Federal Reserve Bank of Atlanta President Bostic

- Fed does not face urgency to cut rates given current economy.

- Strong economy argues for patience in adjusting monetary policy.

- Fed likely to soon contemplate cutting rates.

- Inflation likely to decline more slowly than markets expect.

- Fed has made solid progress in lowering inflation.

- U.S. economy is in a ‘good spot’.

- Unlikely January CPI signals big change in trend of weakening inflation.

- Sees case U.S. economy less sensitive to interest rate changes.

- ‘Fight is not finished’ on getting inflation back to 2%.

- Job market is remarkably strong.

- Overall economic risks have become more balanced.

Key takeaway here seems to be that indeed the Fed is is no hurry to trim the Fed Funds rate back.

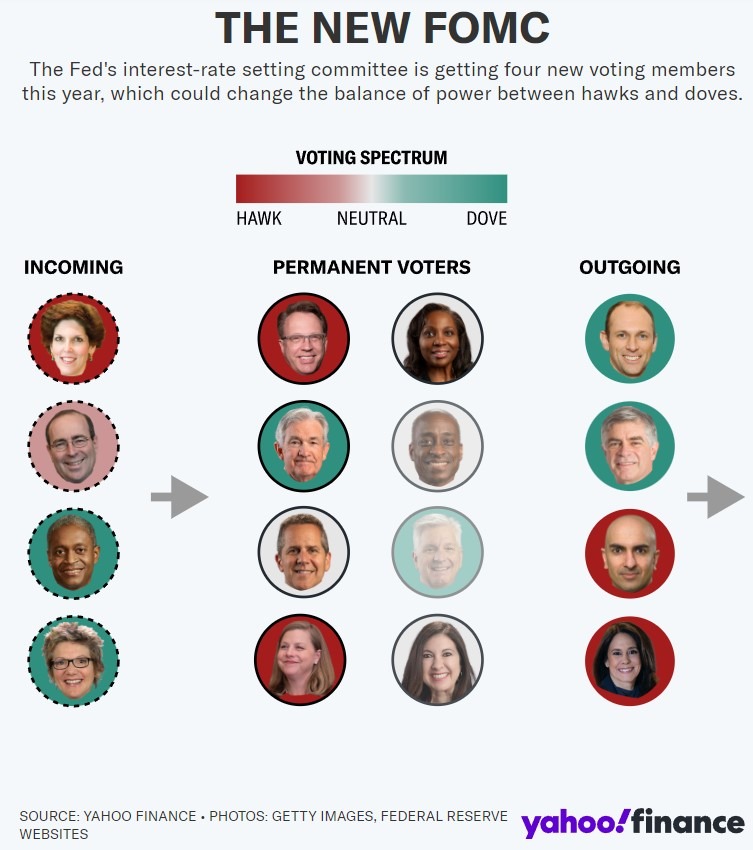

Bostic is on the Federal Open Market Committee (FOMC) this year (that's him in column 1, row 3)