Our monthly transaction data suggest spending ticked up in April after a stagnant performance last month

Insight

Quiet start to week with no market fall-out from weekend Russia news. Weaker Yuan a focus.

I’m not a big County and Western fan, but in case you didn’t know, Garth Brooks is the second best-selling artist of all time, after the Beatles. There’s my value-add for today – hopefully a little more below

A relatively quiet start to the week with no market fall-out from weekend/Monday Russia developments, the main features being extension of Yuan weakness upon China’s return from the dragon boat festival holidays – helping keep AUD subdued – and USD/JPY holding above ¥143 in the face of latest jawboning by MoF officials, describing latest Yen moves as ‘rapid’, ‘excessive’ and ‘one-sided’ US equities have begun the new week as they ended last week – on the defensive – while bond yields are tracking slightly lower everywhere amid a dearth of fresh economic news bar a weak German IFO survey. Canadian CPI and the start of the ECB’s annual Sintra conference are the headline acts tonight.

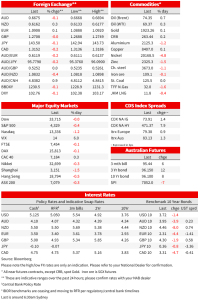

If we start with currencies today, a glance at the June-to-date changes for major currencies shows the standouts are the 2.9% rise in USD/JPY and 1.8% gain for USD/CNY , against which every other G10 currency is stronger against the USD. Only two major central banks are currently in easing mode – the PBoC and BoJ. This is not currency rocket science. Realistically, the Yen will only reverse course when the BoJ does (we remain expectant of a BoJ move on YCC in late July, albeit though nothing coming out of the mouths of Governor Ueda or other BoJ officials gives strong reasons to expect this, and the Yuan on hard evidence of fiscal support for the ailing post-zero covid China recovery, currently notable by its absence. The AUD, after defying the pull from a weaker CNY in the first half of June, has been back showing slavish adherence in the last week or, very slightly weaker Monday (-0.07%) whereas most other G10 currencies are firmer led by NOK (0.9%) and – a little surprisingly given its traditional CNY link – NZD (0.3%).

The impact on USD/JPY (-0.1% Monday) from comments by MoF’s currency czar Masato Kanda around the Australian close yesterday – describing latest Yen moves as ‘rapid’, ‘excessive’ and ‘one-sided’ saw USD/JPY dip from around ¥143.50 to ¥143.00 before fully recouping the loss a few hours later.

Very little change in European currencies and where EUR/USD showed only temporary slippage following a poor German IFO surve y (the main overnight economic news). The overall Business Climate reading came in at 88.5 down from 91.5 in May and 90.7 expected, led by a slump in the Expectations series from 88.7 to 83.6 (the Current Assessment dipped to 93.7 from 94.8%). the survey tends to corroborate the signal from last Fridays’ poor German PMIs, led by a slump in manufacturing but where the Composite reading fell from 53.9 to 50.8, signalling close to zero growth toward the end of Q2. The UK had its June CBI Distributive and Retail sales surveys, which at -12 from -10 for the former and -9 from -10 for the latter point to a weak June official retail sales outcome. GBP/USD was weaker post the release but is finishing flat on the day in New York.

Bond markets , which mostly rallied (lower yields) at the end of last week aided by the poor European PMIs readings, attempted to extend the rally Monday, though in the absence of any significant ‘new news’ and with markets non-plussed by the weekend Russian developments – certainly we couldn’t find good reason to react after it was clear the putsch had not succeeded – Treasuries are coming into the New York close virtually unchanged at the front end and down only about one basis point at 10-years. Earlier, European 10-year benchmark yields finished the day 1-3bps lower.

US equities fell away in the last hour of power, meaning the S&P500 ended down 0.45% having been down only about 0.1% earlier in the session. IT (-1% and with the biggest weight in the S&P) together with Communication Services (-1.9%) and Consumer Discretionaries (-1.25%) led the declines, while Real Estate (+2.3%) and Energy (+1.7%) and were the biggest offsets, the latter helped by a modest rally in oil, WTI and Brent crudes both up 0.6-0.7%. Gold is unchanged, industrial metals mixed.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.