- The European Union officials will try to finalize the Brexit deal with the UK partners on Wednesday, October 17, but the Brexit deal still has time to be delivered until November.

- The European Commision President Jean Claude Juncker said the negotiations with the UK are slower than expected with Irish border solution lagging.

- The trinity of the most important UK macro releases is scheduled for the third week of October with wage growth, the core inflation and UK retail sales are expected to decelerate.

- The GBP/USD is poised to fall sharply on Brexit deal disappointment next week.

- The FXStreet Forecast Poll turned more optimistic for Sterling in 3-monthsa horizon.

The second week of October was slightly positive for Sterling that rose some 60 pips from the opening level of 1.3124 to 1.3190 by the end of the week as Brexit optimism supported Sterling more than UK macro data that saw manufacturing output falling in August and the UK monthly GDP stagnating in the same month.

The key risk factor for currency traders is the result of the Brexit negotiations that overshadows the macroeconomic development. This is particularly true for the week ahead that will see all the important macro releases in the UK published while Brexit summit scheduled for Wednesday, October 17 is likely to be a greater currency market influencer that anything else next week.

While the Brexit optimism was supporting Sterling during the second week of October, given the latest announcement from the European Commission President Jean Claude Juncker, the Brexit deal is likely to be struck at the last minute in November turning next week’s summit to become just another round of discussion.

“We are not where we should be to find an agreement in Irish issue in Brexit talks,” Juncker said for French newspapers Le Monde, indicating that the time to reach the Brexit agreement will have to be made between next week’s meeting and possible November Brexit summit.

While the UK macro releases on the UK manufacturing output falling -0.2% over the month in August and monthly GDP stagnating at 0% m/m having little effect on the currency market driven by Brexit headlines, the US inflation missing the market forecast had a negative effect on the US Dollar on Thursday driving Sterling to mid 1.3200s, last week’s high.

Combination of Brexit optimism fading away and Chicago Fed President Charles Evans indicating that given the current strength of the US economy monetary tightening makes sense drove GBP/USD towards 1.3180 on Friday. Optimism over the US rate outlook was reflected also in the US Treasury yields with benchmarfk yields rising to 2.259% over the second week of October, the highest level in seven-and-a-half year that triggered massive equity markets selloff on Wednesday, October 10.

Technically, the short-term uptrend on GBP/USD ended on Friday with currency pair falling past trend support line at around 1.3200, while daily chart saw Slow Stochastics moving from the oversold to the overbought territory, ready to make the bearish crossover, should the spot FX rate fall a bit further lower towards mid 1.3100s.

Technical analysis

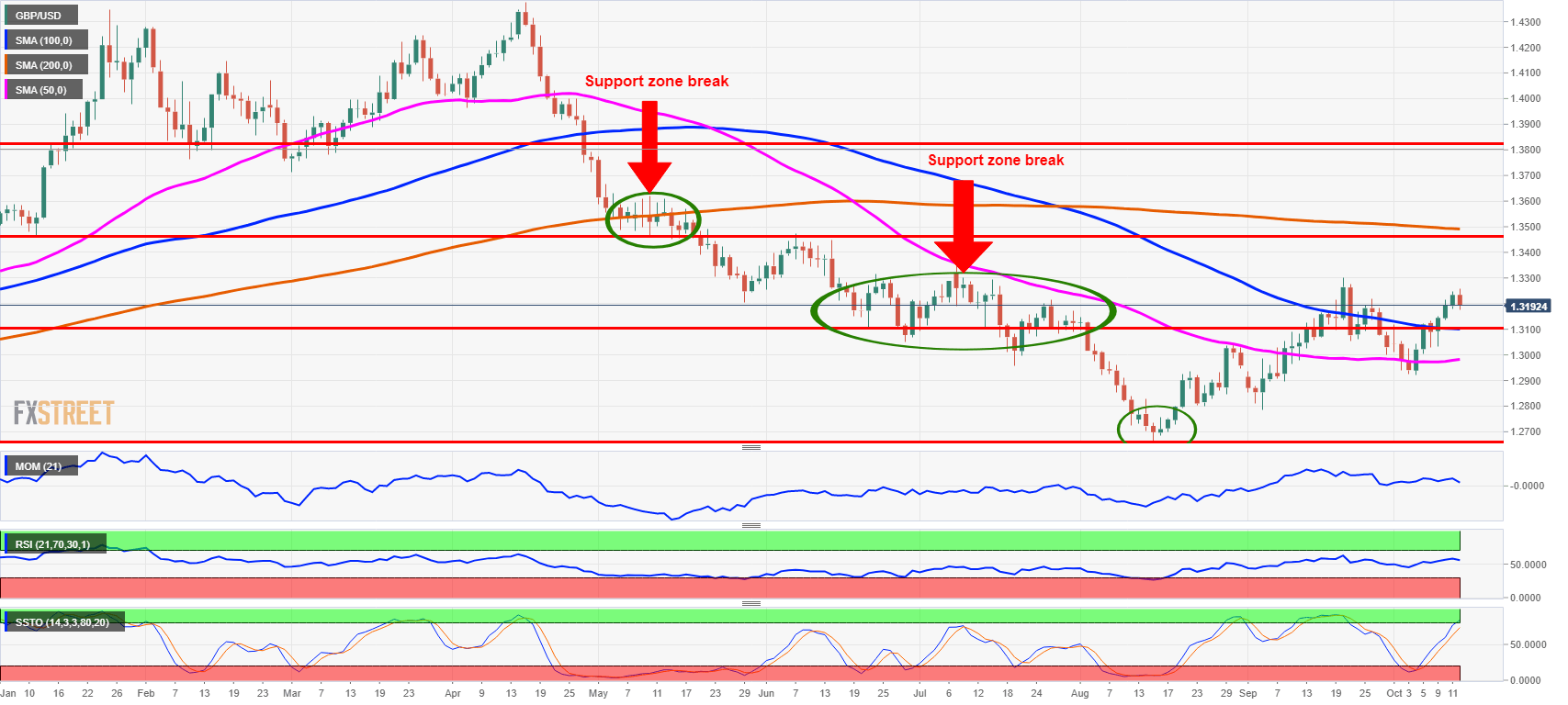

GBP/USD daily chart

The GBP/USD was moving sideways at the beginning of the second week of October with currency pair trapped between the 50-day and the 100-day moving average of 1.2975 and 1.3110 respectively. With the US inflation decelerating beyond market expectations and the Brexit optimism supporting Sterling, the GBP/USD rose to 1.3254 high before correcting lower on Fed driven rate hike outlook. The GBP/USD need to break below 1.3105 confluence of a 100-day moving average and the 38.2% Fibonacci retracement of the down move from 1.4377 to 1.2666 to resume the sideways trend. Technical oscillators including Momentum and the Relative Strength Index are both pointing downwards while Slow Stochastics moved to the overbought territory.

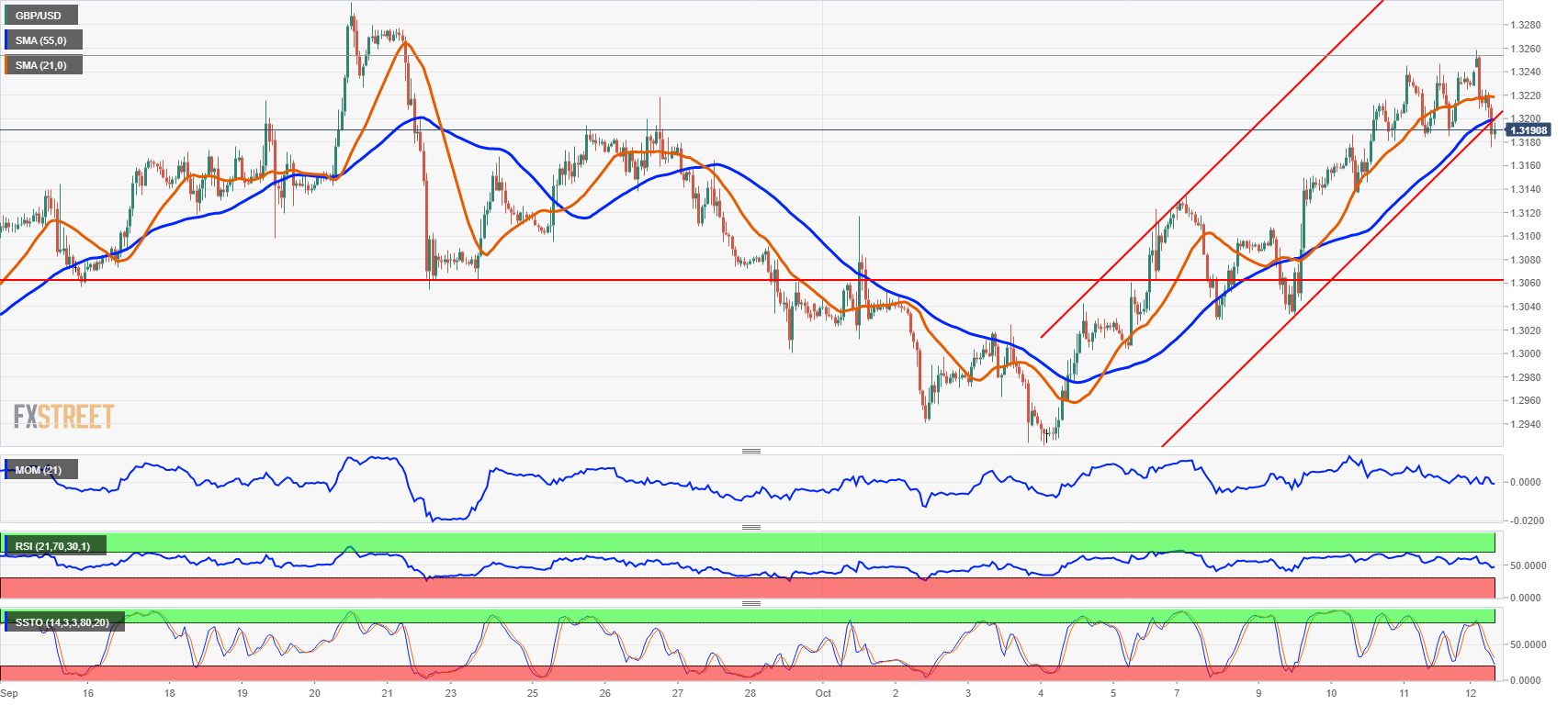

GBP/USD 1-hour chart

The GBP/USD was moving within upwards rising trend channel for the ost of the second week of October. The combination of Brexit optimism fading away and the US rate hike outlook voiced by Chicago Fed President Evans saw GBP/USD breaking away from the upwards rising trend on Friday. The short-term outlook is sideways with Slow Stochastics moving swiftly lower while Momentum and the Relative Strength Index remain relatively neutral.

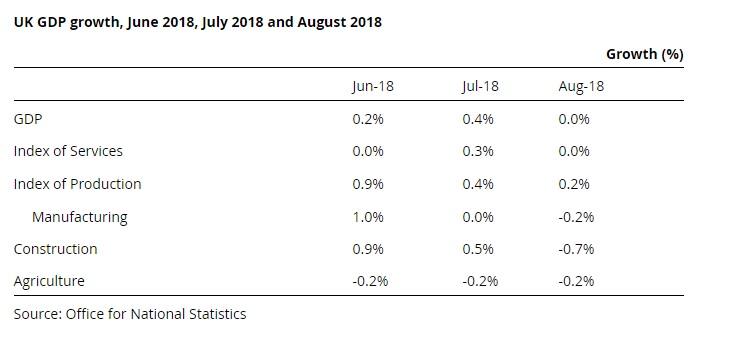

The UK macro data

In August, the UK manufacturing output dropped -0.2% over the month due mainly to falls of 2.3% in chemicals and chemical products and 1.7% in wood and paper products. Seven out of thirteen manufacturing sub-sectors decreased in August.

Total index of industrial production increased 0.2% m/m in August due primarily to rises in electricity and gas supply of 1.8% m/m and mining and quarrying of 2.1% m/m.

Monthly GDP growth rate was flat in August 2018. Growth rates in June and July 2018 were both revised up by 0.1 percentage points to 0.2% and 0.4%, respectively.

Decomposition of the UK monthly GDP

The Bank of England chief economist’s comments

The Bank of England chief economist Andy Haldane said in a speech in London on Wednesday that market expectations of 25 basis points a year increase in policy rates are "not dissimilar" to the Bank’s own forecasts for pick up in wage growth over the next 3 years. Haldane also said he sees longer-term threats to pay growth from reduced worker bargaining power, automation, and business monopolies.

Brexit and the UK Office for Budget Responsibility forecasts

The UK Office for Budget Responsibility (OBR) released the policy document on Thursday, October 11 outlining the macroeconomic impact of Brexit.

In terms of near-term impact, the OBR lowered the forecast for real GDP growth between the second quarters of 2016 and 2018 from 4.4% to 3.0% while the Office for National Statistics currently estimates that growth over this period was 3.2%. The UK economy suggests that output in mid-2018 is around 2% to 2.5% lower than it would have been in the absence of the Brexit referendum. Estimates in external studies of the long-run hit to GDP from leaving the EU to trade solely on WTO terms, compared to staying in the EU, are concentrated around 2% to 7% – with the full effect only felt over a period of greater than ten years. That compares with a productivity shortfall of 17.5% in the ten years since the global financial crisis relative to a continuation of the pre-crisis trend.

US inflation miss in September

The US inflation rose less than expected in September with core inflation staying at 2.2% y/y compared with 2.3% expected while headline US inflation decelerated to 2.3% y/y from August’s 2.7% y/y increase. Within the US inflation data, the energy prices rose less than expected and decelerated sharply from 5% annual increase in September last year. The sizeable increase dropping out of the year-over-year calculation, the annual increase in inflation dropped to 2.3% in September. With core inflation remaining stable at 2.2%, the concerns of the US economy moving to the overheating territory, especially after the US unemployment rate dropped to 3.7% in September, well below Fed’s preferred the range of 4.3% to 4.6%. Market expectation is that the US inflation report will not prevent the Fed from tightening further but will keep the pace gradual.

The economic calendar in the week ahead

The third week of October is calendar-heavy in the UK with the most prominent macroeconomic indicators due. Even more importantly, the Brexit summit is scheduled for the week ahead that will decide upon the direction Sterling is going to take in near future. Failure of the negotiating partners in the European Union and the United Kingdom to strike the Brexit deal will put pressure on Sterling regardless of the macro picture.

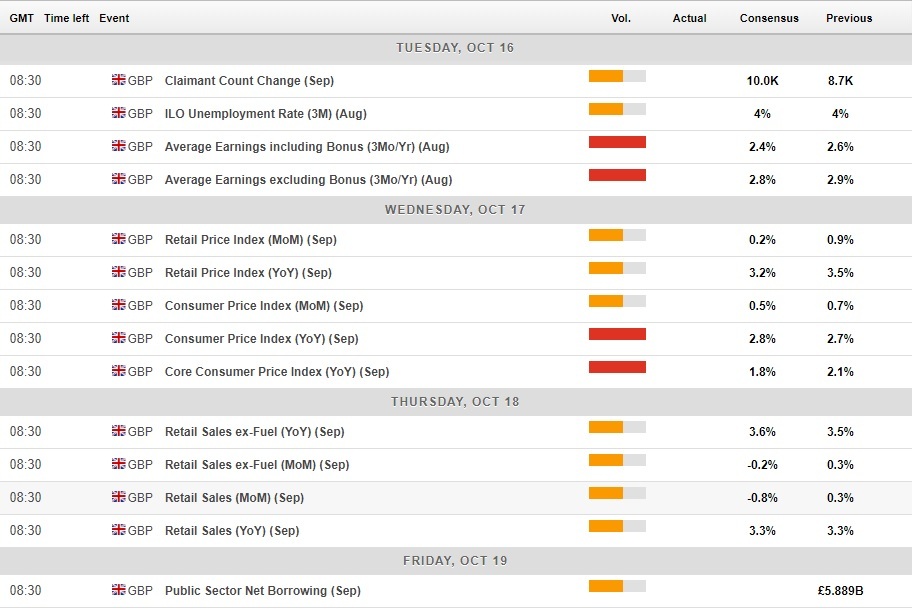

The trinity of the macro events will kick off with the UK labor market report for September on Tuesday, October 16. The number of unemployment benefits seekers, so-called claimant count, is expected to rise by 10K in September while the unemployment rate is expected to remain at 4.0%, the lowest level since December 1974 to February 1975 three months average. The most important part of the UK labor market report is wage growth. Both total and regular period. While total pay (including bonuses) is expected to rise by 2.4% over the year compared with 2.6% in three months ending in July, the regular pay (excluding bonuses) is expected to decelerate to 2.8% over the year from 2.9% in three months ending in July. Deceleration of wages beyond market estimates is expected to weigh on Sterling as prospects for future wage-driven inflation diminish.

Next on the agenda is the UK inflation due on Wednesday, October 17. While the headline UK inflation is expected to accelerate to 2.8% over the year in September, core inflation stripping the consumer basket off food and energy items is seen decelerating to 1.8% y/y. The inflation data are scheduled for the same day as the Brexit summit later in the evening with the outcome of the summit being fundamentally the strongest driver on the currency market.

To complement the week ahead, the UK retail sales are scheduled for Thursday, October 18. Although the news is likely to be flooded by Brexit summit outcome, the UK retail sales are expected to fall by -0.8% m/m in September, while core sales excluding motor fuel sales are seen falling -0.2% m/m.

UK economic calendar October 15-19

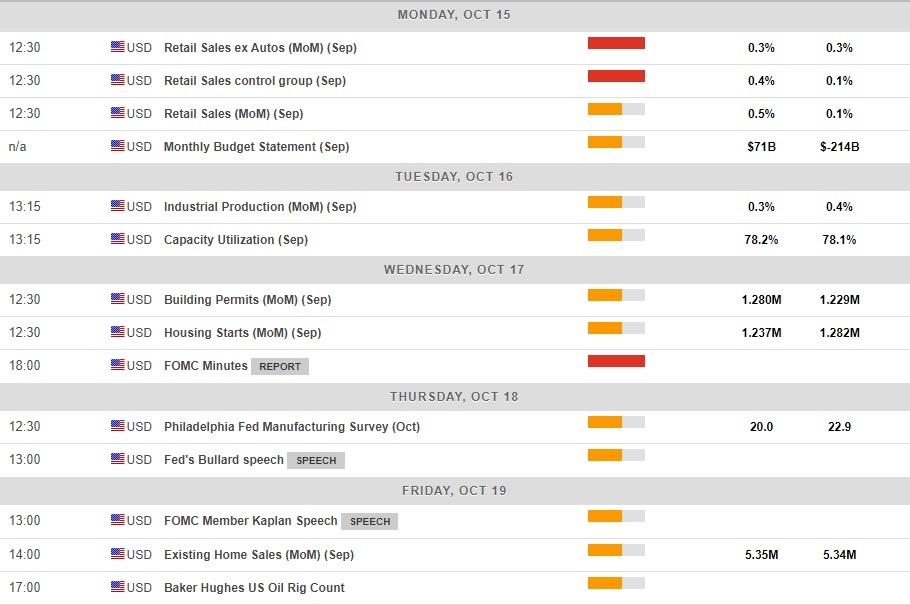

In the US, the third week of October is not that much macro data intensive. The most important release is scheduled for Monday with the US retail sales expected to rise 0.5% over the month in September while the control group of retail sales that are included in the US GDP is forecast to increase 0.4% m/m.

Apart from US retail sales report, Wednesday’s FOMC meeting minutes headline the week exhibiting the details of September FOMC rate hiking meeting. For the remainder of the next week, some US housing market data are due including housing starts, building permits and existing home sales while Fed officials’ speeches are scheduled for Thursday and Friday next week.

The FOMC meeting minutes are expected to confirm recent optimism of the policymakers. The US Federal Reserve chairman Jerome Powell’s said on October 3, that Fed may raise rates past “neutral” territory as they need to gradually move towards normal, indicating further rates hikes are coming and that rates are far from neutral and still accommodative. The tone of the recent Fed officials is US Dollar bullish.

US economic calendar October 15-19

FXStreet Forecast Poll

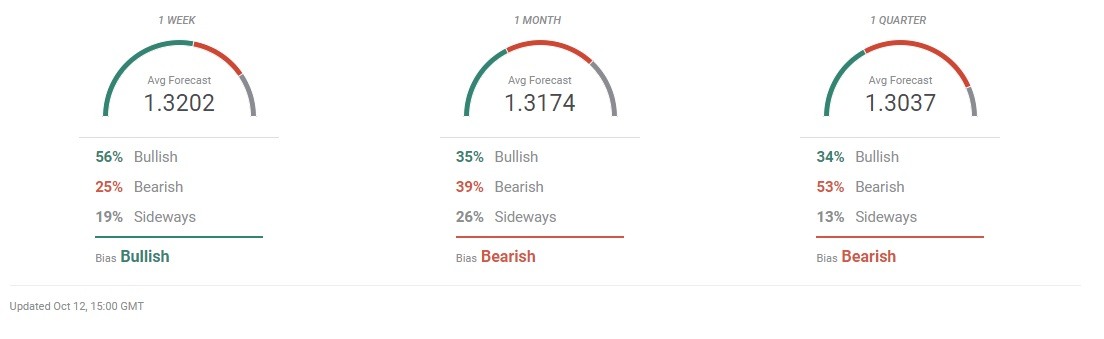

The FXStreet Forecast Poll expected GBP/USD to reach 1.3078 last week compared with 1.3165 on Friday, October 12. For the third week of October, the FXStreet Forecast Poll expects bullish trend to continue towards 1.3202.

For the third week of October, the share of bullish forecasts remains unchanged from the previous week at 56% compared with 25% of bearish forecasts and 19% of sideways trend forecasts for a week ahead.

Forecasts for 1-month ahead are almost evenly distributed among bullish, bearish and sideways estimates on average expecting 1.3172 FX rate for GBP/USD, up from 1.3042 last week.

The FXStreet Forecast Poll is most bearish for the 3-months ahead with 1.3037, up from 1.2983 last week and with 53% of bearish forecast compared with 34% of bullish predictions.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD surges above 0.6600 on soft US jobless claims

The Australian Dollar rallied against the US Dollar on Thursday, printed gains of more than 0.60%, due to the Greenback remained offered following a softer than expected US jobs report. The AUD/USD trades back above the 0.6600 threshold as Friday’s Asian session begins.

EUR/USD climbs over 1.0780 on broad-market risk appetite recovery

EUR/USD gained ground on Thursday, finding upside on the week after the US Dollar broadly fell back after rising US Initial Jobless Claims sparked renewed hope of rate cuts from the Federal Reserve.

Gold marches higher as weak jobless claims, increase Fed rate cut speculation

Gold price resumed its uptrend on Thursday and climbed more than 1% as US Treasury yields dropped, undermining the Greenback's appetite. Labor market data from the United States was softer, increasing the chances for a rate cut by the Federal Reserve despite dealing with inflationary pressure.

Ethereum waiting on a bullish trigger, Consensys CEO takes a jab at the SEC

Ethereum co-founder alleges that the SEC aims to stifle innovation through its enforcement actions against Ethereum-related companies. Grayscale CEO says he's optimistic the SEC would approve its spot ETH ETF application.

Dow Jones Industrial Average gains 330 points as investors celebrate rising unemployment claims

The Dow Jones Industrial Average (DJIA) found further gains on Thursday as investors bet on Fed rate cuts to come after US Initial Jobless Claims rose to a multi-month high.