Welcome to NAB’s newsletter on the Sustainable Finance market from an Australasian perspective.

Newsletter

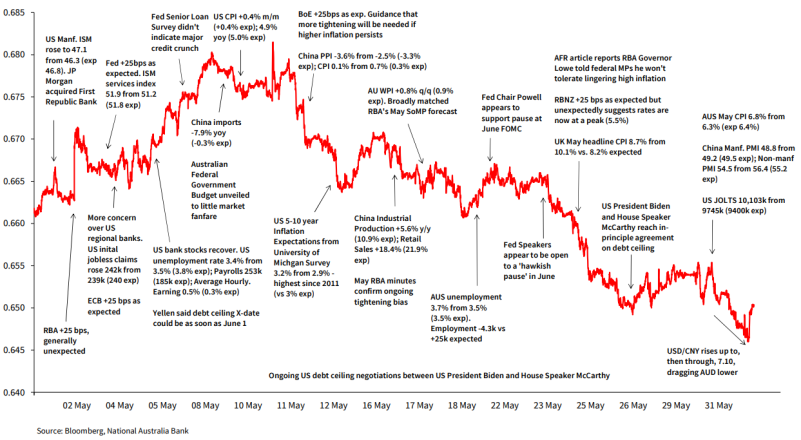

The AUD fell below 65 cents in May, in doing so re-establishing a more ‘normal’ monthly trading range after two months of highly compressed volatility.

Following two months of very compressed ranges AUD/USD volatility returned to ‘normal’ in May, insofar as the monthly hi-low range of 3.6 cents was fractionally above the 10-year average of 3.5 cents (Chart 1). The month’s high was 0.6818 on 10 May and the low right on month-end at 0.6458 – the weakest since 10 November 2022. Recall that AUD weakness back in October/November 2022 – when AUD/USD printed a low of 0.6170 – was a period when China was in the midst of its zero covid nationwide lockdowns and market were busily scaling up their expectations for Fed policy tightening following some upside inflationsurprises. Some parallels are justified in so far as May AUD weakness reflects doubts about the veracity of the post zero covid China economic recovery and markets have been forced to reassess a prior view that the 3 May Fed rate rise would likely be the last.

AUD/USD gains in the early part of May followed a generally unexpected 25-point Cash Rate rise from the RBA, quickly followed by a fully-expected +25bps from the Fed and which elicited a ‘sell-the news’ USD response, on the view the Fed was now likely done. This latter view was eroded as the month progressed, aided by some upside data surprises (e.g. Uni. of Michigan 5–10-year inflation expectations, core PCE inflation) and incoming Fed speak suggesting that if the Fed pauses in June, it is likely not finished raising rates.

China developments became a dominant influence on AUD in the latter part of the month, after first the April activity readings then May official PMI surveys all underwhelmed versus expectations. USD/CNY’s move first above 7.0 (18 May) then 7.10 (31 May) had direct read-throughs to AUD.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.