Where next for central banks?

Everything you need to know about central bank policy around the world

Federal Reserve: Tightening on track

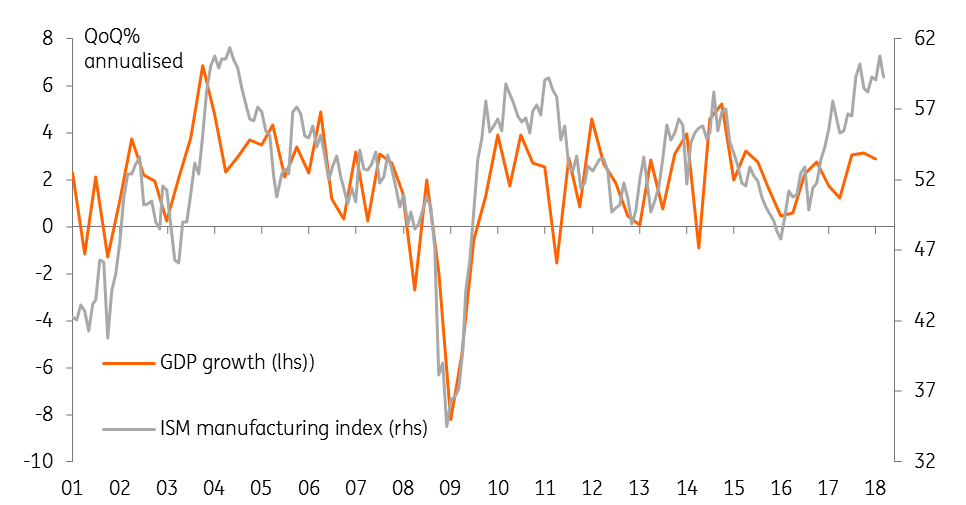

There has been a slight sense of loss of momentum in 1Q18, partly weather-related and partly sentiment driven due to protectionist concerns, but on balance we remain upbeat on the US economy’s prospects. Domestic demand is strong, supported by a firm jobs market, rising house prices and an expansionary fiscal policy driven primarily by significant tax cuts. At the same time, the US dollar’s depreciation means exporters are in a competitive position to benefit from the upturn in the global economy.

Meanwhile, consumer price inflation is broadly in line with the Federal Reserve’s 2% target. Given the tight labour market, we find it easy to envisage wage growth rising towards 3.5%YoY later this year. With energy prices and import prices picking up again there is the possibility headline CPI rises towards 3%.

In this environment of robust growth and rising inflation, we forecast the Fed raising rates three more times this year with a further two, possibly three likely for 2019, especially if President Trump makes progress on his infrastructure spending plan. This would take the Fed funds rate up to around 3%.

Surveys suggest US GDP is understated

European Central Bank: Questions about quantitative easing

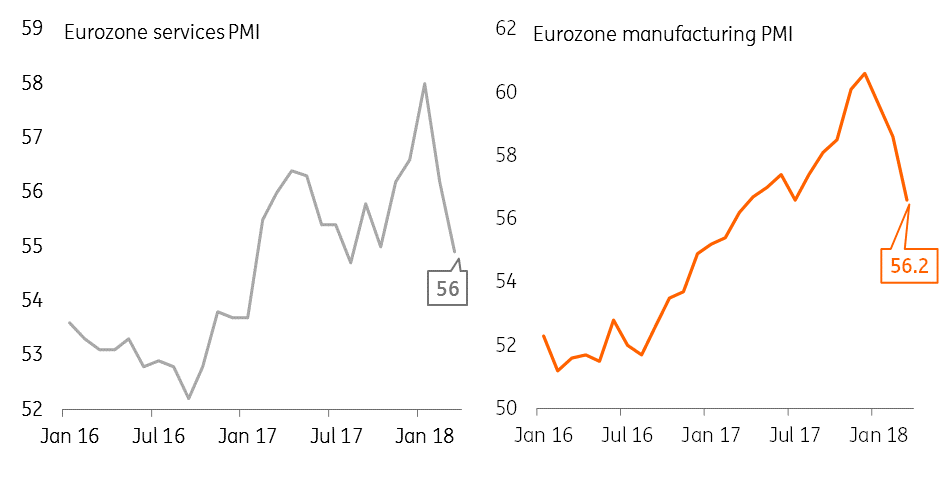

Behind the scenes, next week’s European Central Bank meeting should be much more exciting than what ECB president Draghi will present during the press conference. While trade tensions and the soft patch in the economy should lead to a somewhat more cautious tone, the ECB will wait until the next round of staff projections in June to get a better grip on inflation developments.

The only thing that Draghi could give away on Thursday would be a confirmation of his previous statement that there would be no abrupt ending to QE in September. A clear sign QE will be extended once again.

Looking beyond next week’s meeting, lack of inflationary pressure combined with some weakening of the cycle should keep the debate on the end of QE lively. In fact, the central question is if there will be an extension of QE by three or six months and will it be an extension with an open or a definite end.

Eurozone data dips in the first quarter

Bank of England: Cautious Carney casts serious doubt over May hike

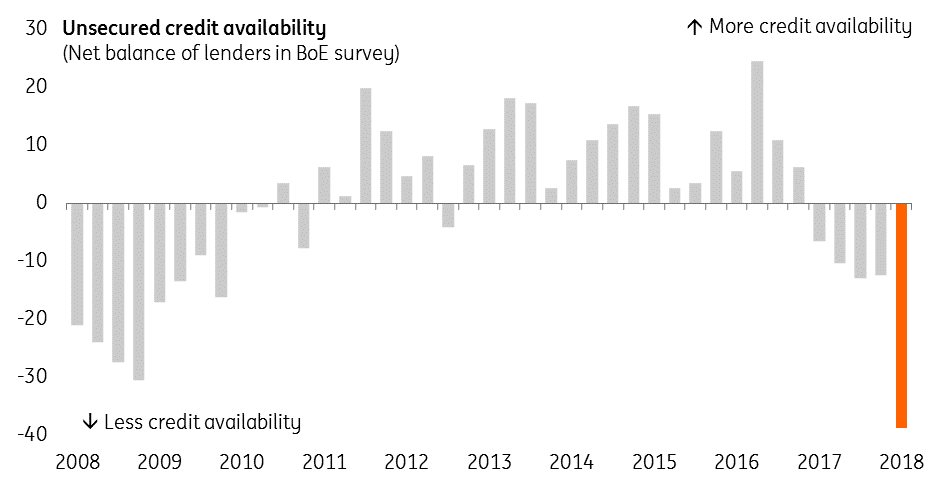

Cautious comments from Bank of England Governor Mark Carney mean a May rate hike now looks like much more of a 50:50 call.

However, the surprisingly strong wage growth numbers over recent months, coupled with the post-Brexit transition period agreement had led markets to near-enough price in a rate rise at the next meeting. And given the hawkish comments from the Bank so far this year it seemed as if the Bank was trying to boost expectations ahead of a May move. “Earlier”, “somewhat greater” and “ongoing” are all words that have been used to describe the nature of future tightening.

But since then, it has become clear the retail sector has had a dreadful quarter – perhaps the worst since the crisis. Some of this is weather-related, and that’s also seen manufacturing and other service-sector output dip. But much of this is down to ongoing consumer caution. Real incomes, while no longer falling, remain under pressure. And with consumer credit availability dropping “significantly” according to the BoE, we see few catalysts for a recovery in spending in the short-term.

That said, we still think a near-term hike is likely as Carney’s comments might simply be a case of buying some extra time to see how things play out between now and August. But with growth fragile, core inflation imminently set to return to target and Brexit talks likely to be bumpy, thoughts of multiple rate hikes this year look premature.

UK consumer credit availability drops off cliff in first quarter

Bank of Japan: Held back by inflation

Following some possibly loose-lipped comments by the Bank of Japan's Governor, Haruhiko Kuroda, to the effect that the BoJ’s qualitative and quantitative easing programme (QQE) could come to an end by mid-2019, there has been little to suggest that this is indeed on the cards. Indeed, a recent back-slip by inflation makes the BoJ’s task look as insurmountable as ever. Kuroda’s comments were most likely aimed to chime with the BoJ’s projection of inflation rising to 2% over this same time frame, though this has never looked particularly realistic, and markets may have overanalysed these remarks.

However, things may not be as stagnant as they seem. The Japanese economy remains in good shape, with profitability strong in the manufacturing sector, and resilience to further yen strength good. But this good news does not spill over into the political sphere, and some analysts are speculating that PM Abe’s days as Japan’s political leader are numbered, following the scandal over land sales to nationalist schools with links to the PM’s wife.

If Abe does stand down later this year, the Abenomics policy approach would probably continue in overall substance and direction, but not perhaps with as much zeal as previously. This may even entail an acknowledgement that 2% inflation is not attainable and that some elements of monetary stimulus could be pulled back.

People's Bank of China: Interest rate liberalisation meets financial deleveraging

New central bank governor Yi Gang has emphasised that interest rate liberalisation could be sped up. In particular, the central bank would like banks or other financial institutions to link market rates when they quote lending rates so that lending rates are market-based. For example, linking SHIBOR for short-term rates and CGB yields for long-term rates. Currently, lending rates are linked to the one-year benchmark lending rate, which the central bank is trying to phase out.

Moreover, the central bank also wants deposit rates to be market driven. Liberalising deposit rates is related to both interest rate liberalisation and financial deleveraging. If deposit rates are more competitive, there would be less demand for wealth management products, which would result in fewer shadow banking products.

We expect the People's Bank of China to follow the Fed’s remaining three rate hikes but at five basis points each to reflect the already tightened liquidity situation in China. Following the Fed’s rate hike path will keep the interest rate spread between China and US steady, and therefore avoid capital outflows.

Reserve Bank of Australia: Labour market could stretch rate hike forecasts

Recent labour market data out of Australia has been somewhat disappointing, and if this is reflected in quarterly wages data, then even our expectation that the Reserve Bank of Australia will eventually hike rates by 25bp in 4Q18 looks a bit stretched. The next meeting is on 1 May, and really, the RBA is under no obligation to offer guidance in any direction, with markets not looking for any action. The Monetary Policy statement out on 4 May will likewise be equally uncommunicative.

In the background though, the housing market continues to lose steam gradually, with recent house price figures somewhat stronger than anticipated, though still with an overall downward trend. The RBA’s inactivity, coupled with the Australian Prudential Regulatory Authority's (APRA) consistent but gradual tightening of lending regulations, seems to be delivering a somewhat improbable but welcome soft-landing in this sector.

With so much Australian household net worth tied up in property, and the gross liabilities being overwhelmingly in property too, this is a very favourable outcome and one that neither the RBA nor APRA will want to mess up with precipitous action.

Bank of Canada: Hiking to resume once NAFTA uncertainty clears

The Bank of Canada kept rates on hold again in their April meeting, which was the most likely scenario given trade uncertainties relating to NAFTA and US-tariffs. However as NAFTA uncertainty clears (talks of a deal being reached by early May), we expect the Bank to recommence their hiking schedule with two moves, starting in July.

The Canadian economy is still growing healthily, albeit at a slower pace than in 2017, and this is expected to continue throughout 2018. Additionally, there has been a slight fall in the worryingly high debt to income ratio, which the Bank will continue to watch closely among other measures as they monitor the economy’s sensitivity to changes in interest rates.

Price and wage pressures have also been building, climbing above the Bank’s 2% target. This is likely to challenge the Bank’s recent dovish ‘wait-and-see’ approach and is a pivotal reason as to why we think the Bank will start hiking soon after a NAFTA deal is signed.

Build-up of Canadian inflation

Reserve Bank of New Zealand: On hold for foreseeable future

On 26 March this year, the Reserve Bank of New Zealand (RBNZ) decided to add maximum sustainable employment alongside price stability. The current unemployment rate is only 4.5%, but it has historically troughed lower (December 2007 saw it hit 3.3%). Moreover, at the current unemployment rate, inflation has not been accelerating, but decelerating, suggesting maximum employment remains elusive and that the RBNZ can sit with the policy rate at 1.75% for the foreseeable future.

Our house forecasts, like the RBA, have a 4Q18 rate hike pencilled in. But this is a low conviction holding-pattern forecast, and even if the unemployment rate keeps falling while inflation moves away from, not towards 2.0% (now 1.1%), this forecast remains at risk of being pushed back into 2019.

Tags

Reserve Bank of New Zealand Reserve Bank of Australia Bank of Japan Bank of England Bank of CanadaDownload

Download article20 April 2018

In Case You Missed It: The unreliable boyfriend returns This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more