Markets Today – Disturbia

An impending Israeli ground operation into Gaza saw risk aversion rise on Friday.

Todays podcast

- Israel/Gaza-led risk aversion impacted global markets on Friday

- Oil (Brent +5.7%), Gold (+3.3%), Equities lower (S&P500 -0.5%)

- Bad weather though delayed ground operations, timing uncertain

- NZ election to see National/Act government, no material impact

- Coming up today: V. Quiet, CH MLF Rate, US Empire Manufacturing

- Week: CH GDP; Fed’s Powell; NZ CPI; AU Jobs; RBA’s Bullock & Minutes

Key Events/Headlines

BBG: Israel Is Preparing for ‘Significant’ Gaza Ground Operation

US: U. of Mich. cons sentiment, Oct: 63.0 vs. 67.1 exp.

US: U. of Mich. 5-10yr inflation exp, Oct: 3.0 vs 2.8 exp.

Good morning

‘Your mind’s in disturbia, it’s like the darkness is the light; Disturbia, am I scarin’ you tonight?; Your mind’s in disturbia, ain’t used to what you like’, Disturbia, Rihanna 2008

An impending Israeli ground operation into Gaza saw risk aversion rise on Friday. The key uncertainty is whether a ground operation risks widening the conflict, with markets focused on whether Iran and its allies are drawn into the conflict. Bad weather though has likely delayed operations with timing still uncertain. On Saturday the Israeli Defence Forces said they were making preparations for “significant ground operations”, while an Israeli city near the Gaza Strip has been told to evacuate by Monday.

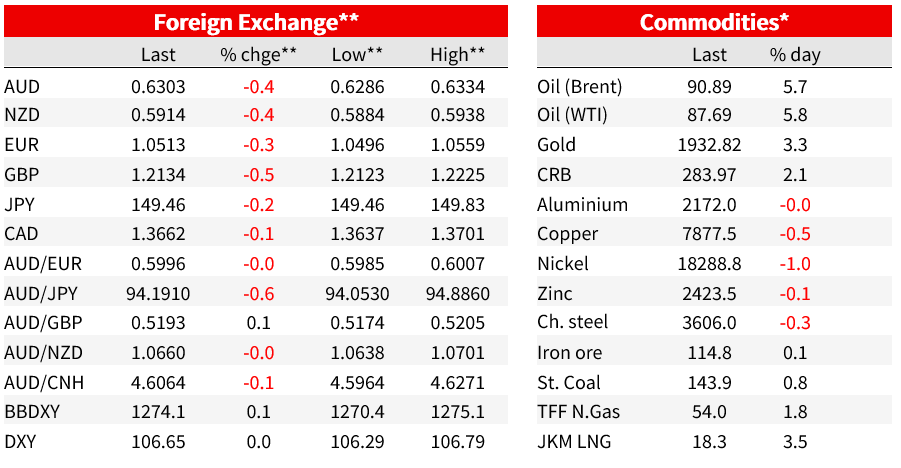

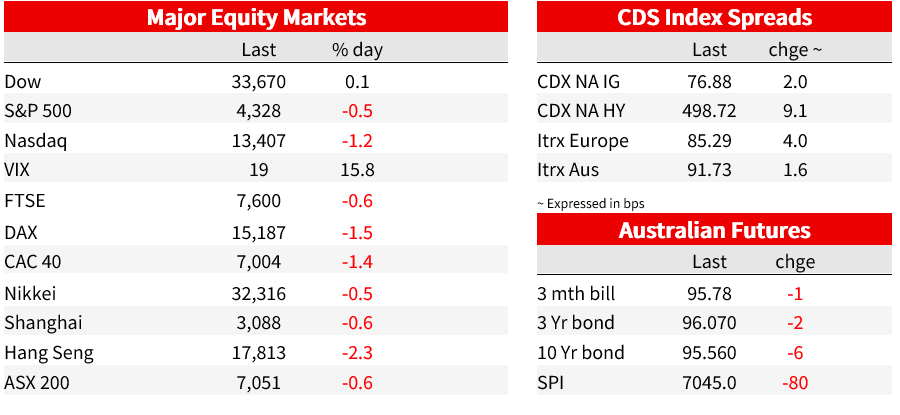

The biggest moves has been seen in commodities with brent oil +5.7% to $90.89 and the gold price +3.3% to $1933. Analysts point to poor positioning in gold given the higher for longer narrative from central banks as a major driver of the move. Equities have been mixed with larger falls in European equities (-1.5%), while US equities were more mixed amid bank earnings that beat (Dow +0.1%, S&P500 -0.5%). Citi (-0.2%), JP Morgan (+1.5%) and Wells Fargo (+3.1%) all reported on Friday and mostly topping expectations, while Microsoft (-1.0%) closed its $67bn acquisition of Activision. The VIX did lift 15.8% to 19.

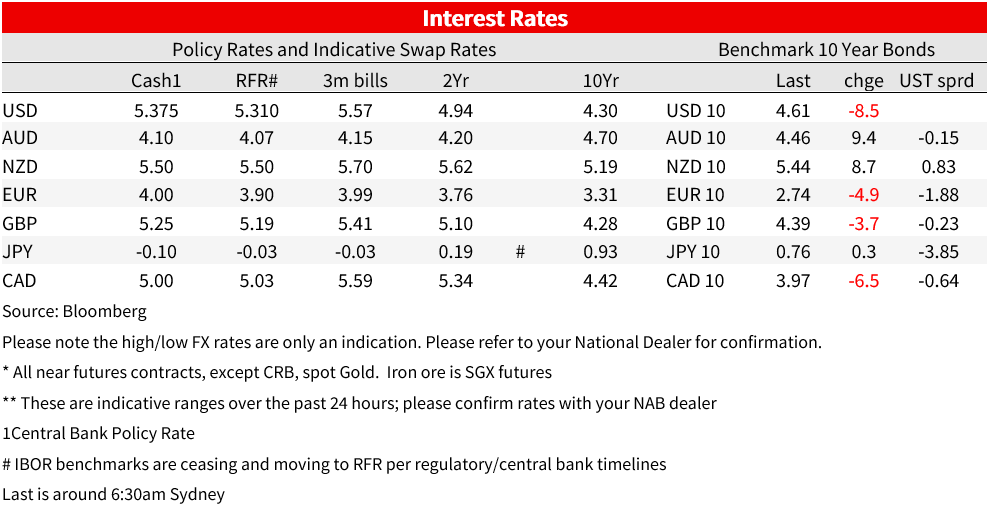

Yields were lower likely reflective of some safe haven demand. The US 10-year yield fell -8.5bps to 4.61% (low 4.58%, high 4.69%). The front end underperformed in the rally with 2-year yields ending 1bp lower at 5.05%. The 2s/10s curve flattened to -44bp, down from a recent peak in October of -28bp. European government bond yields declined aligned with the move in treasuries with 10-year Bunds down 5bps to 2.73%.

The risk-off tone was also reflected in FX. The USD gained (BBDXY +0.1%), as did CHF (USD/CHG -0.7%) and YEN (USD/JPY -0.2%). The sharp rise in oil prices did see oil-linked currencies outperform with USD/CAD (-0.1%) and USD/NOK (-0.3%). The global growth antipodean whipping boys fell with AUD -0.4% and NZD -0.4%. The AUD currently trades at 0.6303 after having fallen to a low of 0.6286 on Friday night. Across the ditch the NZ election points to National and Act forming a coalition government and is unlikely to materially impact the currency or rates markets to start the week.

There was one Fed speaker, Harker, who sounded similar to his colleagues: “absent a stark turn in what I see in the data and hear from contacts … I believe that we are at the point where we can hold rates where they are”. After a busy week of commentary from Fed officials, futures market pricing suggests there is little chance a rate hike at the early November meeting (only 1.9bps priced) and there is only a 32% chance priced by December (cumulative 8.1bps). Fed Chair Powel speaks on Thursday with Q&A and it will be interesting to see where he stands, especially following a run of relatively ok CPI reports.

Economic data was mostly sparse and not overly market moving. The US, the Michigan consumer sentiment index fell to 63.0 in October, which was below the median estimate of 67.2, and the lowest level since May. This is the third straight fall and can largely be attributed to the rise in gas prices as well as the pullback in equities. However, consumer spending has remained healthy despite weaker sentiment in recent months. Within the Michigan survey, Five-to-10-year inflation expectations increased 0.2% to 3.0%. This is a continuation of the 2.7-to-3.1% range where this indicator has oscillated since January 2021 which is above its pre-Covid average of 2.5%.

Meanwhile in China, CPI remained flat year-on-year in September while producer prices declined 2.5% amid lingering concerns about weak demand. Both measures were marginally below consensus estimates. Data this week on industrial production, retail sales as well as Q3 GDP will provide a clearer picture of the impact from the Government’s incremental stimulus measures. The PBOC is expected to leave the medium-term lending facility rate steady at 2.5% today.

Coming up this week:

- Australia: Employment data for September on Thursday. Also this week are the RBA Minutes for October on Tuesday and Governor Bullock in a fireside chat on Wednesday (sharing ‘insights into the current economic climate with a focus on system stability’). Note Ms Bullock speaks again on 24 October, the day before the Q3 CPI. Of interest in the Minutes will be nuance on the discussion around CPI given the August Monthly CPI Indicator showed persistent services inflation. There could also be discussion around the RBA’s balance sheet, but no change and certainly no move towards active QT given Assistant Governor Kent’s recent remarks. As for Employment we look for 30k jobs, a little above the consensus for 20k, and we expect unemployment to be unchanged at 3.7%.

- Offshore: Israel/Gaza will dominate with the big question being whether a mooted Israeli ground operation in Gaza widens the conflict. China: Q3 GDP and activity indicators on Wednesday will be pivotal in whether the tentative stabilisation in activity picked up in the official PMIs is starting to show in the harder data. We think it will. Consensus for Q3 GDP sits at 1.0% q/q. US: Fed Chair Powell on Thursday the main focus. Chair Powell may provide an opportunity to cut through the noise and markets will be sensitive to his interpretations of CPI. Also in the US is retail sales, while the earnings season continues with more banks on Tuesday (Goldmans and BofA), and later in the week the first of the big tech names Tesla and Netflix (both Wednesday). NZ: Q3 CPI, important for the RBNZ, but also for parallels to AU CPI (25 Oct). UK: lots of data including CPI, employment and retail sales.

Market Prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.