Bank of Canada: On your marks…

No change from the Bank of Canada, but the accompanying statement indicates the central bank thinks interest rate hikes won’t be far away. We look for four next year with the first coming in March. The Canadian dollar has further room to rise into year-end if global sentiment keeps improving

Omicron isn't deterring the BoC from hiking

The Bank of Canada left monetary policy unchanged today, but the accompanying statement confirmed expectations that 2022 will see the central bank raise interest rates in response to strong growth, record employment and elevated inflation. The forward guidance remains that the timing of the first hike will come “in the middle quarters of 2022”, but we see the possibility of a first move in March with three further moves in each of the subsequent quarters.

The central bank is forecasting GDP growth of 4% in 2022 and 3.75% in 2023 on the back of strong consumer demand, business investment and a recovery in exports to the US. High prices are also going to be supportive for activity in the natural resource sector of the economy, which accounts for 10% of economic activity.

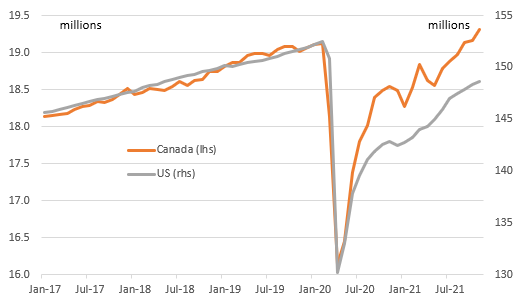

Canada employment is above pre-Covid levels, outperforming the US (millions)

Growth and inflation risks remain to the upside

Anxiety relating to the Omicron Covid variant could depress activity in the near-term and this is acknowledged by the BoC, particularly in the leisure and travels sectors. Nonetheless, like the BoC, we retain an upbeat outlook on the economy. After all, employment is already above its pre-pandemic peak with November’s 153,700 jump meaning there are now 185,800 more people in work than there were in February 2020. Job vacancies are also at record highs, suggesting employment growth will remain robust. With incomes rising and household savings built up through the pandemic providing an additional resource to fund expenditure we see demand continuing to run hot through next year.

This is likely to mean inflation imminently breaks above 5% and stays there throughout the first quarter. However, the BoC have only slightly tweaked their inflation assessment from inflation being likely to “ease back to around the 2% target by late 2022” to “ease back towards 2%”. We are more wary that supply chain strains and labour shortages could keep inflation more elevated for longer.

On track for four rate hikes in 2022

With the BoC having pointed to the prospect of earlier rate hikes and abruptly ending QE at the October policy meeting we changed our own forecast to four 25bp rate hikes in 2022 – one in each quarter. The emergence of the Omicron variant is a cause for concern, but the tone of the BoC statement suggests that even if it does lead to some consumer caution the case for policy tightening remains strong. As such, we see no reason to change our four-hike view for 2022.

CAD: Eyeing 1.25

The Canadian dollar was trading marginally weaker after the rate announcement, but the impact is proving very contained and short-lived given the lack of surprises in the statement. Some of the recent CAD strength is likely being fuelled by the notion that the BoC is ready to respond to inflation pressures with tightening, assuming the global picture does not significantly worsen. We think today’s statement did very little to dent this notion, allowing CAD to continue benefiting from the rebound in global sentiment.

We think USD/CAD may extend its decline to 1.2500 by the end of the year, although that is heavily reliant on further improvements in the Omicron-related sentiment.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more