The Bank of England's surprising governors

Thursday 25 April 2019 17:35, UK

The appointment of the governor of the Bank of England has thrown up a fair few surprises over the years.

It was certainly unexpected when the current incumbent, Mark Carney, was appointed by the then chancellor George Osborne in 2012.

Mr Carney, who at the time was governor of the Bank of Canada, had denied several times that he was even a candidate for the job.

When the Financial Times reported that he was a possible contender, in April 2012, Mr Carney told a news conference in Ottawa: "The report is not accurate."

Mr Carney followed that up in August that year with a TV interview in which, when asked whether he was saying "no" or "never" to the job, he replied: "It's both, it's both. How's that?"

So it was a huge surprise when, in November that year, his appointment was announced by Mr Osborne.

The City and the bookies had assumed Paul Tucker, the Bank's deputy governor, would get the job.

There was little surprise with the appointment of Mr Carney's immediate predecessor.

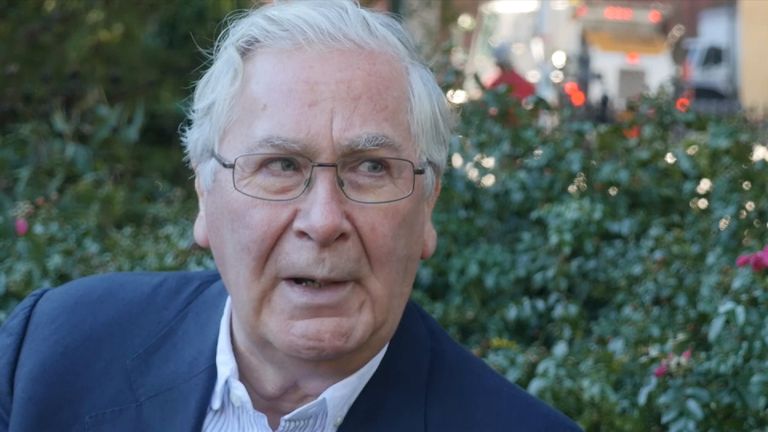

Mervyn King, governor from 2003 to 2013, was one of two deputy governors at the time and seen as the obvious choice.

It is thought that Gordon Brown, the then chancellor, would have liked there to have been more of a competition for the job - especially given his habit of taking his time over big decisions.

However, with the UK economy growing less slowly than expected and concerns starting to mount about the strength of the public finances, Mr Brown was relatively quick to make the appointment - particularly once rumours began circulating Mr King, now Lord King of Lothbury, was in the running to become director of the London School of Economics.

No rival had the opportunity to get a bandwagon running in their favour.

Like Lord King, Eddie George, the governor from 1993 to 2003, was also the odds-on favourite with the bookies to be appointed.

He was the only deputy governor at the time of his appointment and was hugely respected for his inflation-fighting credentials - in those days, interest rates were set by the Treasury, not the Bank - and for his vast experience in financial markets.

His warm personal relationship with the then Prime Minister John Major - both were south London boys from working class families - also helped.

Perhaps the biggest shock of recent times came when, just before Christmas in 1982, Robin Leigh-Pemberton was appointed governor by Margaret Thatcher.

The appointment was made during the parliamentary recess and nor was it known that an appointment was imminent.

The new governor's background also raised eyebrows.

A Kent landowner, Mr Leigh-Pemberton - who later became Lord Kingsdown - was a barrister by profession, before becoming chairman of National Westminster Bank in 1977.

He had no central banking experience.

Most controversial of all was that he had also been a Conservative Party activist at a local level.

The Labour Party was furious, as was the Financial Times, which thundered: "It is surprising and regrettable that Mrs Thatcher should have opted for the candidate whose experience of banking, and more particularly of international financial relations, was least extensive."

Ironically, though, Lord Kingsdown turned out not to be the "Thatcher's poodle" many in the City and in Westminster assumed he would be at the time of his appointment.

He turned out to be fiercely independent.

Also surprising, but not nearly as controversial, was the appointment of Gordon Richardson in 1973 because of his background as a merchant banker.

The controversial tenure in Threadneedle Street between 1961 and 1966 of Lord Cromer, who clashed repeatedly with Harold Wilson after the latter's election in 1964, led many in Westminster and the City to argue that never again should a merchant banker become governor.

Lord Richardson, as he became, was also to suffer clashes with prime ministers during his decade in office.

His poor relationship with Mrs Thatcher led to her turning down his offer to serve a third five-year term.

The race to succeed Mr Carney looks to be one of the more open ones in the Bank's history. Here are a dozen of the likeliest candidates.