Bank of England Aiming for Patient Optimism, Global Policy Comparisons Crucial for Pound Sterling Reaction

The Bank of England (BoE) will announce its latest monetary policy decision on Thursday and release the latest quarterly Monetary Policy Report (MPR).

This will be the last MPR prepared under chief economist Haldane who is leaving the bank in June.

As far as the interest rate decision is concerns, there are no expectations of any change in rates with expectations of a 9-0.

There is, however, the possibility that there will be a split vote on asset purchases.

The bank is likely to take a positive stance, but will be aware that optimism needs to be kept in check, especially in the global context of a very accommodative policy by the Federal Reserve.

Barclays summarises the bank’s dilemma; “The MPC treads a narrow path here: it must acknowledge the firm data and more optimistic outlook while also avoiding creating expectations for a pre-emptive tightening of the overall policy stance.”

If the Pound strengthens into the policy decision and the bank tempers hawkish expectations, there is scope for some temporary selling after the decision.

Economic Outlook will be Upgraded

The bank will adjust its economic projections in the report update with expectations of a more optimistic assessment.

BNY-Mellon commented; “The bottom line is that the BoE’s February judgement of growth risks being "skewed somewhat to the downside" faces removal or even an outright flip to upside risks within the next three-month MPR cycle, and it might even happen this week.”

“Such a change would be the exact fillip sterling needs to recapture some shine.”

According to Credit Agricole, “The expectations are for a continuing improvement in the UK fundamentals, which should allow the BoE to upgrade its economic outlook on May 6.”

ING expects a cautiously optimistic tone from the BoE. In particular; “the reopening plan potentially also means a sharper 2Q uplift than the Bank had previously been pencilling in.”

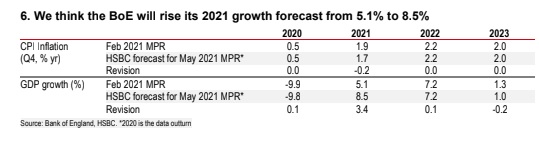

HSBC also expects a sharp upgrade; “The result would be a significant upgrade to calendar year growth in 2021, from 5% to around 8.5%.”

Above: Bank of England forecasts chart

Goldman Sachs noted; "The UK economy is rebounding sharply from the Covid crisis." The bank has a striking forecast of 7.8% GDP growth for this year, above its US estimate.

Recent labour-market data has been encouraging. Howard Archer, chief economic advisor to the EY Item Club commented; “While it still looks likely that some jobs will be lost when the furlough scheme ends in September, it also looks like the peak in the unemployment rate will be less than the Bank of England previously forecast.”

Marshall Gittler, Head of Investment Research at BDSwiss Group added; “This favorable [economic]background is likely to result in a substantial upward revision to the forecasts in the Monetary Policy Review.”

Inflation forecasts will also be important for the Pound Sterling reaction.

According to ING; “We also suspect we could see an upward tweak to the 2021 inflation profile, taking headline CPI above target. The question is whether it stays around 2%.”

Pace of Asset Purchases Could be Tapered

Although the decision on interest rates is likely to be straight forward, the decision on bond purchases is more complicated.

The bank is currently aiming to buy £4.4bn of gilts per week with a ceiling for purchases of £875bn and it expects to complete the programme by the end of 2021.

MUFG notes; “At the current GBP 4.4bn weekly purchase pace, completion will be in the week ending 10th September.”

There will, therefore, be pressure to slow (taper) the rate of purchases so that the existing envelope will last until late in 2021.

According to Credit Agricole; “A QE taper this week could see the BoE cutting its weekly QE purchase pace from GBP4.4bn a week to GBP3.2bn. That being said, the BoE could ultimately decide to wait until June and even August. This would mean slowing the pace of purchases more aggressively, however.”

MUFG also does not see that there is an urgent need to take action now; “The difference in the purchase pace through the remainder of the year by waiting until June is not significant and hence we lean toward holding off and allowing for early analysis on the rate of run down in UK household savings.”

NAB took a similar view; “we suspect the MPC might just carry with the same amount in the interests of supporting the economy in still uncertain times and then meeting the £875bn target three months early in September.”

TD Securities expects a cautious stance; “We don't think the macro justification is there to start winding down QE so soon.”

In contrast, Credit Suisse expects the bank will taper at this meeting. “The BoE is likely to taper its bond purchases, reducing the weekly pace of bond buying from £4.4bn a week to £3.0bn a week. This should allow the Bank of England reach its Asset Purchase Facility (APF) target of £895bn by the end of 2021.”

BDSwiss’ Gittler added; “That [forecast upgrade] could provide the justification for the MPC to follow the Bank of Canada’s footsteps and begin tapering its bond purchases.

ING considers the implications of a slowdown in asset purchases; “While this should come as no surprise, on the margin it should be GBP positive. We expect GBP/USD to re-test the 1.40 level.”

Forward Guidance Important, Keeping Market Expectations in Check

The policy statement and minutes will also be important to assess underlying thinking within the committee.

Barclays added; “our base case is that the MPC will not yet wish to materially alter current market pricing, but will want to effectively endorse an extend period of patience.”

MUFG also considers that the bank will not want to take an overly-hawkish stance, especially as this could trigger an unwarranted tightening of financial conditions.

This is particularly important given that most other central banks, including the Federal Reserve, are taking a dovish stance. This could prompt a cautious stance and restrained rhetoric from the BoE.

Credit Suisse expects a pragmatic outlook despite expecting a tapering of purchases; “Even though the near-term growth outlook has improved, it is still uncertain how the recent positive news translates to the medium-term outlook. Overall, we don’t expect the BoE to send a strong hawkish signal that can push forward market expectations of a rate hike.”

Capital Economics’ Thomas Pugh took a similar stance; "They are going to come out with a new, more positive set of economic forecasts and at the same time they will be trying to dampen down market expectations that that is going to lead to faster rate increases."

HSBC notes; “From recent pronouncements, it does not seem that the more cautious external members have become more hawkish.”

Nevertheless, the bank takes a hawkish overall stance; “the market certainly thinks that the March 2020 rate cut could be reversed by the end of next year, with further hikes to follow. We don’t think this MPR will do anything to dent that belief: the commentary is likely to be optimistic, the forecasts upgraded and the pace of purchases tapered.”

A similar line to the Bank of Canada which tapered bond purchases and forecast an earlier than expected increase in interest rates would be likely to trigger Pound Sterling buying.

Sterling could weaken in an immediate reaction if there is no tapering. MUFG noted “It could lead to some initial disappointment and pound weakness this week although we expect it to prove short-lived as BoE moves closer to tapering QE over the summer.”

Credit Agricole continues to hold a short Pound to Dollar (GBP/USD) exchange rate position.