- GBP/USD bulls are in the market and eye higher highs.

- Bears note the prospects of a test of the trendline support.

GBP/USD bulls are in the market with the price rallying on Tuesday from a low of 1.2495 to a high of 1.2624 so far. Traders are getting behind the central bank divergence theme which has helped the pound reach to the strongest since May 10th as recent US inflation rate data reinforced the view that the Federal Reserve is about to change course.

Besides the sentiment turning at the Fed, the recent UK labour market report has sewn the seeds for a hawkish Bank of England for longer. The unemployment rate fell to 3.8% for the period of February to April, while both employment levels and wage growth experienced significant increases. This follows Monday's hawkish rhetoric from BoE's policymaker Catherine Mann who emphasized a need to take measures to curb inflation.

On Tuesday, data showed that the US Consumer Price Index edged up 0.1% last month after increasing 0.4% in April, core CPI increased 0.4% in May, rising by the same margin for the third straight month. However, the Greenback pared back initial knee-jerk losses as this is a number that is too high to be compatible with the Fed's 2% inflation target, thus there are still chances that the FOMC will justify another 25-bp rise at the outcome of the FOMC meeting.

Nevertheless, GBP/USD remains better bid with the money markets pricing in a 95% chance the US central bank will decide to forgo an 11th straight interest-rate hike and keep the benchmark rate at 5.00% to 5.25% on Wednesday. Moreover, the rate futures market also trimmed bets on a Fed rate hike in July following today's CPI report.

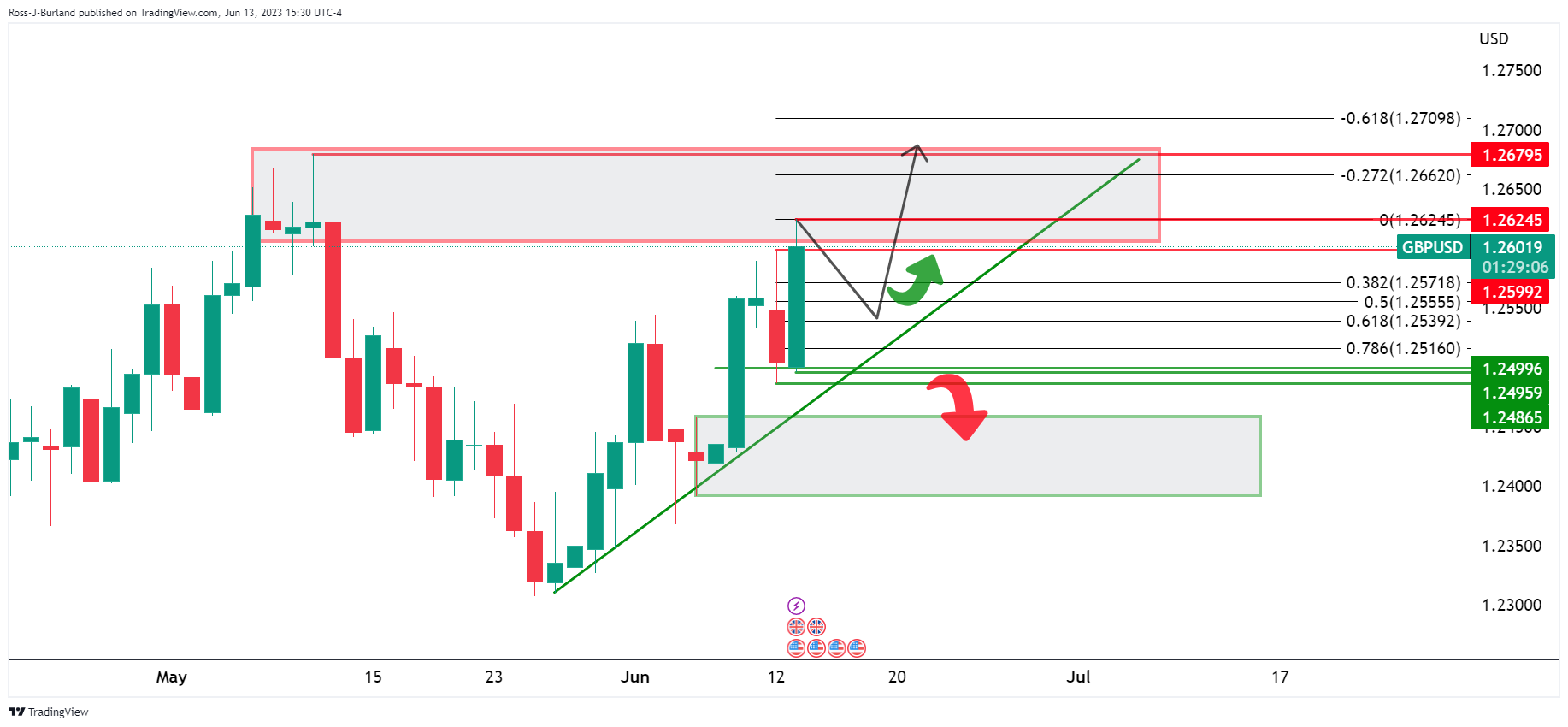

GBP/USD daily chart

The daily chart is bullish while above 1.2285 swing low. There are prospects of a meanwhile correction, however, which leaves the trendline support vulnerable.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD turns negative near 1.0760

The sudden bout of strength in the Greenback sponsored the resurgence of the selling pressure in the risk complex, dragging EUR/USD to the area of daily lows near 1.0760.

GBP/USD comes under pressure and challenges 1.2500

GBP/USD now rapidly loses momentum and gives away initial gains, returning to the 1.2500 region on the back of the strong comeback of the US Dollar.

Gold retreats from highs on stronger Dollar, yields

XAU/USD trims part of its initial advance in response to the jump in the Dollar's buying interest and the re-emergence of the upside pressure in US yields.

XRP tests support at $0.50 as Ripple joins alliance to work on blockchain recovery

XRP trades around $0.5174 early on Friday, wiping out gains from earlier in the week, as Ripple announced it has joined an alliance to support digital asset recovery alongside Hedera and the Algorand Foundation.

Week ahead – US inflation numbers to shake Fed rate cut bets

Fed rate-cut speculators rest hopes on US inflation data. After dovish BoE, pound traders turn to UK job numbers. Will a strong labor market convince the RBA to hike? More Chinese data on tap amid signs of slow Q2 start.