- AUD/USD bulls pressing up against a key support area before the RBA.

- Australia's interest rate is up for review in money markets while forex traders will brace for a possible mini-taper tantrum.

- It is a flip of a coin as to whether the RBA will decline to taper or increase its asset purchase at today's meeting.

The Reserve Bank of Australia will meet today and decide on its monetary policy for the foreseeable future.

While traders are certain that interest rates are on hold, the prospects of tapering are the risk.

This leaves the Aussie vulnerable to a strong bid and paints a bullish backdrop going into the event today.

With that being said, something to the contrary could be catastrophic for the currency considering markets are searching for yield.

Cyclical currencies, such as AUD, may already come under pressure this week should the delta variant be seen to stamp out near-term growth prospects in APAC nations.

The US dollar is showing signs of robustness at the start of this week, despite the dismal Nonfarm Payrolls data that arrived on Friday.

Investors are of the opinion that should the US sneeze, the rest of the world will catch a cold as well.

While the Federal Reserve is unlikely to taper as soon as markets might have expected during the course of very strong employment over the last quarter, it is unlikely to fall too far behind.

Other central banks that have already started or are on the brink of tapering, such as the BoC and the RBA, could rein it all in should need be.

The RBA was due to start to taper, if only very cautiously, in September.

However, considering the latest outbreak of the highly contagious Delta variant of coronavirus, the lockdowns mean they might not.

“We think the RBA Board will decide to delay the bond taper from AUD5 B per week to AUD4 B scheduled for September, but the decision is likely to be very close and could go either way,'' analysts at ANZ Bank said.

In such a scenario, traders might continue to favour currencies of nations that are not seen to be so worse off in terms of the virus and lockdowns.

An exodus from the Aussie could see it plummet vs the greenback as a result.

“We fully expect that the taper commitment will be deferred,'' analysts at Westpac said.

''But an even better response would be to lift purchases from AUD5 B to AUD6 B with a review at the November Board meeting when the risks around the reopening of the economies and the spread of the virus will be much clearer,'' the analysts argued.

Such a move would be expected to really hit the Aussie across the board.

''The RBA has always been prepared to contribute to policy efforts to assist in dealing with economic shocks. This brutal contraction in the economy should be no exception,” the analysts at Westpac explained.

However, it is not a done deal and traders should be prepared for an outcome both ways for the RBA has been known to ook through current events and remain bullish on the outlook going forward and beyond the lockdowns.

“We expect the RBA to stick to its taper decision at its Board meeting on 7 September,'' analysts at TD Securities forecast.

''Despite the worsening COVID-19 situation, the silver lining is the better vaccination rollout while ample fiscal stimulus appears more suited in supporting the economy at this juncture than monetary stimulus. This should give the RBA room to justify its decision to carry on with its taper until its next review in November.”

US dollar technical analysis

Meanwhile, as measured by the DXY index, the greenback is attempting to regain support in the 92.20 / 92.30s area:

This is critical for the commodity complex for which it is priced by USD.

AUD trades as a proxy to the commodities and should we see a significant resurgence n the US dollar, perhaps to test the 61.8% ratio near 92.50, then the Aussie would be expected to come under strong selling pressure.

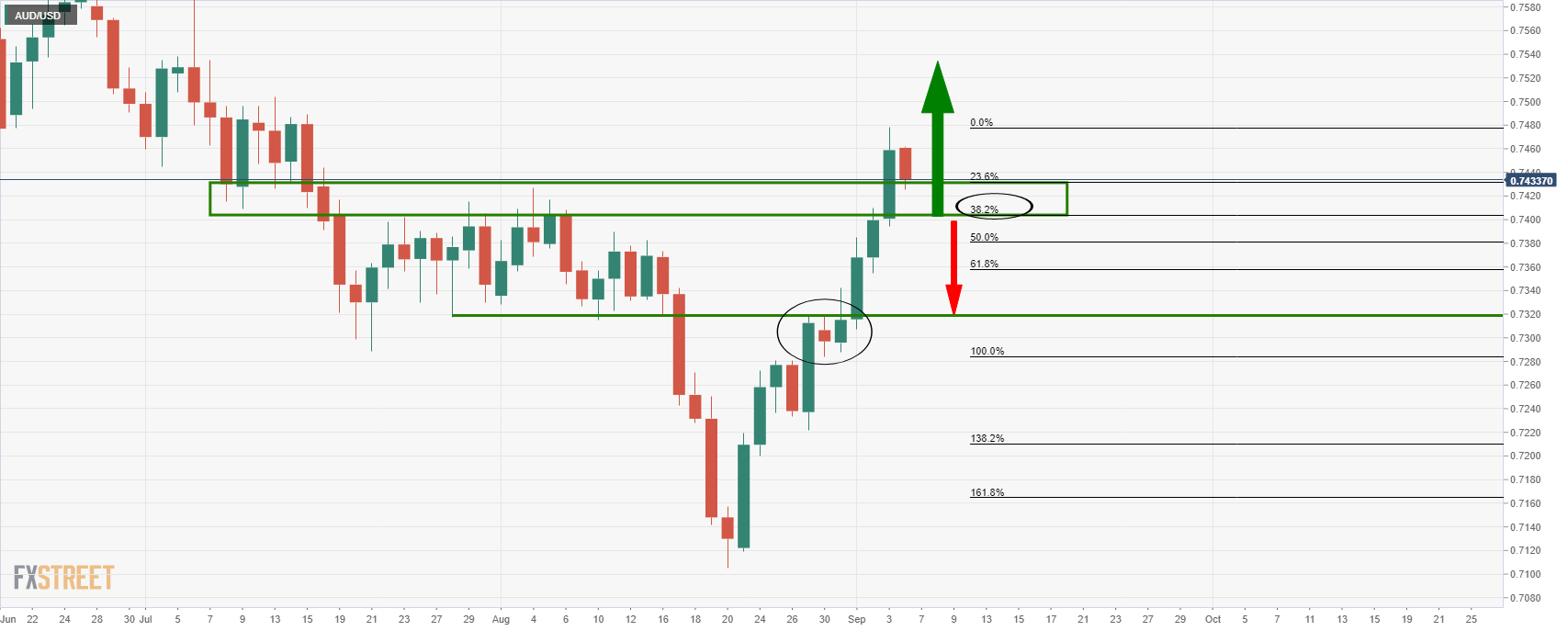

AUD/USD technical analysis

The price is on course for a restest of the 38.2% or possible the 50% ratios if bulls do not commit at this juncture.

Failing that, there is support all the way beyond the 61.8% ratio near the Aug 30 structure between 0.73 the figure and 0.7320.

On the upside, bulls may commit and see 0.7480 and then 0.75 taken on. 0.7650 marks the weekly sprint lows done in April 2021.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.