Welcome to NAB’s newsletter on the Sustainable Finance market from an Australasian perspective.

Newsletter

5% Netflix post-earnings pop helps drive best day for S&P500 in two weeks

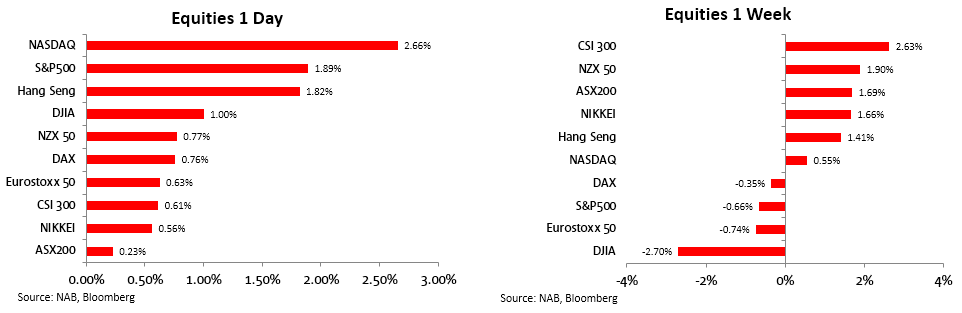

In front of the Lunar New Year ‘Communications Services’, the equity subsector which includes Netflix, lead a 1.9% gain for the S&P500 on Friday and 2.7% rise for the NASDAQ, thanks in large part to an 8.5% gain for the global entertainment provider’s significantly stronger than expected quarterly net new subscriber numbers (7.66mn against the 4.5mn street consensus). This was the S&P500’s best day in two weeks but not enough to prevent it being a down-week overall (-0.7%) though the Nasdaq managed a 0.6% weekly gain. In front of the Lunar New Year holidays though, it was Shanghai (+2.6%) and Hong Kong (1.4%) that outperformed, so too the Nikkei (+1.7%) following the BoJ’s ‘unchanged’ on Wednesday. The ASX 200 (+1.7%) and NZ’s NZX 50 (+0.9%) also fared much better last week than US or European indices.

US Treasury yields, which hit a more than 4-month low of 3.32% at 10 years on Thursday last week, rose by between 5bps (2s) and 9bps (10s through 30s) on Friday but only the 30-year shows a rise on the week, 2s down 6bps and 10 by 2.5bps, to see the curve some 4bps less inverted. Globally, yields were higher on the day everywhere on Friday – US Treasury yields pulled up by higher European yields, the latter after some hawkish ECB comments (see below). Yet on the week, only Australia shows a significant change, down 20bps with most of the decline recorded following the softer than expected employment report on Thursday. The money market is still (just) better priced for +25bps on February 7 than no change (+15bps) with this Wednesday’s CPI report set to be the final arbiter. NAB expects +25bps.

Central bank speaker-wise Friday, Fed governor and erstwhile FOMC hawk Christopher Waller threw his hat in the ring for a 25-point rate rise at the next (Jan 31-Feb 1) FOMC meeting but said ‘I expect to support continued tightening monetary policy’, even though he thinks Fed policy is ‘pretty close’ to being sufficiently restrictive’. In adding to the chorus supporting 25bps next month, this surely seals the deal (26bps priced) but more tellingly, Waller said that the Fed has a different view on inflation to the market, which he describes as ‘very optimistic’.

ECB President Lagarde in Davos said China’s abandonment of its zero-Covid policy is “positive for the rest of the world, but there will be more inflationary pressure”, in which respect she notes the likelihood of stronger demand/prices for LNG, oil and other commodities. 50bps from the ECB on February 1 still looks baked in the cake (49bps priced). On the commodity price front, China re-opening optimism continues to drive most commodity prices higher, with Brent crude up 2.8% on the week. At $87.63 it is getting closer to the $90 level that NAB’s commodity strategists regard as the base level desired by OPEC+ producers. Base metals also had a good week, LMEX up 1.8%, though thermal coal lost over 5%.

Offshore Economic data Friday saw UK Retail Sales fall by 1% against an expected 0.5% rise, with ex-auto fuel down a bigger 1.1% (+0.4% expected) which leaves this volume-based measures down 6.1% in the past year down from -5.6% in November. The energy price and mortgage rate rise chickens finally look to be coming home to roost. Canadian retail sales meanwhile fell by a smaller than expected 0.1% (market -0.5%) and ex-autos by 0.6% (-0.7% expected.). the Bank of Canada meets on Wednesday with money markets assigning a 77% probability to a 25-point rate rise (which is what NAB expects to be delivered).

US economic data was restricted to December Exiting Home Sales, which ‘only’ fell by 1.5% (consensus -3.5%) but off a downward revised 7.9% November fall and still representing an eleventh straight monthly decline, with the monthly level of sales running almost 40% below where it was at the start of 2022.

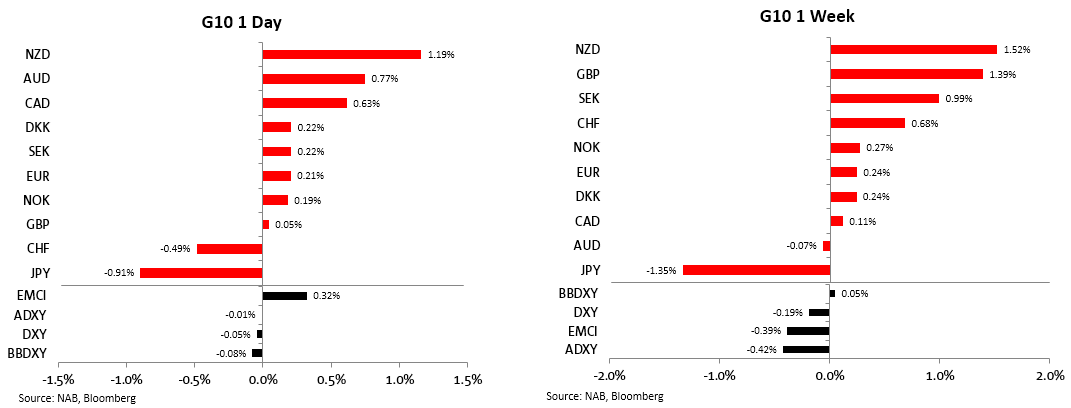

In FX, the USD was overall little changed both on Friday and the week (DXY (-0.2%). The NZD took up the mantle as the strongest G10 currency with a 1.5% weekly gain followed by GBP, the latter little impacted by the weak retail sales report with the strength in earnings data within the earlier labour market data seeing markets even more convinced the Bank of England will raise base rate by 50bps when it next meets on 2 February. AUD had a good day Friday, up 0.8% and second-best performer after the NZD – the latter despite more negative economic news last week – but is little changed on the week (-0.1%).

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.