Mar 14, 2022

Fed traders now fully pricing in seven standard hikes for 2022

, Bloomberg News

Investors could see a relief rally once the Fed raises rates: Strategist

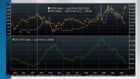

Traders have boosted their expectations for the amount of Federal Reserve policy tightening that could occur this year, moving at one stage on Monday to fully price in seven standard quarter-point rate hikes.

The last time the market for overnight index swaps linked to Fed meeting dates fully priced that much tightening was on Feb. 11, the day after U.S. consumer-price inflation numbers for January came in hotter than expected, prompting investors to wager on more hawkish central bank policy.

The rate on swaps linked to the December meeting climbed as high as 1.86 per cent Monday, 178 basis points above the current effective fed funds rate of 0.08 per cent. That’s equivalent to seven 25-basis-point increases, although the central bank itself has flagged that it could move in bigger increments down the line if necessary.

“It’s rational for the market to price in seven rate hikes for the year at this point in time,’ said Jason Bloom, head of fixed income and alternative ETF product strategy at Invesco. “The Fed is way behind the curve and consumer remains pretty flush at the moment, so they need to get back to 2 per cent or neutral pretty quickly.”

The swaps rate had reached as high as 1.87 per cent on Feb. 11, but then proceeded to fall in recent weeks, weighed down in large part by the financial market fallout from Russia’s invasion of Ukraine. It slipped to less than 1.2 per cent on March 1, suggesting at that point that traders were only envisaging between four and five standard hikes.

The latest uptick in U.S. market rates follows the war-related rally in global commodity prices that has helped to rev up investor expectations for inflation, which in turn means that the central bank might need to act more firmly in raising rates.

The selloff in global bond markets Monday saw yields on benchmark Treasuries surge, with those in the belly leading the way higher. The five-year rate topped 2 per cent for the first time since 2019, jumping as much as 15 basis points to 2.09 per cent, while the advance in the seven-year yield topped 16 basis points.

Officials are widely tipped to lift the monetary authority’s benchmark by a quarter point, and market pricing for this gathering reflects that. Policy makers may also provide clues about their broader thinking and the longer-term path for rates.

“At the very least, six and seven hikes will allow the Fed to have some ammunition to cut in the future if the economy slows down a lot,” said Invesco’s Bloom. “If the economy cools and inflation comes down, then the Fed could pause towards the end of the year.”

Chair Jerome Powell told lawmakers recently that he would recommend a quarter-point rate hike at the March 15-16 Federal Open Market Committee meeting, leaving little doubt in the view of economists that will be the outcome. He said larger increases might be warranted in the future if inflation fails to moderate, and swaps tied to the May policy meeting price in about 60 per cent of a half-point increase then.

Economists surveyed by Bloomberg say the Fed’s quarterly forecasts in the so-called “dot plot” will show around four hikes for 2022, and they predict the Fed will follow through with five increases with no half-point moves. The economists predict the Fed may raise rates by 1.25 per cent this year, with rates reaching 2.5 per cent in 2024.