- Inflation and wages disappointed rising less than expected, but do not alter the view of the Bank of England hiking rates on May 10, 2018.

- Looking at the combination of lower inflation and tight labor market, the Bank of England will prefer precautious rate hike to tame labor market tightness.

- The interest rate outlook is expected to drive GBP/USD higher long-term.

The UK Consumer Price Index (CPI) decelerated to 2.5% over the year in March with core inflation that is stripping the food and energy items out of the consumer basket rising 2.3% over the year in March, the Office for National Statistics said on Wednesday. Both figures coming out below market expectations.

Sterling fell to about 70 pips in the knee-jerk reaction to the UK inflation data as decelerating inflation is putting the pressure off the Bank of England to raise the Bank rate as early as in May this year.

I argue that decelerating inflation that is still above 2% inflation target of the Bank of England does not alter the expectations of May rate hike much, as nominal wages are rising by 2.8% y/y turning the real, inflation-adjusted wages back to positive territory for the first time since January last year. I believe that the Bank of England is looking rather at the long-term effects of the tight labor market that will eventually press on wages to rise even as the inflation rate will decelerate further as the post-Brexit effect of Sterling depreciation wanes.

Related stories

- UK CPI Preview: With Sterling higher inflation fears wane as rate hike nears

- The end of the darkness for real wages in the UK

It is Sterling’s appreciation from post-Brexit referendum lows that is actually starting to have an effect on the UK inflation now and as the time passes on, the magnitude of this inflation-taming effect will increase.

The Bank of England Monetary Policy Committee has already turned partially hawkish in March with two members Ian McCafferty and Michael Saunders voting for a rate hike and McCafferty recently claiming that the Bank should not delay hiking interest rates again due to a possibility of faster pay rises.

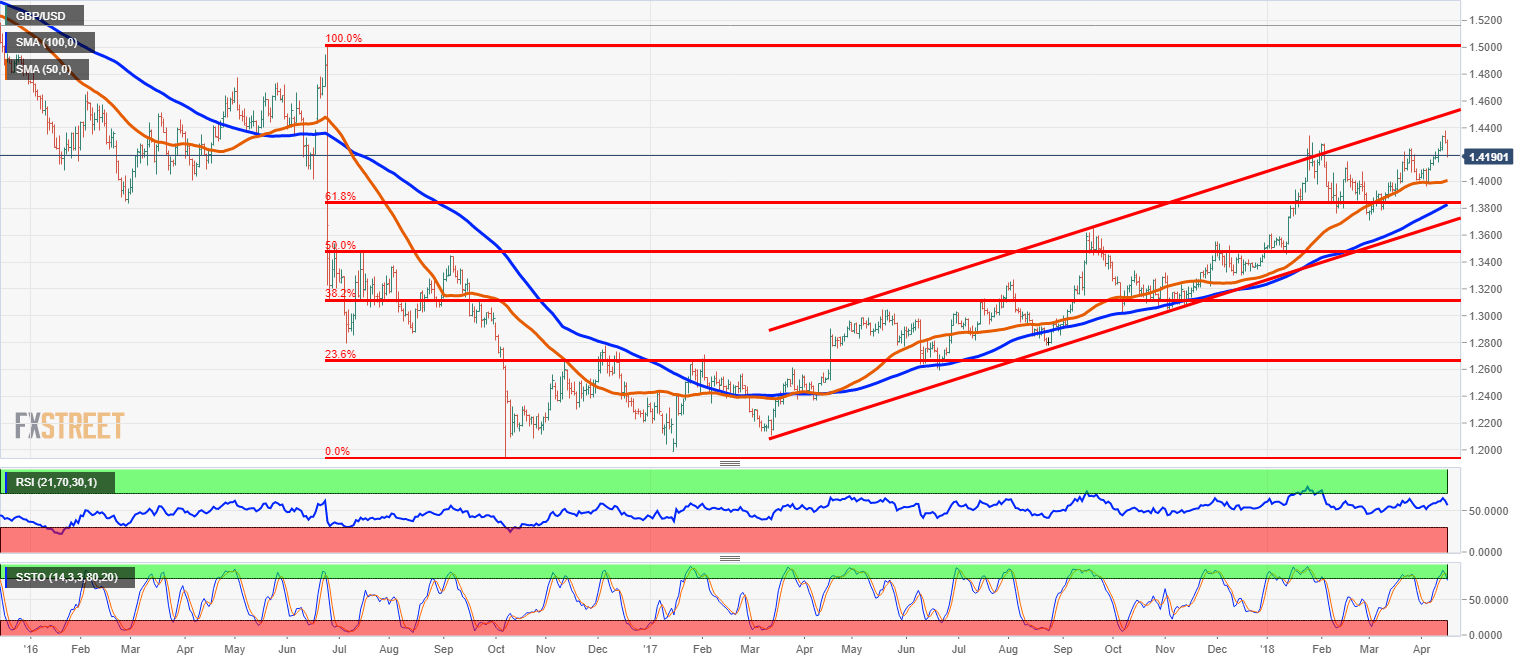

Looking at the long-term perspectives recent knock-out of GBP/USD off the 22-month high is just a technical correction within a long-term trend of Sterling’s appreciation.

GBP/USD daily chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD turns negative near 1.0760

The sudden bout of strength in the Greenback sponsored the resurgence of the selling pressure in the risk complex, dragging EUR/USD to the area of daily lows near 1.0760.

GBP/USD comes under pressure and challenges 1.2500

GBP/USD now rapidly loses momentum and gives away initial gains, returning to the 1.2500 region on the back of the strong comeback of the US Dollar.

Gold retreats from highs on stronger Dollar, yields

XAU/USD trims part of its initial advance in response to the jump in the Dollar's buying interest and the re-emergence of the upside pressure in US yields.

XRP tests support at $0.50 as Ripple joins alliance to work on blockchain recovery

XRP trades around $0.5174 early on Friday, wiping out gains from earlier in the week, as Ripple announced it has joined an alliance to support digital asset recovery alongside Hedera and the Algorand Foundation.

Week ahead – US inflation numbers to shake Fed rate cut bets

Fed rate-cut speculators rest hopes on US inflation data. After dovish BoE, pound traders turn to UK job numbers. Will a strong labor market convince the RBA to hike? More Chinese data on tap amid signs of slow Q2 start.