we expect battery capacity to reach 11.7 GW. A look at state-level policies shows that momentum for low-carbon investment can be independent of federal policy.

State-level renewable portfolio standards and voluntary renewable energy targets supported wind and solar capacity expansions of over 13% a year on average between 2016 and 2020, during the last Trump presidency. Right now, 13 US states have statutory carbon regimes, covering around 8% of US emissions. Markets in the Regional Greenhouse Gas Initiative and the Western Climate Initiative pack a punch by supporting net zero technologies like long-duration energy storage. Meanwhile, California’s Low Carbon Fuel Standard (LCFS) creates price signals for investment in over 600 fuels and carbon abatement technologies. Long term, LCFS and similar programs in other states will help underpin investments in low-carbon hydrogen, direct air capture (DAC) and bioenergy across the country.

While a second Trump administration would almost certainly reduce federal support for decarbonisation, individual states will take up the baton.

Conclusion:

the conditions exist for a delayed transition in the US

The 2024 election, the trajectory of trade policy and the challenge of infrastructure reform could slow down low-carbon investment in the US.

However, focusing on decarbonisation will be an enduring priority for investors, companies and consumers. US companies that want to sustain the momentum for low-carbon investment should tackle three areas. These are: advocating for global carbon markets, continuing value-creating new energy investments and supporting innovation for next-generation technologies.

Trading carbon credits among countries is not yet global, but should be. To help offset higher fossil fuel consumption in a delayed transition scenario, COP29, the UN climate summit to be held in Azerbaijan in November, should finally establish global carbon trade. Launching the Article 6.4 mechanism will support a global trade in carbon credits that can be counted towards national carbon reduction goals. In the context of the US, the ability to buy emissions credits from countries that have a surplus would support progress towards national emissions reduction goals but also scope 1 and 2 emission reduction targets for US companies.

Peak fossil fuel demand will be delayed, not eliminated. With a higher demand outlook, our delayed transition scenario calls for US$154 billion more in US upstream oil and gas capital investment compared to our base case over 2023-2050. This does not mean the sector should withdraw from new energies. The US oil and gas sector will need to continue diversifying into low-carbon technologies to build a business model that is resilient through the energy transition.

The emerging technology sector in the US will need to reassess costs, project sizes and subsidy reliance. This should be approached from a position of confidence. The dramatic reversal of the US from an LNG importer to the world’s largest LNG exporter in about a decade highlights just how capable US companies, policymakers and investors are at adapting to change.

Join us at the Solar & Energy Storage Summit in San Francisco, 12-13 June.

Find out if the Inflation Reduction Act (IRA) is paying off for US solar and storage manufacturing.

Explore our latest thinking in Horizons

Loading...