- EUR/USD bears target the 1.0850 level.

- Bears eye a move to test daily lows for the new month ahead.

EUR/USD is on the back foot. The US Dollar index climbed to a two-week high on Thursday after economic data showed the labour market remained solid.

It's been a strong week of data for the US and was topped off with Weekly Initial Jobless claims that decreased 26,000 to a seasonally adjusted 239,000, the largest drop in 20 months and below the expectation of 265,000 by economists polled by Reuters. Federal Reserve's Chair Jerome Powell also indicated the central bank is likely to resume its rate hike path and this is weighing on the Euro as the following technical analysis illustrates with a focus on the 1.0850s:

EUR/USD daily chart

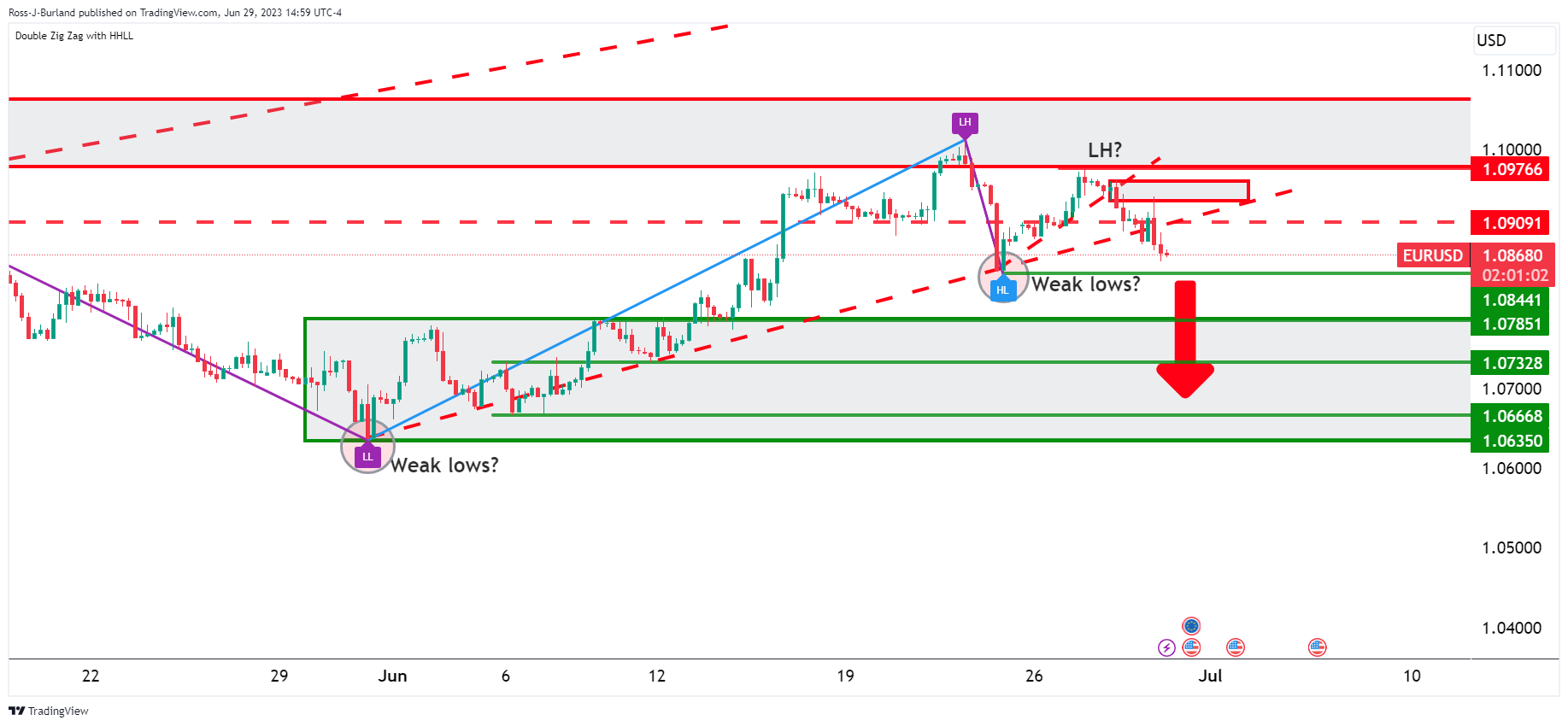

The current state of play is targeting the weak lows in 1.0635 as the Euro fails to make a higher high, so far.

EUR/USD H4 chart

1.0844 is a target on the 4-hout chart for the same, guarding the daily support areas below.

EUR/USD H1 charts

The hourly chart leaves 1.0850 vulnerable as a -272% Fibonacci of the recent bullish correction's range.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds recovery above 0.6650 after Aussie Retail Sales data

AUD/USD is clinging to recovery gains above 0.6650 even after Australian Retail Sales data missed estimates with 0.1% MoM in April. The pair draws support from broad US Dollar softness and China's property market measures. Focus shifts to Fedspeak.

USD/JPY cycles below 157.00 as investors await hints on central bank rate moves

USD/JPY is treading water ahead of Tuesday’s Pacific market session, holding ground just below the 157.00 handle as investors await key data that will determine the pace of rate cuts from central banks moving forward.

Gold price posts modest gains on weaker US Dollar, investors await US key data

Gold price edges higher on Tuesday after bouncing off two-week lows of $2,325. The uptick of yellow metal is bolstered by the softer US Dollar and safe-haven flows amid the ongoing geopolitical tensions in the Middle East.

Ethereum investors confident of rally as ETH developers schedule Pectra upgrade for Q1 2025

Ethereum gained nearly 3% on Monday as investors exhibited high bullish sentiment. Michael Saylor also commented on the recent spot ETH ETF approval by the Securities & Exchange Commission.

Trading the week ahead

This week is set to be a relatively quiet week. On Tuesday, US consumer confidence figures will be released. Given the context of hawkish FOMC minutes, a stronger consumer confidence report could reinforce dollar strength.